July 28, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, left its benchmark policy rate unchanged at between 1% and 1.25% on Wednesday, noting in a statement that risks over the near-term look “roughly balanced.“ Central bank policymakers, however, said they intend to start normalizing their balance sheet, announcing plans to unwind the bank's $4.5 trillion portfolio of bonds “relatively soon.“

The Fed purchased trillions in Treasury securities and mortgage bonds in the aftermath of last decade's financial crisis to lower long-term borrowing costs, called quantitative easing, and a move to unload these holdings should put downward pressure on the prices of these assets and send yields higher.

Fed officials are also watching progress toward the bank's inflation goal, which has fallen short of their goal of 2% in recent months. The Fed is penciling in another interest rate hike this year, but if inflation continues to be soft, policymakers may opt to raise interest rates more slowly than expected, or even forgo another increase.

The economy's outlook is undeniably cloudy. The jobs market is the biggest bright spot, with the unemployment rate hovering near a 16-year low in June. While data this week showed consumer confidence jumped in July to its second-highest reading since 2000, recent reports on home and retail sales show notable softness in the sectors. Meanwhile, the economy has been growing at an unremarkable pace. GDP rose a mere 1.25% in the first quarter, and the Atlanta Federal Reserve is forecasting a 2.5% increase in the second quarter.

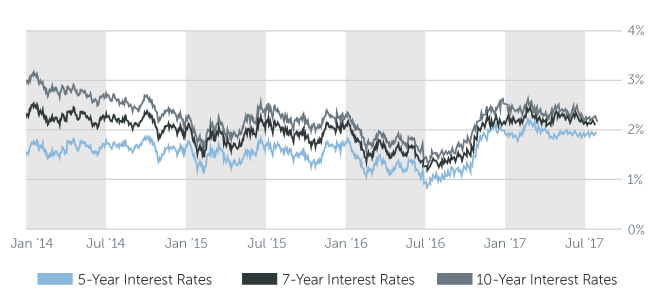

Long-term 10-year Treasury yields, last trading at 2.29%, have fallen since hitting a two-year high of 2.61% in March. Bearish bets were unwound in recent months on reduced expectations of large fiscal stimulus from the Trump administration that would bolster the economy and raise inflation.

“When interest rates rose in the first quarter, it became more expensive to finance real estate transactions, and that played a role in suppressing investment sales activity in the first half,“ said Paul McCormick, Senior Vice President, Investment Sales and Capital Services. Indeed, according to Ariel Property Advisors' 2017 Mid-Year Sales Reports, sales volume across the boroughs has decreased for virtually every submarket in the first half of 2017.

“Any rise in rates from here, however, should prove temporary unless there are clear signs of higher inflation or accelerated economic growth,“ McCormick said.

Even if the Fed tightens monetary policy further, rates should remain attractive because an abundance of traditional and alternative lenders are competing for business in the marketplace right now. Overall, the normalization of Fed monetary policy reflects a sturdy economy, and therefore we expect capital markets to remain strong, allowing investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 7-27-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 7-27-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.86% |

| 7-Year Treasury | 2.13% |

| 10-Year Treasury | 2.32% |

| Prime Rate | 4.25% |

| Term | Interest Rates |

| 3-Year Swap | 1.76% |

| 5-Year Swap | 1.97% |

| 7-Year Swap | 2.13% |

| 10-Year Swap | 2.31% |

Pricing current as of 7-27-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.