Press Releases Archive

NEW YORK, NY – July 24, 2017 – Queens Investment property sales saw a considerable slowdown in the first half of 2017, a trend witnessed throughout New York City, as uncertainty surrounding the political and economic climate suppressed activity, according to Ariel Property Advisors’ newly released “Queens 2017 Mid-Year Sales Report.”

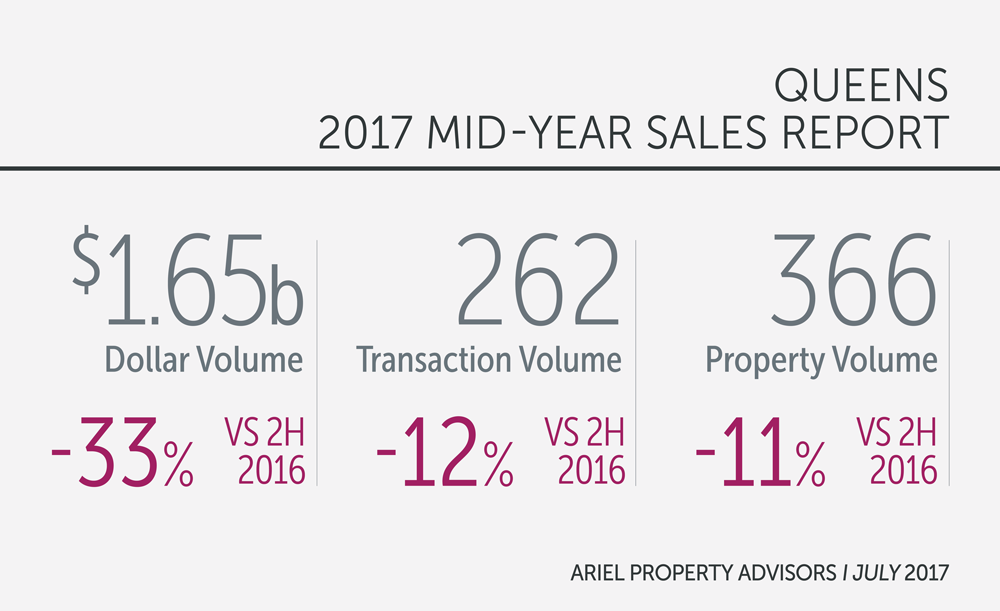

During 1H17, Queens saw 262 transactions consisting of 366 properties, totaling approximately $1.65 billion in gross consideration. Compared with 2H16, transaction, property and dollar volume decreased 12%, 11%, and 33%, respectively. Year-over-year the drop was more pronounced, with transaction and property volume dropping 25% and 23%, respectively, while dollar volume slid 27% compared to the same period in 2016.

Investors were wary throughout most of the first half, focusing on an array of factors and events, namely the new presidency, rising interest rates, revisions to rent regulation, and the new iteration of the 421-a tax abatement. Concerns about the absorption of a flood of new residential units about to hit the market affected sellers and investors alike.

“There was a lot to chew on in the first half, so many participants opted to stay sidelined,” said Daniel Wechsler, Director at Ariel Property Advisors. “That waned a bit in recent months and when it comes down to it, investors are still willing to pay premiums for well-located assets with upside.”

Multifamily properties were the most transactional asset type during 1H17, snagging 48% of the volume in Queens. During 1H17, Queens saw nearly $600 million of multifamily assets trade over 125 transactions and 184 properties. Those numbers reflect a 24% drop in dollar volume, 5% decline in transaction volume, and a 16% increase in property volume versus 2H16.

Nevertheless, while year-over-year transaction volume decreased versus 1H16, the first six months of 2017 saw several transactions above $20 million, with Astoria, Elmhurst, Flushing, Holliswood, Jackson Heights and Ozone Park all registering intuitional-level transactions. The most notable multifamily transaction in the first half of the year was Kushner Companies’ sale of a 4-building package in Astoria for $76.25 million.

With limited available inventory, the average price per square foot for multifamily assets climbed 9% in 1H17 from 2016’s average, reaching $377. Price per unit edged 1% higher to $287,000 during the same period.

“Demand for multifamily assets continues to outpace supply as average rents are still below many other parts of the City and the borough’s neighborhoods are established, safe and serviced by good transportation.” Wechsler said.

Office properties saw a sharp drop in aggregate dollar volume in 1H17, falling 68% from 2H16 to $166 million. However, year-over-year, dollar volume skyrocketed 389% versus $34 million in 1H16. The most notable sale in 1H17 was Lefrak Organizations sale of an office building at 95-25 Queens Boulevard in Rego Park for $140 million, representing nearly $400 per square foot.

Meanwhile, sales of development sites slumped in 1H17, partly due to the lack of 421-a, which was reinstated in April as “Affordable New York.” A large amount of supply in the pipeline and tightened capital markets led the Queens development market to continue the slowdown that started in 2016. In 1H17, there was a 29% decline in dollar volume to $642 million, a 31% decrease in transaction volume to 72, and a 41% drop in property volume to 107 compared to 2H16.

While the average price per buildable square foot for development sites decreased to $181 from 2016’s average of $185, pricing is still stronger than 2015’s average of $154. One of the more notable transactions that took place in 1H17 was the $16 million sale of 111-10 Astoria Boulevard in East Elmhurst where the NYC School Construction Authority plans to construct a new 600 seat middle school. The largest development/conversion site sold was 43-10 23rd Street in Long Island City for $54 million.

While transaction and dollar volume slowed, prices remained steady in Queens, and there is much to look forward to for 2H17 as assets in prime areas of Queens are still trading at a discount compared to Manhattan and prime Brooklyn locations.

To view the full report, please click here: http://arielpa.com/report/report-APA-Queens-mid2017-Sales-Report

For More information, please contact: Daniel Wechsler, ext. 44, dwechsler@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.