October 11, 2017

By Paul McCormick, Ariel Property Advisors

The U.S. economy was hindered by the havoc caused by hurricanes last month, with the country registering the first monthly job loss in seven years in September. While payrolls declined by 33,000 – marking the end of the longest stretch of job creation on record – the unemployment rate fell, reaching a new 16-year low of 4.2%, and worker’s wages improved.

Recent havoc from storms will impact the economy over the near term, but are “unlikely to materially alter the course of the national economy over the medium term,” the Fed said in a statement.

“The devastating hurricanes distorted the jobs data and their impact on the economy should persist for a while,” said Paul McCormick, Senior Vice President, Investment Sales and Capital Services. “Nevertheless, the labor market remains a bright spot and there are significant pockets of strength in the economy that should keep the Fed on track to raise rates again.”

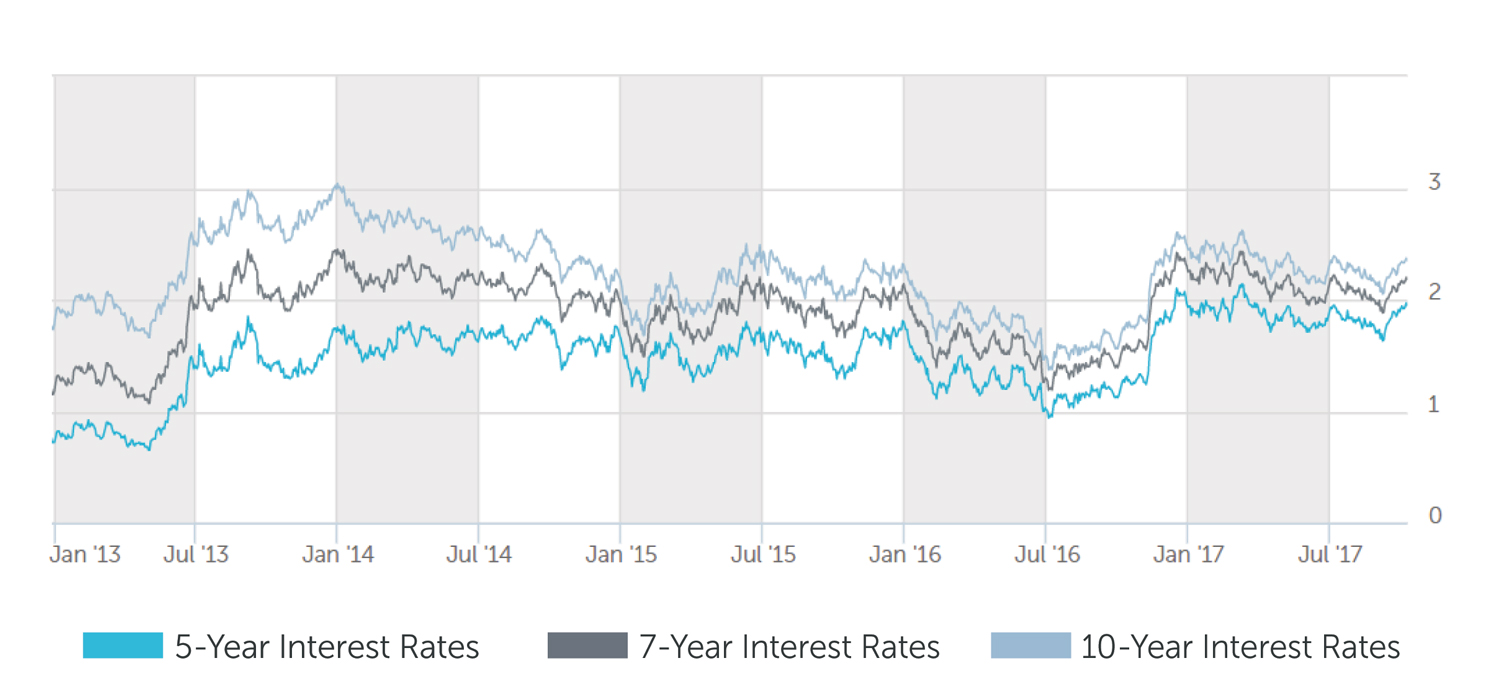

Heightened expectations of a Fed rate hike later this year, as well as a slew of government debt auctions, weighed on Treasury bonds in recent weeks. Investors sought assets perceived as risker after a string of sanguine economic reports. The Institute of Supply Management’s monthly indexes of activity in the manufacturing and services sectors climbed to their highest levels in more than 10 years in September, and during the same month automobile sales surged to a 2017 peak.

The yield on the 10-year Treasury note, last trading at 2.35%, is up about 15 basis points since the Fed’s last policy-setting meeting in mid-September, but below a two-year peak of 2.61% reached in March and 2.45% at the end of last year. Treasuries could come under added pressure as the Fed starts unwinding its $4.5 trillion portfolio of Treasury securities and mortgage bonds.

Gross domestic product rose 3.1% in the second quarter, sharply above the first quarter’s tepid 1.2% growth and the economy’s average of a little more than 2% a year since the recession ended in mid-2009. Forecasters expect between 2% and 3% growth in the third quarter and stronger output in the fourth quarter. Nevertheless, pockets of weakness persist, with retail sales a notable soft spot, and the housing market’s strength has shown signs of slowing.

Even when the Fed chooses to tighten monetary policy further, interest rates should remain alluring because a host of lenders, both traditional and alternative, are aggressively competing for business. Overall, the normalization of Fed monetary policy indicates an economy that is on solid footing, and therefore we expect capital markets activity to remain vibrant, allowing investors easy accessibility to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 10-11-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 10-11-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.94% |

| 7-Year Treasury | 2.16% |

| 10-Year Treasury | 2.34% |

| Prime Rate | 4.25% |

| Term | Interest Rates |

| 3-Year Swap | 1.89% |

| 5-Year Swap | 2.03% |

| 7-Year Swap | 2.16% |

| 10-Year Swap | 2.30% |

Pricing current as of 10-11-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.