August 1, 2018

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, left its benchmark short-term interest rate unchanged at between 1.75% to 2.00% on Wednesday, reiterating its plans to raise them steadily in the months ahead. At the end of its two-day policy-setting meeting, central bank officials said the economy has been ''rising at a strong rate'' and reaffirmed that ''monetary policy remains accommodative.''

Fed officials at the previous meeting forecasted four interest rate increases in 2018. That means two more rate hikes are in the pipeline this year, with the first likely to be implemented at the Fed’s September 25-26 meeting.

The U.S. economy has undeniably heated up in recent months with strong consumer spending, vigorous business investment and a leap in exports among the many factors that buoyed gross domestic product in the second quarter. GDP – the broadest measure of goods and serviced produced in the U.S. – grew at a seasonally and inflation-adjusted annual rate of 4.1% from April through June, decidedly higher than the first quarter’s 2.2% and the strongest growth since the third quarter of 2014.

Bolstered by low unemployment, robust job growth and President Trump’s $1.5 trillion tax cut, consumers accelerated their spending in the second quarter. Exports played a significant role in the economy’s performance, however, due largely to a jump in soybean exports as purchasers scrambled to acquire supplies ahead of China’s retaliatory tariffs on U.S. crops that took hold in July.

''The GDP report all but guarantees the Fed will continue raising short-term interest rates to avert an overheating of the economy,'' said Paul McCormick, Senior Vice President of Investment Sales and Capital Services. ''The big question mark is whether this type of growth is sustainable, and we will likely need to see broader, non-tariff related increases in order for that to happen.''

Despite solid corporate earnings and economic strength, pockets of weakness have emerged in certain sectors, particularly the housing market, which contributes about 15% to 18% to GDP. Existing home sales fell on a month-over-month basis in June and declined on an annual basis in five of the first six months of 2018.

''It is important to keep a close eye on the housing market as it lifted the country out of last decade’s recession and it has the ability to put the brakes on it now,'' McCormick said. ''Housing impacts almost every aspect of the economy, from home-improvement spending and construction to mortgage lending and employment.''

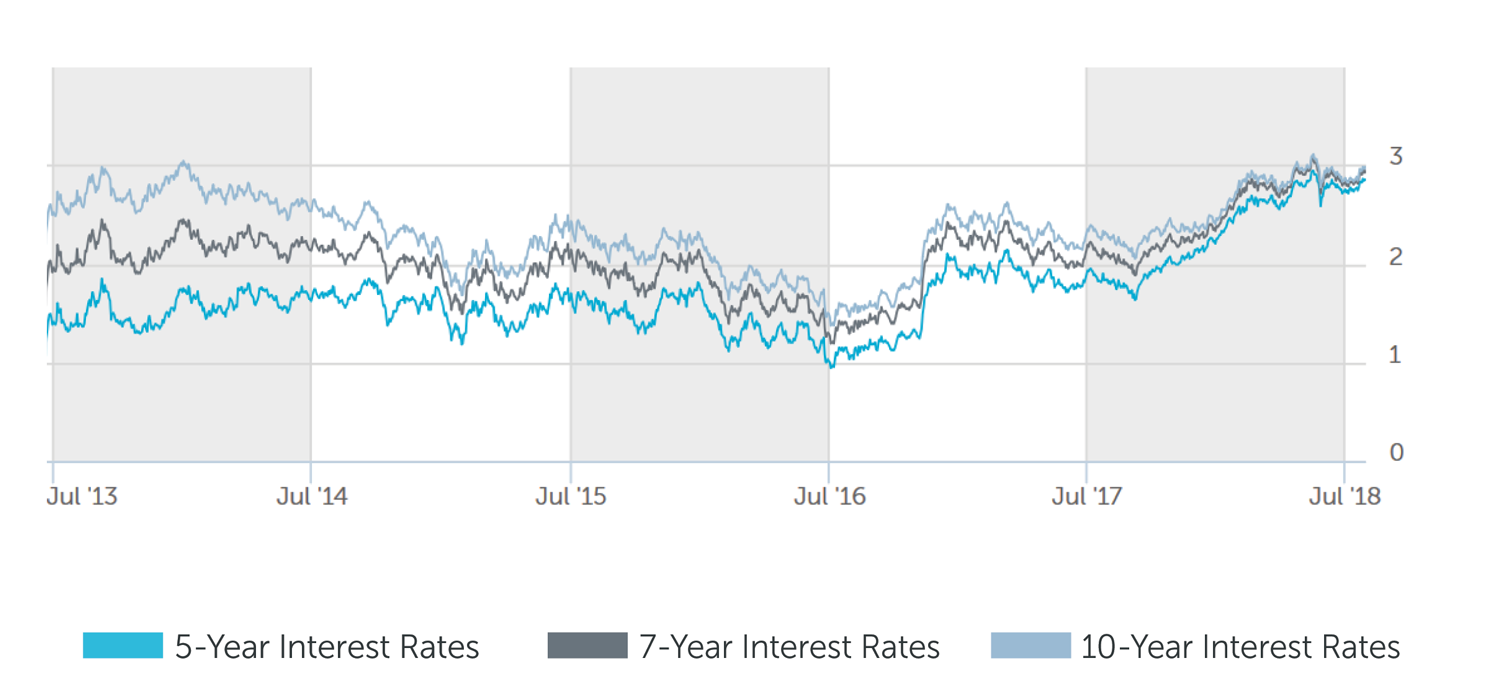

Prior to the Fed’s announcement, the 10-year Treasury yield touched 3 percent for the first time since June on concerns about supply. The 10-year yield, last trading at around 2.99%, has been trading in a relatively narrow range in recent months as political turmoil overseas converged with concerns that tariffs between with the U.S. and its major trading partners will slow global growth.

Long-term Treasury yields, which influence everything from mortgage rates to corporate loans, pierced 3% in April, due partly to rising energy costs. Many contend a sustained move above 3% would require higher interest rates from other developed nations and/or a hastening of inflation, which diminishes the value of the fixed-payments made on long-dated bonds.

It has become more expensive to finance projects and more restrictive lending is sapping the bottom line of builders as they are being forced to raise more equity, according to McCormick. Indeed, around this time three years ago, the loan-to-cost ratio was around 70 percent for a construction loan, significantly higher than today’s average of 55%. Developers, therefore, must get more creative, going to the private sector where they can get more proceeds, but where the cost of capital is approximately 300 basis points higher than traditional lenders.

Overall, Fed monetary tightening reflects confidence in the economy, and while interest rates have risen, they remain historically low. At the same time, new alternative lenders, both individual and institutional, have emerged with an enthusiastic appetite to extend credit. We therefore expect capital markets to remain vibrant, permitting investors unconstrained access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.125% - 4.375% |

| 7 Year | 4.375% - 4.625% |

| 10 Year | 4.50% - 4.75% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.25% - 4.50% |

| 7 Year | 4.50% - 4.75% |

| 10 Year | 4.75% - 5.00% |

Pricing current as of 8-1-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.75% - 5.00% |

| 7 Year | 5.00% - 5.25% |

| 10 Year | 5.25% - 5.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.00%-7.50% |

| Re-Position | 9.00%-11.00% |

Pricing current as of 8-1-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.88% |

| 7-Year Treasury | 2.96% |

| 10-Year Treasury | 2.99% |

| Prime Rate | 5.00% |

| Term | Interest Rates |

| 3-Year Swap | 2.97% |

| 5-Year Swap | 3.01% |

| 7-Year Swap | 3.03% |

| 10-Year Swap | 3.07% |

Pricing current as of 8-1-2018

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.