November 2, 2017

By Paul McCormick, Ariel Property Advisors

U.S. President Donald Trump nominated Federal Reserve Governor Jerome Powell to be the next chairman of the central bank after Fed Chairwoman Janet Yellen’s four-year term expires in early February. The announcement followed the Fed’s widely-expected decision on Wednesday to leave its benchmark rate unchanged at between 1% and 1.25%.

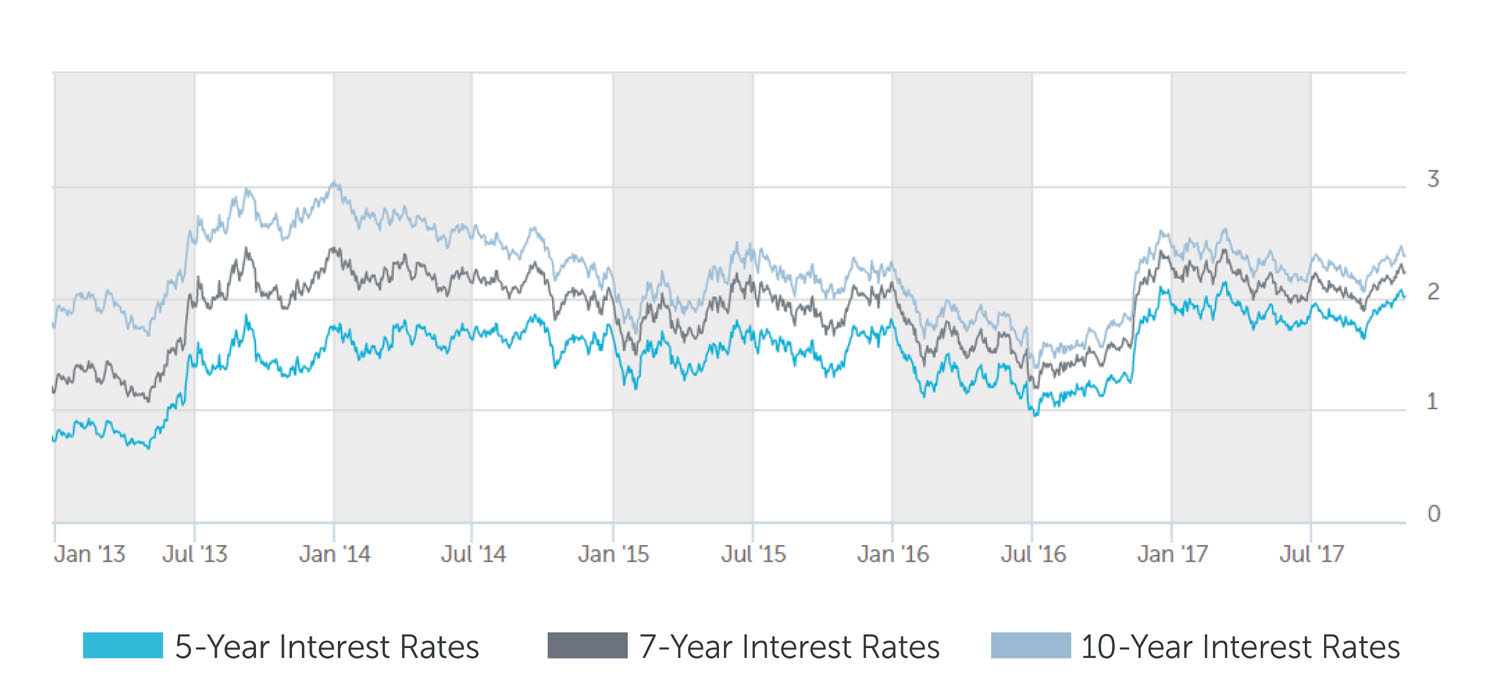

Fed watchers believe Mr. Powell will be friendlier to Wall Street than Ms. Yellen, but take a similarly dovish approach to monetary policy, continuing its slow-but-steady approach to interest rate increases. Strength in the economy should keep the Federal Reserve on track to raise rates for a third time this year in December despite persistently low inflation.

The U.S. economy is on much firmer footing than earlier this year, with gross domestic product growing at a 3% annual rate in the third quarter. That followed 3.1% annual growth in the second quarter, marking the first time since mid-2014 that the economy registered two quarters of back-to-back expansion of a least 3%. GDP was also sharply above the first quarter’s tepid 1.2% and the economy’s average of a little more than 2% a year since the recession ended in mid-2009.

“Strong consumer and business spending, as well as increased exports, helped avert the slowdown that many expected after the string of devastating hurricanes in August and September,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services. “The economy has undoubtedly picked up steam, and there are significant pockets of strength that should keep the Fed on track to increase rates next month.”

While the hurricanes skewed September’s payroll data – registering the first monthly job loss in seven years – the labor market remains one of the economy’s biggest bright spots. Heightened expectations of a Fed rate hike and a string of sanguine economic reports, particularly those gauging the manufacturing and services sectors, weighed on Treasury bonds recently.

The yield on the 10-year Treasury note reached its highest since March last week after the Commerce Department reported new orders for durable goods rose by a seasonally adjusted 2.2% in September from a month earlier. Meanwhile, the Conference Board said a gauge of consumer confidence rose to nearly a 17-year high in October.

Treasury yields have fallen in recent days after Special Counsel Robert Mueller issued indictments in an investigation into Russian interfering with the 2016 U.S. election. Some contend this could sidetrack President Trump’s legislative priorities, namely lowering tax rates for individuals, corporations and other businesses.

A tax overhaul is expected to stimulate growth and inflation, but it could also increase the budget deficit and supply of Treasury debt. Nevertheless, Treasury bonds have mostly gained in 2017, indicating ongoing demand for assets perceived as safe havens amid geopolitical tensions and reduced expectations of a large fiscal stimulus package. The 10-year yield, last trading at 2.37%, remains below a two-year peak of 2.61% in March, but not far from 2.45% at the end of last year.

While caution persists in the current climate, the market for real estate financing is ripe with opportunity. Even when the Fed opts to tighten monetary policy further, interest rates should remain attractive because a barrage of lenders, both traditional and alternative, are actively competing for business. Overall, the normalization of Fed monetary policy indicates an economy that is gaining steam, and therefore we expect capital markets to remain robust, allowing investors easy accessibility to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.75% |

| 7 Year | 3.75% - 4.00% |

| 10 Year | 4.125% - 4.375% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.50% - 3.875% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 11-2-2017 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.25% |

| 7 Year | 4.00% - 4.50% |

| 10 Year | 4.25% - 4.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 6.50% |

| Stabilized | 5.00% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 11-2-2017 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.00% |

| 7-Year Treasury | 2.21% |

| 10-Year Treasury | 2.35% |

| Prime Rate | 4.25% |

| Term | Interest Rates |

| 3-Year Swap | 1.93% |

| 5-Year Swap | 2.08% |

| 7-Year Swap | 2.20% |

| 10-Year Swap | 2.33% |

Pricing current as of 11-2-2017

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.