September 22, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, left its benchmark policy rate unchanged at between 1% at 1.25% on Wednesday, reiterating that interest rates will likely rise at a “gradual” pace. Fed officials, however, announced plans to start shrinking their $4.5 trillion portfolio of Treasury securities and mortgage bonds in October.

Recent havoc from storms will impact the economy over the near term, but are “unlikely to materially alter the course of the national economy over the medium term,” the Fed said in a statement.

Fed officials have been awaiting progress toward the central bank’s inflation goal, which has been below their target of 2% for most of 2017. Policymakers have penciled in one more rate hike this year, but if inflation continues to fall short, they may opt to forgo another increase. Nevertheless, the odds of another rate hike jumped last week after data showed consumer prices climbed last month at the strongest pace since January.

“While this report assuaged fears that inflation is slowing broadly, it will take more than one reading to ascertain whether last month’s pickup was an anomaly or a trend,” said Paul McCormick, Senior Vice President, Investment Sales and Capital Services. “Unless inflation firms or economic growth strengthens, the Fed will remain on its slow-but-steady path.”

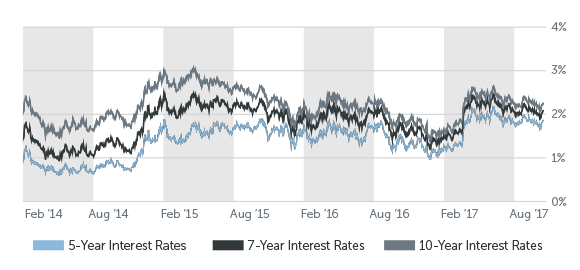

Treasury bonds have mostly gained in 2017, indicating ongoing demand for assets perceived as safe havens amid geopolitical tensions and reduced expectations of a large fiscal stimulus package from the Trump administration that would bolster the economy. Yields have climbed in recent weeks, reflecting diminished fears about the economic impact of Hurricane Irma and signs of a possible end to the recent slowdown in inflation.

The yield on the 10-year Treasury note, last trading at 2.23%, is sharply below a two-year peak of 2.61% reached in March and 2.45% at the end of last year.

The economy’s outlook is unequivocally cloudy. The labor market is by far the biggest bright spot, with the unemployment rate sitting at a 16-year low in July. However, wage growth remains stagnant and the housing market’s strength is showing signs of slowing.

Meanwhile, the Commerce Department reported U.S. retail sales fell 0.2% in August from the prior month. Brick-and-mortar stores are swiftly falling by the wayside as online retailers drastically sap traffic. Toys “R” Us Inc., the country’s largest toy store, this week filed for bankruptcy protection, casting a dark cloud over the future of the 64,000 employees who work at its nearly 1,600 stores.

Even if the Fed tightens monetary policy further, rates should remain attractive because an abundance of traditional and alternative lenders are competing for business in the marketplace right now, allowing investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 9-20-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 9-20-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.82% |

| 7-Year Treasury | 2.06% |

| 10-Year Treasury | 2.23% |

| Prime Rate | 4.25% |

| Term | Interest Rates |

| 3-Year Swap | 1.74% |

| 5-Year Swap | 1.90% |

| 7-Year Swap | 2.03% |

| 10-Year Swap | 2.19% |

Pricing current as of 9-20-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.