March 22, 2018

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, raised its benchmark short-term interest rate by a quarter-percentage point to a range of 1.50% to 1.75% on Wednesday, its sixth rate hike since December 2015. While central bank officials maintained their projection of three quarter-percentage point rate increases in 2018, they are penciling in three rate hikes in 2019, up from the two projected at their December meeting.

According to their March statement, Fed officials said annual inflation “is expected to move up in coming months.“ That differed from their January statement when they said inflation was expected to move up “this year.“

Data last week showed U.S. consumer prices rose slightly in February, but at a slower pace than the previous month. Should inflation gain considerable steam, the Fed may opt to raise rates more aggressively. The Fed’s preferred measure of inflation, the price index for personal-consumption expenditures, has largely undershot its 2% target over the past year.

Recent reports indicate the economy is on firm footing, with the labor market undeniably the biggest bright spot. Job growth jumped in February, registering the largest increase in more than 1-1/2 years and the unemployment rate remained at a 17-year low of 4.1%. Solid data gauging business and consumer sentiment also conveyed strength.

“The economy is in a goldilocks scenario right now,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services. “Inflation is firming, but not too much to cause concern from the Fed, and the jobs market is conspicuously robust.”

There are, however, pockets of weakness in the economy. Retail sales fell for a third straight month in February. In one of the biggest retail liquidations in U.S. history, Toys “R” Us last week said it will sell or close all of its more than 700 stores, a move that threatens up to 33,000 jobs.

Nevertheless, the New York Fed is currently forecasting first quarter gross domestic product at 2.7%, sharply above the 1.2% registered in the same quarter in 2017. Many economists expect continued, solid growth this year, bolstered by recent tax cuts.

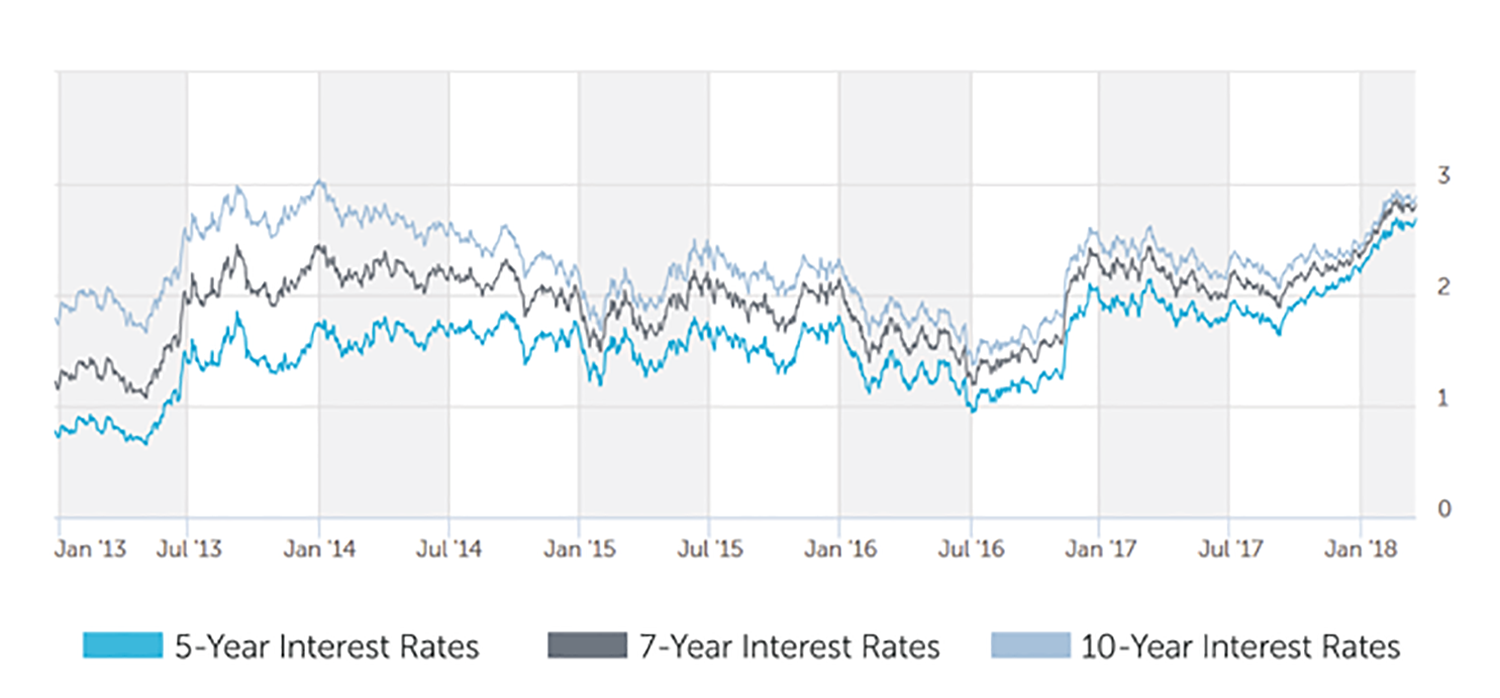

Long-term 10-year Treasury yields, which influence everything from mortgage rates to corporate loans, reached a four-year high of 2.94% in February as upbeat economic data and strong company earnings caused investors to shed safe-haven securities in exchange for riskier assets. The 10-year yield, last trading at 2.91%, has fallen in recent weeks, due partly to concerns about the White House’s trade policy. Possible retribution to tariffs put on steel and aluminum imports from U.S. trading partners spurred demand for government bonds.

“It has undoubtedly become more expensive to finance real estate transactions in recent months, but the cost of borrowing remains attractive and the value of properties should remain stable as the economy continues to hum along,” McCormick said.

Last week the Senate approved a bipartisan plan to ease banking rules. More than two dozen small and mid-sized banks will have their regulatory threshold increased from $50 billion in assets to $250 billion. This could potentially spur an uptick in lending activity. The bill is perceived to have a good chance at becoming a law, which would make it the largest revamp of financial rules since the Trump administration set out broad goals to reduce business regulations.

Looking ahead, with rates likely to continue heading higher, senior lenders may pull back as properties qualify for less leverage. Higher borrowing costs should also drive stronger demand for loans higher up the capital stack, such as mezzanine debt, preferred equity, or from transitional debt funds that underwrite to a business plan with upside. Overall, Fed monetary tightening reflects a robust economy, and therefore we expect capital markets to remain robust, allowing investors ongoing access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.875% - 4.125% |

| 7 Year | 4.125% - 4.375% |

| 10 Year | 4.25% - 4.50% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.00% - 4.25% |

| 7 Year | 4.25% - 4.50% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 3-21-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.25% - 4.75% |

| 7 Year | 4.25% - 4.75% |

| 10 Year | 4.50% - 5.00% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.50% - 6.50% |

| Stabilized | 5.50% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 3-21-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.69% |

| 7-Year Treasury | 2.83% |

| 10-Year Treasury | 2.90% |

| Prime Rate | 4.50% |

| Term | Interest Rates |

| 3-Year Swap | 2.76% |

| 5-Year Swap | 2.84% |

| 7-Year Swap | 2.88% |

| 10-Year Swap | 2.93% |

Pricing current as of 3-21-2018

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.