Press Releases Archive

NEW YORK, NY – June 15, 2017 – The New York City multifamily market saw dollar and transaction volume hold steady in April, while building volume surged due to an uptick in outer-borough portfolio trades. Queens fared well in the month, leading all sub-markets in dollar volume as investors continued to pursue the value offered by neighborhoods in the region.

The market’s stabilization marked a change in direction, with volume metrics in previous months falling across the board. However, they were well below the same month in 2016, and the trailing 6-month average for transaction volume dropped to its lowest level since May 2011. In terms of pricing, price per square foot and per unit either improved or held firm in all sub-markets, however, capitalization rates and gross rent multiples varied.

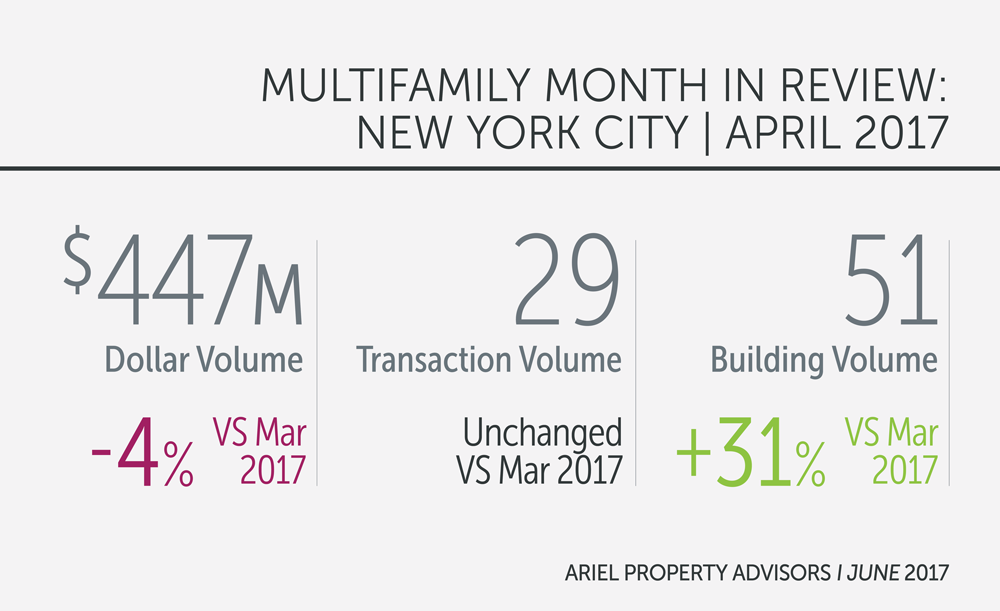

For the month, New York City registered 29 transactions, unchanged from the previous month, while building volume reached 51, a 31% jump. Dollar volume, meanwhile, totaled $477.12 million in gross consideration in April, a 4% drop.

Submarket Overview

Manhattan:

Manhattan registered less than $100 million in dollar volume for a second straight month, with the borough posting $93.07 million in gross consideration across ten transactions consisting of ten buildings. While these numbers represent month-over-month improvements, they also indicate a dramatic drop from the same period a year earlier, with dollar, transaction and building volume slumping 80%, 33%, and 52%, respectively.

One significant trade took place in Greenwich Village, where an 11-unit walk-up building located at 601 Hudson Street sold for $12.75 million, representing $1,335 per square foot and $1,159,091 per unit.

Northern Manhattan:

Northern Manhattan continued to experience light volume in April as only four transactions consisting of five buildings took place. However, all four transactions exceeded $10 million, buoying dollar volume to $83.05 million, a striking 54% month-over-month increase.

The sub-market’s largest sale of the month took place in Washington Heights, where a 57-unit mixed-use elevator building located at 720 West 181st Street sold for $32 million, or $626 per square foot, a reported capitalization rate of 4.32% and a gross rent multiple of 15.72. Another notable transaction took place in Central Harlem at 9 West 110th Street, where a 31-unit mixed-use walk-up building sold for $13.65 million, or $577 per square foot.

The Bronx:

The Bronx saw more than twice the number of buildings sell in April compared with the previous month despite declines in transaction and dollar volumes, which can be largely explained by the sale of two institutional-caliber portfolios. For the month, the borough saw seven transactions consisting of 23 buildings totaling $115.28 in gross consideration, a month-over-month decline of 30% and 31% for transaction and dollar volumes, respectively.

The largest of these sales was the 11-building, 291-unit portfolio in Fordham, which was sold by Prana Associates for $49.3 million, or $189 per square foot. The other significant portfolio to trade was the six-building, 209-unit package that Pistilli Realty bought for $38.5 million, or $209 per square foot.

Brooklyn:

Brooklyn, once again, saw the steepest month-over-month declines of any sub-market, with a mere 3 transactions taking place, producing a total dollar volume of $25.48 million in gross consideration, representing a 40% and 72% drop, respectively.

Notable sales included the $11.7 million sale of a 70-unit elevator Section 8 building located at 761 Bushwick Avenue in Bushwick and the $11.4 million sale of 66 Graham Avenue in Williamsburg, where the price for the 37-unit mixed-use walk-up building represented $440 per square foot and $308,108 per unit.

Queens:

Queens, which saw record dollar volume in 2016, continued to dominate all sub-markets in April, with $130.25 million trading across 5 transactions consisting of 10 buildings. In fact, the borough was also the only sub-market to register month-over-month and year-over-year increases across all metrics.

Since January, the average price per square foot leaped 9% to $387. However, the average capitalization rate jumped to 4.38% from 4.05%, while the average gross rent multiple fell by nearly 3% to 15.55.

The largest transaction in the City this month took place in Astoria, where the Kushner Companies sold a four-building, 154-unit portfolio for $76.25 million, or $617 per square foot.

For the six months ending in April of 2017 (page 5), the average monthly transaction volume for New York City fell to 36 transactions per month from 38 in the previous month and the average monthly dollar volume decreased to $816.99 million from $827.51 million during the same period.

To view the full report, please click here: http://arielpa.nyc/research/report-MFMIR-April-2017

For More information, please contact: Shimon Shkury 212.544.9500, ext. 11, sshkury@arielpa.com

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.