August 23, 2017

By Paul McCormick, Ariel Property Advisors

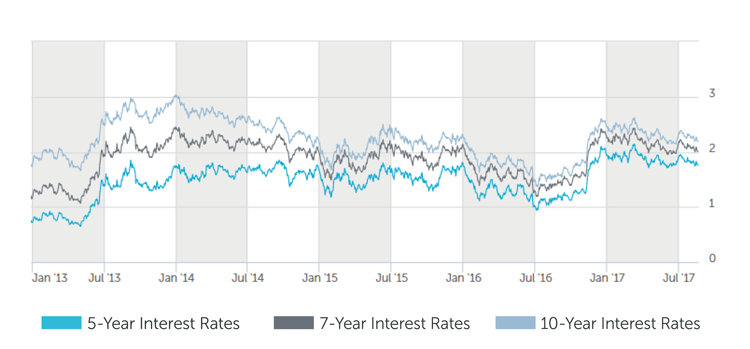

The U.S. economy continues to improve, albeit at a lackluster pace. While the Federal Reserve left its benchmark policy rate unchanged at between 1% and 1.25% last month, minutes from July’s meeting show officials are squarely divided about when to raise interest rates again due to concerns about softening inflation.

Fed officials, who have penciled in one more rate hike this year, are looking for progress toward the bank’s inflation target, which has fallen short of their goal of 2% over the past few months. If inflation continues to fall short, the central bank may elect to forgo another rate hike this year. That belief has buoyed long-term Treasuries in recent weeks because inflation tends to erode their value over time.

Treasury bonds have strengthened in 2017, reflecting ongoing demand for safe-haven assets amid geopolitical tensions and reduced expectations of a large fiscal stimulus package from the Trump administration that would bolster the economy and raise inflation. Nevertheless, Treasuries could come under pressure when the Fed, as widely expected, starts unwinding its $4.5 trillion portfolio of bonds in the coming months.

The yield on the 10-year Treasury note, last trading at 2.19%, is sharply below a two-year peak of 2.61% reached in March and 2.45% at the end of last year.

The economy’s outlook is undeniably foggy. The labor market is by far the biggest bright spot, with the unemployment rate sitting at a 16-year low in July. However, wage growth remains stagnant, which has impacted consumer spending, the largest component of the economy. Meanwhile, while the housing market, also a sizeable economic driver, has markedly strengthened since last decade’s bust, the pace of its improvement is showing signs of slowing.

This week’s focus will be on Jackson Hole, Wyoming, where an annual gathering of central bankers will take place. The powwow has been used in the past to make policy pronouncements and market participants this year are expected to hone in on comments made by European Central Bank President Mario Draghi. Should Draghi announce looser accommodation, the euro should gain versus the dollar, which would weigh on Treasury prices.

“Central bankers hold the cards right now and we are currently in a wait-and-see mode,” said Paul McCormick, Senior Vice President, Investment Sales and Capital Services. “Rates could head higher from here, but unless inflation firms and economic growth gains momentum, the Fed will likely stay on its slow-but-steady path.”

Even if the Fed opts to tighten monetary policy further, rates should remain enticing because a slew of traditional and alternative lenders are currently competing for business. Overall, the normalization of Fed monetary policy indicates a strong economy, and therefore we expect capital markets to remain active, allowing investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 8-22-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 8-22-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.78% |

| 7-Year Treasury | 2.02% |

| 10-Year Treasury | 2.21% |

| Prime Rate | 4.25% |

| Term | Interest Rates |

| 3-Year Swap | 1.67% |

| 5-Year Swap | 1.84% |

| 7-Year Swap | 1.99% |

| 10-Year Swap | 2.15% |

Pricing current as of 8-22-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.