June 14, 2018

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, raised its benchmark short-term interest rate by a quarter-percentage point to a range of 1.75% to 2.00% on Wednesday, its second rate increase this year and seventh since December 2015. At the end of its two-day policy-setting meeting, Federal Reserve officials raised their forecast to four total increases in 2018, which means two more rate hikes should be expected this year.

According to their June statement, Fed officials said, “The committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2 percent objective over the medium term.”

The U.S. economy is undeniably on firm footing, with the labor market the biggest bright spot. A higher-than-expected 223,000 jobs were added in May, prolonging the longest nonstop growth on record to 92 months. The unemployment rate, meanwhile, fell to 3.8% last month. The last time the joblessness was lower was in 1969, a time when thousands of people were enlisted into the Vietnam War.

In addition, a recent Labor Department survey showed job openings exceeding the number of unemployed Americans for the first time since record-keeping began in 2000. Job vacancies rose to 6.7 million in April, far outweighing the 6.3 million who were unemployed.

“This could precede stronger increases in average hourly earnings, which may lead to a hastening of inflation as higher wages typically fuels greater demand for products and services,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services. “That, along with the impact of government trade tariffs on import prices, may put pressure on the Fed to raise rates more aggressively.”

Meanwhile, April’s bigger-than-expected gain in U.S. consumer spending bodes well for second-quarter GDP since purchases comprise about 70 percent of the economy. The Atlanta Federal Reserve, widely viewed as one of the most reliable predictors of GDP, is forecasting 4.6% growth in the second quarter.

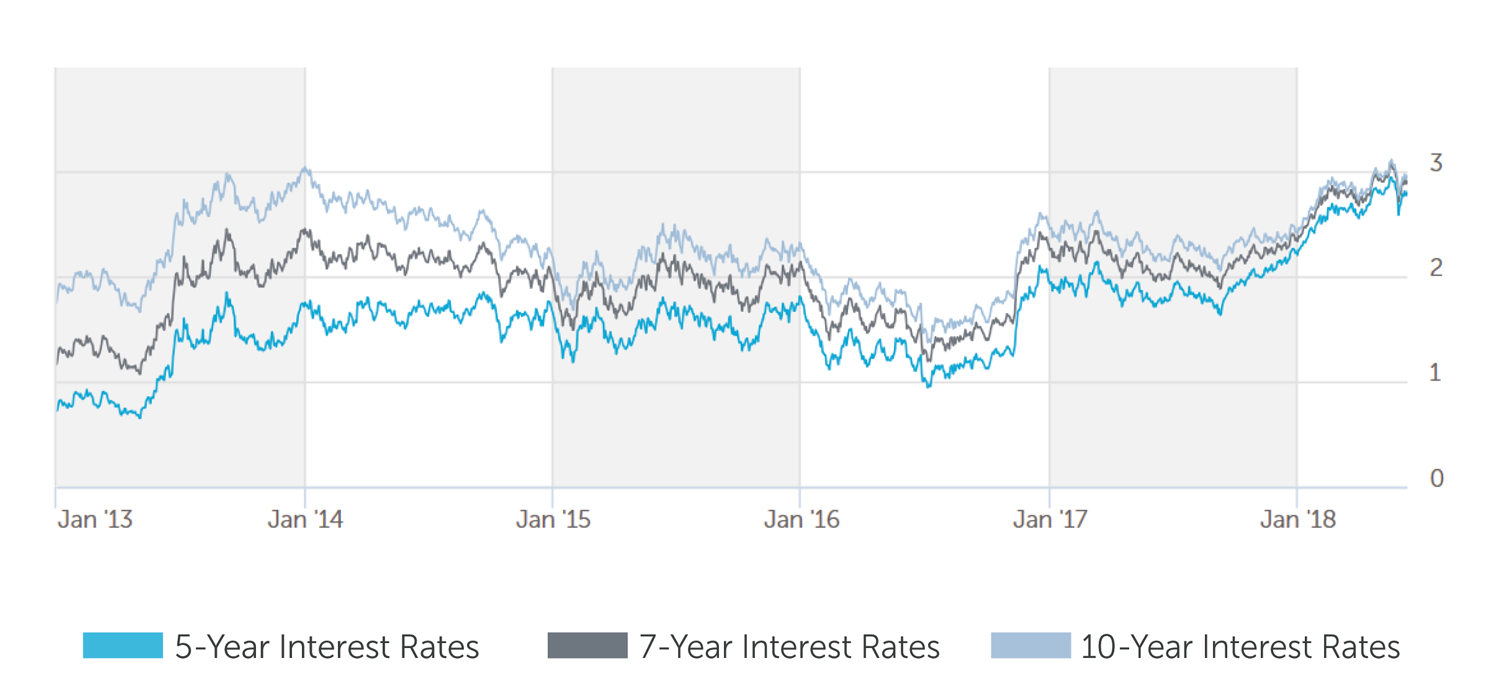

The 10-year Treasury yield, last trading at 2.97%, has traded in a relatively narrow range over the past month as political turmoil in Europe converged with concerns that tariffs between with the U.S. and its major trading partners will slow global growth. Additionally, the Trump administration recently announced it is imposing tariffs on steel and aluminum imported from the European Union, Canada and Mexico.

In the commercial real estate financing arena, significant legislative news emerged this past month. The U.S. House of Representatives voted to dismantle part of the Dodd-Frank Act, which was put in place as a safeguard in the aftermath of last decade’s recession. A similar Senate bill passed in March.

The bill relaxes regulations for all but the largest U.S. banks, raising the level at which banks face the tight oversight spelled out in Dodd-Frank to $250 billion in assets, from the current $50 billion. The bill is perceived to have a good chance at becoming a law, which would make it the largest revamp of financial rules since the Trump administration set out broad goals to reduce business regulations.

“This could spur an uptick in lending activity, particularly from smaller banks who had previously held off due to the lower threshold,” McCormick said. “This revision has the potential to be very positive for commercial real estate financing, but it may also usher in a rise in risky activity that historically emerges when regulations are loosened.”

However, the prime rate - used for an array of credit, such as student loans, auto loans, home loans, credit cards, construction loans and some bridge loans - is pegged to the Fed’s benchmark lending rate by 300 basis points. Therefore, every move higher by the Fed makes an impact on the cost of living.

Overall, Fed monetary tightening reflects confidence in the economy, and interest rates remain historically low. We therefore expect capital markets to remain vibrant, allowing investors unfettered access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.875% - 4.125% |

| 7 Year | 4.125% - 4.375% |

| 10 Year | 4.25% - 4.50% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.00% - 4.25% |

| 7 Year | 4.25% - 4.50% |

| 10 Year | 4.50% - 4.75% |

Pricing current as of 6-13-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.00% - 7.50% |

| Re-Position | 9.00% - 11.00% |

Pricing current as of 6-13-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.81% |

| 7-Year Treasury | 2.91% |

| 10-Year Treasury | 2.97% |

| Prime Rate | 4.75% |

| Term | Interest Rates |

| 3-Year Swap | 2.90% |

| 5-Year Swap | 2.96% |

| 7-Year Swap | 2.99% |

| 10-Year Swap | 3.02% |

Pricing current as of 6-13-2018

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.