May 3, 2018

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, left its benchmark short-term interest rate unchanged at between 1.50% to 1.75% on Wednesday, indicating it plans to raise them gradually in the months ahead. At the end of its two-day policy-setting meeting, the Fed’s accompanying statement did scant to quash expectations that it will initiate its second rate hike of 2018 at its June meeting. The central bank raised rates in March, which was its sixth since December 2015.

Data this week showed inflation reached a critical landmark, with the Fed’s favored gauge, the Commerce Department’s price index for personal-consumption expenditures, hitting its target of 2% for the first time in over a year. A mere six months ago, year-over-year inflation stood at 1.4%. Tepid inflation has been the primary reason for the Fed’s “slow-but-steady” approach to interest rate increases over the past 3 years.

“Should inflation gain considerable steam, the Fed may opt to raise rates more aggressively and we have a host of forces right now that could bring that to fruition,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services.

Indeed, the U.S. government’s trade tariffs should continue to push import prices higher and there is mounting pressure on wage growth. Meanwhile, consumer spending, which accounts for 70% of U.S. economic production, may pick up steam as the impact of President Trump’s $1.5 trillion tax cut, signed into law late last year, takes hold.

Recent reports indicate the economy is on firm footing, with the labor market undeniably the biggest bright spot. The unemployment rate remained at a 17-year low of 4.1% in March and data last week showed the amount of people applying for unemployment insurance reached its lowest level since 1969.

Nevertheless, U.S. economic growth slowed a bit in the first quarter as frugal consumer spending countered robust business expenditures. From January through March, gross domestic product expanded at an annual rate of 2.3% to $174 trillion. While first quarter GDP was the best for the quarter since 2015, it was slower than the 3% recorded during the second-through-fourth quarters of 2017.

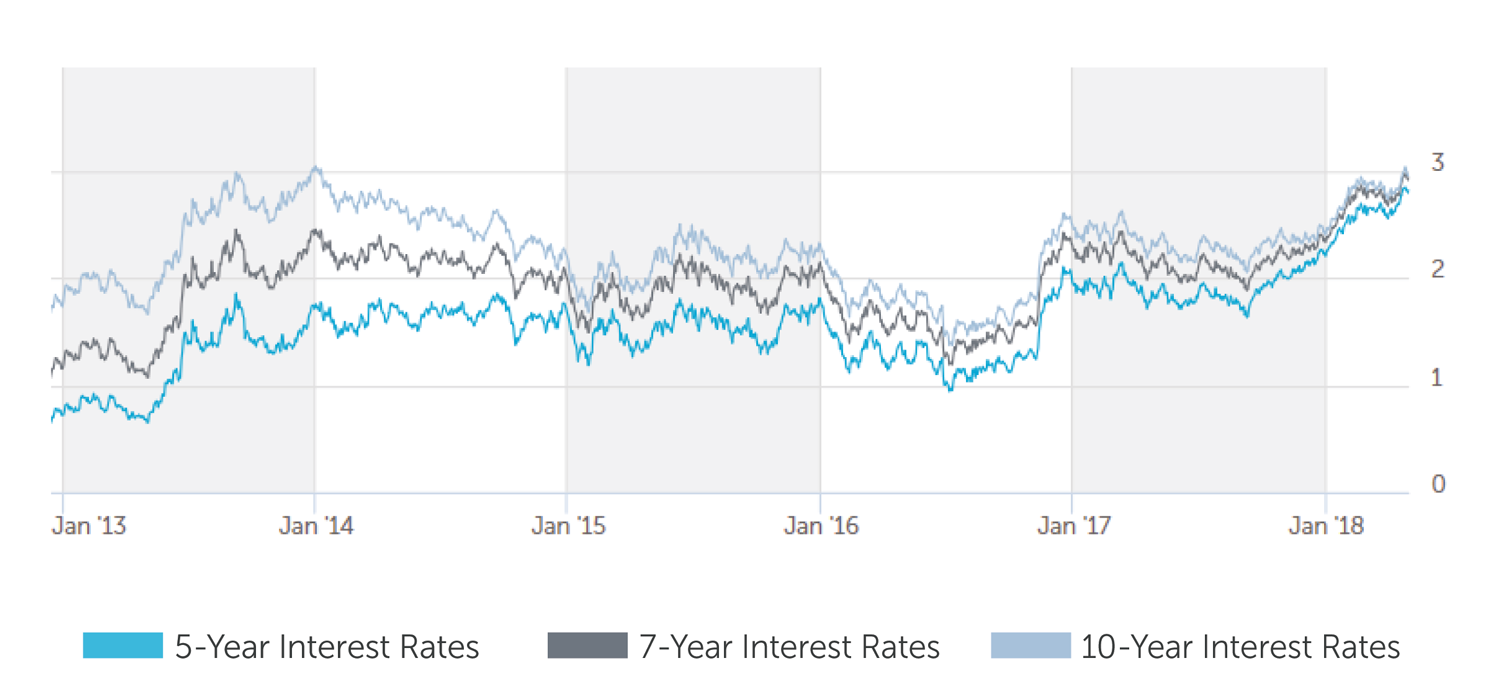

Long-term Treasury yields, which influence everything from mortgage rates to corporate loans, pierced 3% for the first time in four years in April due to a combination of strong corporate earnings and rising energy costs. A rise in oil prices fanned concerns about inflation, which diminishes the value of the fixed payments made on long-dated bonds.

The 10-year yield, last trading at 2.97%, has fallen in recent days as the spike in yields enticed buyers. Meanwhile, a sustained move above 3% could prove difficult given long-term Treasury yields are still higher than other developed nations, such as Germany’s.

“Balance sheet lenders have already reflected higher rates in anticipation of the Fed, but the prime rate, which is used for the most creditworthy borrowers, is something to keep a close eye on as every move higher by the Fed makes an impact on the cost of living,” McCormick said.

That’s because the prime rate is used for an array of credit, such as student loans, auto loans, home loans, credit cards, construction loans and some bridge loans. The prime rate is pegged to the Fed’s benchmark lending rate by 300 basis points, so a 1.75% benchmark rate equates to a 4.75% prime rate. Nonetheless, the prime rate is much lower than roughly a decade ago when it was around 7%-8%.

Overall, Fed monetary tightening reflects a strong economy, and therefore we expect capital markets to remain active, allowing investors unfettered access to alluring and dependable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.875% - 4.125% |

| 7 Year | 4.125% - 4.375% |

| 10 Year | 4.25% - 4.50% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.00% - 4.25% |

| 7 Year | 4.25% - 4.50% |

| 10 Year | 4.25% - 4.50% |

Pricing current as of 5-2-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.25% - 4.75% |

| 7 Year | 4.25% - 4.75% |

| 10 Year | 4.50% - 5.00% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.50% - 6.50% |

| Stabilized | 5.50% - 7.25% |

| Re-Position | 8.50% - 10.50% |

Pricing current as of 5-2-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.82% |

| 7-Year Treasury | 2.93% |

| 10-Year Treasury | 2.97% |

| Prime Rate | 4.75% |

| Term | Interest Rates |

| 3-Year Swap | 2.88% |

| 5-Year Swap | 2.94% |

| 7-Year Swap | 2.97% |

| 10-Year Swap | 3.00% |

Pricing current as of 5-2-2018

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.