Press Releases Archive

NEW YORK, NY – October 18, 2017 – The New York City multifamily market picked up considerable steam in the third quarter, with dollar and transaction volume reaching 2017 highs as investors became more enthusiastic about the asset class. While sales volume in the City remained lower on a year-over-year basis, the climb in activity signifies the market is poised to end the year on solid ground.

After a tepid start to the year, positive momentum that commenced during the latter part of 2Q accelerated in 3Q, with the market topping $2 billion in sales for the first time since the 4Q16. Dollar volume was decisively driven by Manhattan, which saw two sales above $100 million. During the first and second quarter, New York City registered only one sale at that level across all sub-markets.

“The multifamily investment sales market has noticeably bounced back from a sluggish start to the year and appears to have turned an important corner,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “All signs indicate the market will close out the year stronger.”

Another notable 3Q development was transaction volume, which jumped to its highest level since the same quarter in 2016. Pricing, meanwhile, appreciated year-over-year in The Bronx and Queens, while other sub-markets saw mixed results. The Bronx saw the most sizeable appreciation, with the average price per square foot leaping 10%, reaching $200 for the first time on record.

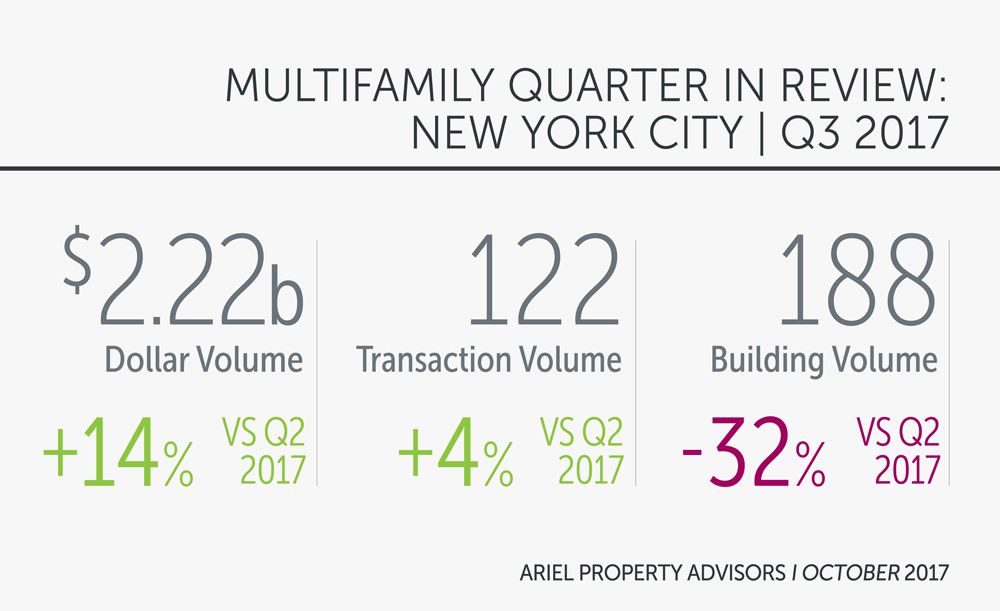

From July through September, New York City saw 122 multifamily transactions comprised of 188 buildings totaling $2.22 billion in gross consideration. This represents a 14% increase in dollar volume, a 4% rise in transaction volume, and a 32% decrease in building volume compared to the second quarter. However, when compared to the same quarter in 2016, third quarter dollar, transaction and building volume declined 24%, 24% and 27%, respectively.

From a macroeconomic perspective, the devastating hurricanes last month distorted data and their impact on the economy should continue for a while, but the labor market remains a bright spot and there are significant pockets of strength in the economy that should keep the Federal Reserve on track to raise rates for a third time this year in December despite persistently low inflation.

Submarket Overview

Manhattan:

Manhattan was a standout in 3Q, registering its strongest quarter of the year, and recording nearly as much dollar volume as the rest of the market combined. For the quarter, Manhattan saw $1.08 billion in gross consideration, representing a remarkable quarter-over-quarter gain in dollar volume of 120%, while transactions held steady at 30.

These numbers are indicative of several institutional level transactions, including 980-996 Avenue of the Americas, the largest multifamily sale of the year so far. The 400,000 square foot mixed-use elevator building known as The Vogue sold for $320 million, representing $800 per square foot and $943,953 per unit.

Manhattan’s trailing 6-month average pricing metrics in the third quarter stood as follows (year-over-year changes): price per square foot at $934 (-2.8%), price per unit at $682,464 (+3.8%), capitalization rate at 3.53% (+1.7%), and gross rent multiple at 19.91 (-1.8%).

Northern Manhattan:

Northern Manhattan also enjoyed a banner quarter, registering across-the-board gains. In fact, it was the only sub-market to register increases in the number of sales year-over-year, with 24 transactions consisting 31 buildings taking place.

Five sales above $20 million pushed dollar volume to $364.55 million, the highest total in Northern Manhattan since the 4Q16. The largest sale of the quarter took place in Washington Heights, where Sugar Hill Capital Partners purchased a 95-unit elevator building located at 200 Haven Avenue for $41 million, or $329 per square foot.

Northern Manhattan’s trailing 6-month average pricing metrics in the third quarter stood as follows (year-over-year changes): price per square foot at $393 (+10.2%), price per unit at $332,973 (+7.5%), capitalization rate at 4.16% (-4.5%), and gross rent multiple at 15.79 (+1.5%).

The Bronx:

The Bronx experienced a mixed 3Q, notching gains in transaction and building volume, but declines in dollar volume due to a dichotomy of transactions. On the one hand, 50% of the transactions were less than $5 million, while on the other hand, four larger portfolio sales pushed the number of buildings sold higher.

In total, the borough saw 24 transactions consisting of 49 buildings totaling $249.96 in gross consideration. An eight-building portfolio with a mix of walk-up and elevator buildings was the largest transaction of the quarter. The 232-unit package sold by Paradise Management for $34.7 million translates to $158 per square foot, and nearly $150,000 per unit.

The Bronx’s trailing 6-month average pricing metrics in the third quarter stood as follows (year-over-year changes): price per square foot at $200 (+10.1%), price per unit at $178,181 (+12.5%), capitalization rate at 4.93% (+7.2%), and gross rent multiple at 12.02 (+8.6%).

Brooklyn:

Brooklyn’s 36 transactions were the most for the borough in a quarter since 3Q16, resulting in a 29% increase against 2Q17. However, the borough’s $444.07 in dollar volume was short of the previous quarter’s total of $467.93, and substantially lower than the same period last year, which notched $686.96 in sales.

One of the most significant transactions took place at the end of the quarter in Bushwick where Cayuga Capital sold its 99-unit elevator building at 626 Bushwick Avenue to Wildenstein & Co. for $51 million. The price for the recently completed building translates to $700 per square foot and more than $515,000 per unit.

Brooklyn’ trailing 6-month average pricing metrics in the third quarter stood as follows (year-over-year changes): price per square foot at $398 (+7.4%), price per unit at $310,864 (-5.2%), capitalization rate at 4.27% (+6.6%), and gross rent multiple at 15.42 (-0.6%).

Queens:

Queens activity was extremely lackluster in 3Q, with the borough experiencing steep declines across the board. The sub-markets’ 8 transactions were the fewest in a quarter since 4Q11 and dollar volume fell below $100 million for the first time since 2Q14.

The only sale of note during the period was a two-building elevator portfolio in Jamaica that sold for $20 million. The 83 units at 88-22 Parsons Blvd & 89-21 153rd St sold for a price that represents $253 per square foot and nearly $241,000 per unit.

Queens’ trailing 6-month average pricing metrics in the third quarter stood as follows (year-over-year changes): price per square foot at $384 (+9.1%), price per unit at $292,176 (+3.1%), capitalization rate at 3.97% (+4.6%), and gross rent multiple at 15.91 (+3.4%).

To view the full report, please click here: http://arielpa.com/report/report-MFQIR-Q3-2017

For More information, please contact: Shimon Shkury 212.544.9500, ext. 11, sshkury@arielpa.com

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.