February 3, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely anticipated, left its benchmark interest rate, currently ranging from 0.5% to 0.75%, unchanged on Wednesday at its first policy-setting meeting after the inauguration of President Trump. The central bank’s outlook remained unchanged, noting the country’s economic expansion has continued, with scant signs from recent reports that it is gaining momentum or decelerating. While strength in the labor market and gradually rising inflation pave the way for more tightening of monetary policy, the Fed said it is taking a wait-and-see stance, awaiting more information about the Trump administration’s economic initiatives.

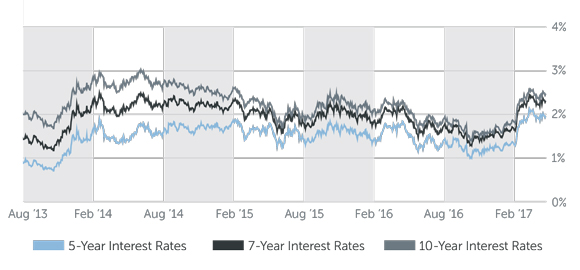

The economy grew by a lackluster 1.6% in 2016, sharply below the 4% rate President Trump has pledged to achieve, namely through lower taxes and increased spending on defense and infrastructure projects. The Fed has signaled that it plans to raise interest rates several more times in 2017 and faster economic expansion could hasten its plans. The yield on the 10-year Treasury, last trading at 2.46%, is 14 basis points lower than its peak hit in December, but nearly 60 basis points higher than where it stood before November's presidential election.

Lender appetite remains robust, and while interest rates are likely to rise in 2017, they remain historically low. Origination and refinancing activity should gain momentum in the months ahead as borrowers try to lock in rates while they remain extremely attractive. Fed tightening reflects a sturdy economy, and therefore we expect capital markets to remain healthy in 2017, enabling investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 02/02/2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year | 4.00% - 4.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 4.75% - 6.25% |

| Stabilized | 4.75% - 7.00% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 02/02/2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.90% |

| 7-Year Treasury | 2.23% |

| 10-Year Treasury | 2.44% |

| Prime Rate | 3.75% |

| Term | Interest Rates |

| 3-Year Swap | 1.69% |

| 5-Year Swap | 1.97% |

| 7-Year Swap | 2.17% |

| 10-Year Swap | 2.35% |

Pricing current as of 02/02/2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.