June 20, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, raised its short-term interest rate by a quarter-percentage point to bring it between 1% and 1.25%, its fourth rate hike since December 2015 and its second this year. The central bank's policy-setting arm maintained its outlook for one more rate hike this year, noting near-term risks are “roughly balanced,“ and laid out some details on how it plans to shrink its $4.5 trillion portfolio of bonds this year.

The Fed said it is watching “inflation developments closely.“ Data released this week showed the “core“ inflation rate softened to 1.7 percent in May, down from 2.3 percent in January. Should inflation continue to weaken, the Fed may opt to forgo another rate hike.

The economy's outlook is undoubtedly murky. The jobs market is the biggest bright spot, with unemployment rate in May dropping to 4.3%, its lowest in 16 years, but employee wages have only increased modestly. Meanwhile, recent data on retail, automobile, and home sales indicated notable weakness in those sectors. While the Commerce Department upwardly revised GDP in the first quarter to 1.2%, it was the weakest performance since the same period in 2016.

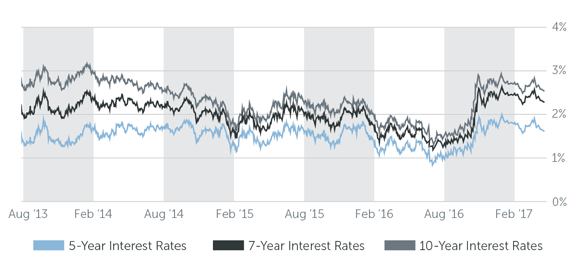

Long-term 10-year Treasury yields last traded at 2.11%, a 7-month low, and have been on a downward trajectory after hitting a two-year high of 2.61% in March. Bearish bets were unwound in recent months amid uncertainty over the Trump administration's economic proposals and weak economic data.

“As interest rates rose earlier this year, investors have been forced to underwrite properties more conservatively as their cash-on-cash and IRR projections have been impacted, which contributed to a slowdown in investment property sales,“ said Paul McCormick, Senior Vice President, Investment Sales and Capital Services.

With rates moving higher, loan amounts will continue to pull back as properties qualify for less proceeds, driving stronger demand for mezzanine debt and preferred equity. Overall, Fed monetary tightening reflects a robust economy, and therefore we expect capital markets to remain strong, allowing investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 6-15-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 6-15-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.76% |

| 7-Year Treasury | 1.98% |

| 10-Year Treasury | 2.16% |

| Prime Rate | 4.00% |

| Term | Interest Rates |

| 3-Year Swap | 1.66% |

| 5-Year Swap | 1.84% |

| 7-Year Swap | 1.97% |

| 10-Year Swap | 2.14% |

Pricing current as of 6-15-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.