Press Releases Archive

NEW YORK, NY – July 26, 2017 – The Bronx captured real estate investors’ attention in the first half of 2017, becoming the only New York City sub-market to notch a rise in dollar volume versus the second half of last year. Prices rose across the board in the borough, with gains particularly pronounced on multifamily assets, according to Ariel Property Advisors’ newly released “Bronx 2017 Mid-Year Sales Report.”

Sales, however, slipped year-over-year, echoing a trend seen throughout the City in 1H17. Transactions slowed amid an abundance of factors and events, from a new presidency and rising interest rates, to revisions to rent regulation and the new iteration of the 421-a tax abatement. In addition, the rental market continued to feel downward pressure and some owners offered price reductions instead of concessions.

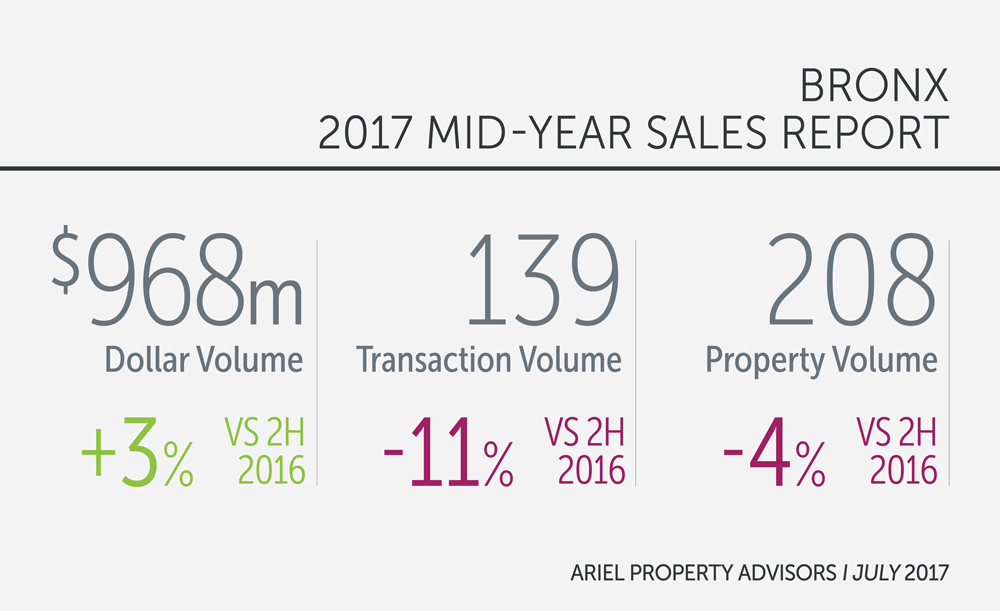

During 1H17, The Bronx saw 139 transactions consisting of 208 properties totaling $968 million in gross consideration. Compared to 2H16, transaction and property volume decreased 11% and 4%, respectively. Dollar volume increased versus 2H16, bucking New York City’s trend, rising 3% on a slew of sizeable multifamily deals. On a year-over-year basis, declines were significant and across the board, with transaction, property and dollar volume sliding 29%, 35%, and 24%, respectively.

“Caution permeated the market in the first half and investors took a more careful approach to their underwriting,” said Jason M. Gold, a Director at Ariel Property Advisors. “That cloud of uncertainty appears to have lifted and investors have re-engaged, with recent bidding activity indicating a pick-up in the second half.”

The Southwest Bronx was the most active quadrant of the borough, with more than 54% of transactions and 50% of dollar volume attributed to these neighborhoods. That was followed by Northwest Bronx, which comprised 23% and 31% of transaction and dollar volume, respectively.

Accounting for roughly 70% of total dollar volume, The Bronx’s multifamily market continued to attract the most interest amongst investors, with dollar volume leaping 22% compared to 2H16, which can mostly be attributed to large portfolio deals. There were 69 transactions that took place in 1H17, a 25% decrease in volume compared to the previous period. Property volume followed a similar pattern, falling 8% versus the same time period.

Despite the drop in sales, demand for multifamily properties continued to outpace supply, causing pricing metrics to increase across the board. Compared to 2016 figures, the average price per square foot climbed 7% to $197. The average price per unit also increased 7%, reaching $174,693, while the average gross rent multiple (GRM) rose to 11.82 from 11.06. Even more impressive, the average cap rate dipped below 5% to a record low of 4.92%, and sharply below 2012’s level of 7.92%.

The largest multifamily transaction of 1H17 was the $78 million purchase of 2862-2864 Park Avenue, which consisted of 520 units and 150,000 square feet. Another notable transaction was the purchase of Prana Associates MF BX Portfolio by Emerald Equity Group for $49.3 million, a reported 5.26% capitalization rate.

With many hospitals, nursing homes, and schools making headlines in 1H17, the special purpose product type saw a 163% increase in dollar volume, a 75% jump in transaction volume, and a 33% rise in property volume year-over-year. The past six months have seen numerous medical facilities trade hands, led by Beth Abraham Health Services, located at 612 Allerton Avenue, which sold for $25 million.

Meanwhile, The Bronx’s industrial and development market saw moderate growth in the borough for 1H17, accounting for 33% of the transactions in the borough.

“With many businesses expanding their presence in the borough, along with several new entrants to the market, the industrial asset class is growing rapidly,” said Marko Agbaba, a Director, who specializes in Northwest Bronx properties. “Several unique sales and a transactional western half of The Bronx drove sizable growth in the asset class.”

Nevertheless, the 47 development sites that sold for $135 million in 1H17 represented a decrease of 9% in dollar volume compared to 2H16, due largely to the sale of smaller properties, which dominated 1H17 transactions. However, with the introduction of the Affordable New York Housing Program, an iteration of the former 421-a tax-exemption program, transaction volume for development sites increased by 18% and property volume increased by 11% compared to 2H16.

The borough saw a modest increase in average price per buildable square foot to $65. Notable transactions include 2050 Grand Concourse and 213 East Burnside Avenue, which sold for $77 per buildable square feet, as well as, 6161 Broadway, which achieved a price of $74 per buildable square feet.

To view the full report, please click here: http://arielpa.com/report/report-APA-Bronx-mid2017-Sales-Report

For More information, please contact: Jason M. Gold, ext. 22, jgold@arielpa.com and Marko Agbaba, ext. 32, magbaba@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.