March 16, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely anticipated, raised its benchmark lending rate by a quarter point to a range of 0.75 percent to 1 percent on Wednesday, its third rate hike since last decade's recession and the first under President Trump. The central bank's policy-setting arm continued to project two more rate increases this year, signifying caution as inflation nears its 2% target.

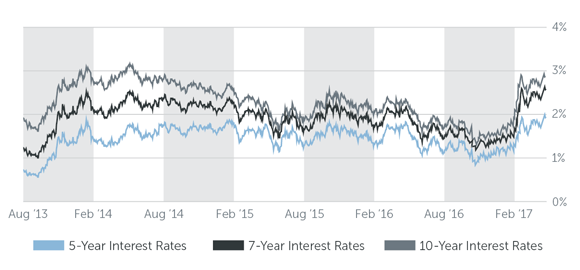

While President Trump has pledged to achieve a 4% growth rate, namely through lower taxes and increased spending on defense and infrastructure projects, faster economic expansion could hasten Fed rate hikes. The yield on the 10-year Treasury note, last trading at 2.51%, is about 10 basis points lower than a recent two-year high. Yields could move higher, but it will likely take progress toward fiscal stimulus for yields to break out of their current range.

Rising rates will cause properties to qualify for smaller-sized loans, which should drive stronger demand for loans higher up the capital stack, such as bridge loans, mezzanine debt, preferred equity, and common equity. This shift will heighten the need for a seasoned real estate broker who is equipped to capture the best deal possible for an investor. Fed tightening reflects a robust economy, and therefore we expect capital markets to remain healthy this year, enabling investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 03/16/2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year | 4.00% - 4.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 4.75% - 6.25% |

| Stabilized | 4.75% - 7.00% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 03/16/2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.03% |

| 7-Year Treasury | 2.32% |

| 10-Year Treasury | 2.52% |

| Prime Rate | 3.75% |

| Term | Interest Rates |

| 3-Year Swap | 1.87% |

| 5-Year Swap | 2.15% |

| 7-Year Swap | 2.33% |

| 10-Year Swap | 2.50% |

Pricing current as of 03/16/2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.