January 18, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. economy continues to strengthen, with the latest jobs report all but guaranteeing more monetary tightening from the Federal Reserve this year. The unemployment rate ticked up to 4.7% from the previous month’s nearly 10-year low of 4.6%. While job creation decelerated somewhat in December, workers’ wages increased 2.9% from a year earlier, the best annual rate since 2009.

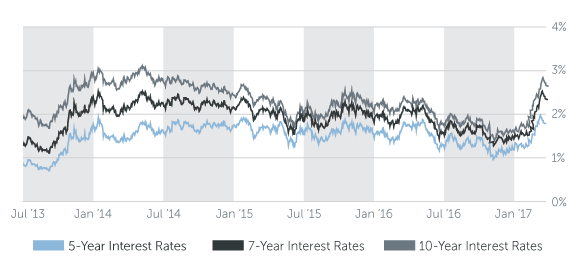

Earnings have outpaced inflation in recent years, but accelerating wage growth could raise the prospect of higher inflation, which erodes the value of fixed income securities, particularly those on the long-end of the yield curve. The yield on the 10-year Treasury note, which last traded at 2.34%, has been on an upward trajectory since November. The yield stood at 1.87% on Election Day and rose as high as 2.6% in December, due largely to expectations of more expansive fiscal policies out of Washington under President-elect Trump and a Republican-led Congress. Many expect the Trump administration to lower taxes and boost spending on defense and infrastructure projects.

Lender appetite remains strong, and while interest rates are poised to rise in 2017, they remain historically low. Origination and refinancing activity should gain steam in the months ahead as borrowers try to lock in rates while they remain extremely attractive. Fed tightening reflects a healthy economy, and therefore we expect capital markets to remain strong in 2017, enabling investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.375% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 01/17/2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year | 4.00% - 4.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 4.75% - 6.25% |

| Stabilized | 4.75% - 7.00% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 01/17/2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.82% |

| 7-Year Treasury | 2.12% |

| 10-Year Treasury | 2.32% |

| Prime Rate | 3.50% |

| Term | Interest Rates |

| 3-Year Swap | 1.64% |

| 5-Year Swap | 1.89% |

| 7-Year Swap | 2.05% |

| 10-Year Swap | 2.22% |

Pricing current as of 01/17/2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.