Our Latest Research

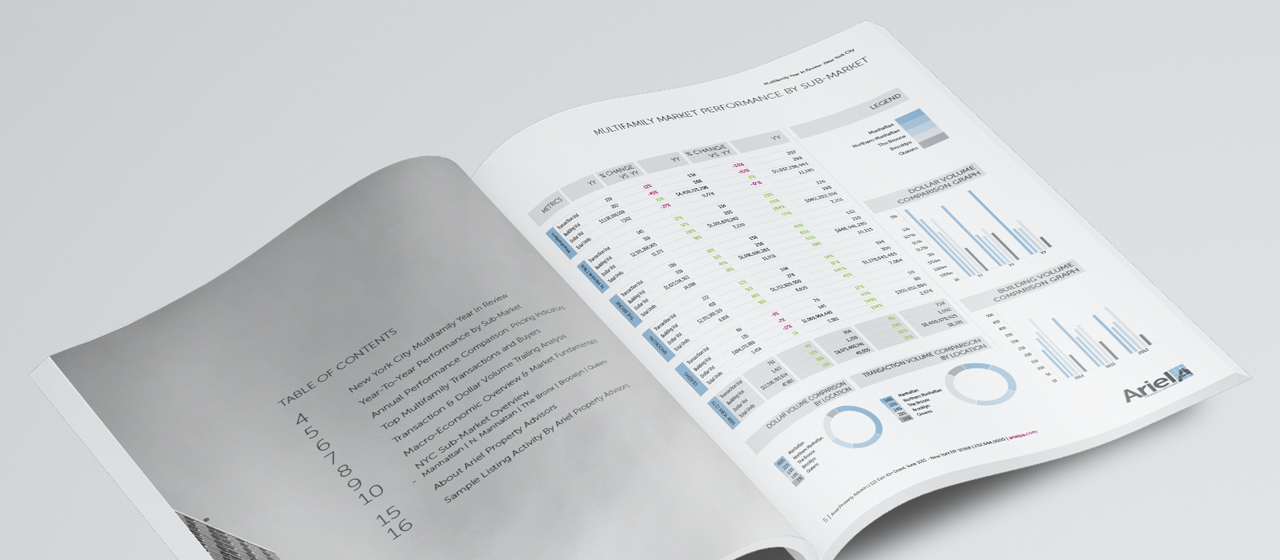

New York City 2025 Year Submarket Sales Reports:

The submarket reports are an in-depth look at the specific Investment Sales markets in Brooklyn, the Bronx, Manhattan, Northern Manhattan and Queens.

We seek to provide our readers with an overview of the 2025 market activity, benchmark transactions, and pricing trends that impact each individual real estate market.

To View and Download Reports, Click Below:

N. Manhattan - click here to open

Manhattan - click here to open

The Bronx - click here to open

Brooklyn - click here to open

Queens - click here to open

Multifamily Year in Review - click here to open