April 11, 2017

By Paul McCormick, Ariel Property Advisors

The possibility of the Federal Reserve moving forward with its stated intention of raising rates at least two more times this year is still open as payroll gains declined sharply in March and the labor markets tightened. With the unemployment rate last month dropping to 4.5%, its lowest since May 2007, the jobs market remains one of the biggest bright spots in the economy.

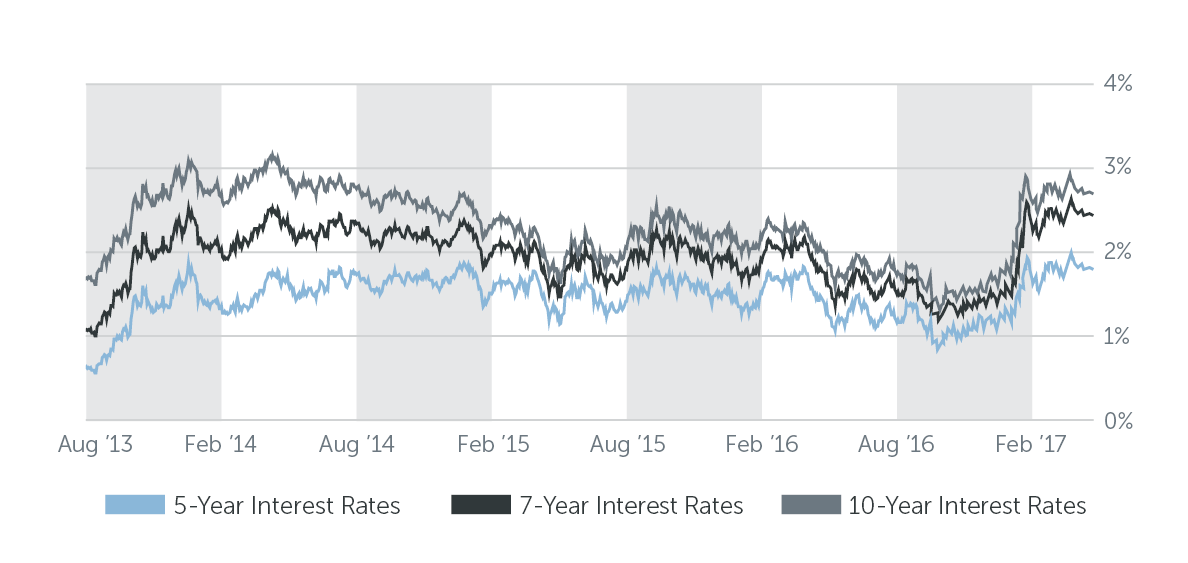

Interestingly, long-term 10-year Treasury yields, which last traded at 2.375%, have been on a downward trajectory after hitting a two-year high of 2.61% in March. Bearish bets on bonds unwound after the Trump Administration failed to put through Congress revisions to the Affordable Health Care Act, called Obamacare. The unsuccessful bid was seen as a sign that measures to stimulate the economy, such as lower taxes and increased spending on infrastructure and defense, may meet a similar fate.

Meanwhile, minutes from the Fed's latest meeting showed policymakers discussed the possibility of reducing its $4.5 trillion portfolio of Treasuries and mortgage securities later this year, a move that could put added pressure on bond prices and send rates higher. However, despite the rising interest rate environment, we expect the lending landscape to remain favorable.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 04/11/2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year | 4.00% - 4.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 4.75% - 6.25% |

| Stabilized | 4.75% - 7.00% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 04/11/2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.87% |

| 7-Year Treasury | 2.15% |

| 10-Year Treasury | 2.34% |

| Prime Rate | 3.75% |

| Term | Interest Rates |

| 3-Year Swap | 1.79% |

| 5-Year Swap | 1.97% |

| 7-Year Swap | 2.13% |

| 10-Year Swap | 2.30% |

Pricing current as of 04/11/2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.