September 25, 2018

By

It is well-known that Hudson Yards, the current and future headquarters of some of the world’s largest companies, is making a notable impact on commercial property values in the area. However, its impact on middle-market condominium units has yet to fully materialize despite the likelihood that a sizeable swath of transplanted employees will decide to reside in the up-and-coming neighborhood.

(From left to right) Andre Sigourney, Director – Investment Sales and Drew Chartash, Analyst – Investment Research

Residential developers would be wise to take heed of the region surrounding Hudson Yards, generally bounded by 30th Street to the south, 42nd Street to the north, 9th Avenue to the east and the Hudson River to the west. That’s because condos in this neighborhood are selling at steep discounts relative to comparable neighborhoods in Manhattan, namely the Plaza District in Midtown.

With the sprawling 28-acre Hudson Yards site destined to become one of New York City’s premier “work-live-play” destinations, residential assets in the vicinity of the megaproject are all but guaranteed to appreciate, and land pricing will certainly trend upward.

As a whole, sales of Manhattan development sites remained relatively stable in 1H18. Versus 1H17, dollar volume for this asset class jumped 18% to $1.13 billion, while transaction volume rose 11% to 39 sales. Year-over-year, property volume dipped 5% to 54 properties, according to Ariel Property Advisors’ “Manhattan 2018 Mid-Year Sales Report.” The price per buildable square foot jumped 10% to $749 in the first half.

Unsurprisingly, Midtown and the Upper East Side remained the most sought-after neighborhoods for development activity in the first half, with each comprising 20% of Manhattan’s overall tally of 35 sales. To view, click on: http://arielpa.com/report/report-APA-Manhattan-mid2018-Sales-Report.

The $20 billion Hudson Yards project – expected to be completed by 2025 – is the biggest and most ambitious mixed-use development plan in the nation’s, history. The mammoth 17 million square foot development will include 5 office buildings totaling approximately 10.4 million gross square feet and 8 residential buildings totaling about 4.6 million gross square feet, according to a report by consulting firm Appleseed.

Notable high-rise office buildings currently being built or under construction at the site include: 10, 30, 50, and 55 Hudson Yards. At 30 Hudson Yards, a 92-story office building is currently topped out.

Put into perspective, when Hudson Yards is completed it will have more office space than downtown San Diego, California and downtown Austin, Texas. Office, retail, hotel and other businesses at Hudson Yards will directly employ 55,572 people, according to Appleseed.

Bolstered by the city’s tax incentives, special zoning district bonuses and attractive pricing, an ever-growing list of large, big-name companies have decided to plant their flags in the area encircling Hudson Yards, including Pfizer and Amazon. At Hudson Yards itself, Wells Fargo and Blackrock are a few of its major upcoming tenants.

As is the case with competing commercial neighborhoods, namely Midtown East and the Financial District, many of the relocated employees will likely seek to reside in the region, with some estimates at 10%, or around 5,000 employees. Many of these people will likely be mid-level employees, so moderately priced condos should become costlier due to increased demand.

Pricing At Hudson Yards: The Time Is Ripe

Manhattan land is always in short supply, a primary reason why it is the priciest borough for development. As builders seek to capture the live-work demographic, sites around Hudson Yards have become increasingly attractive from a pricing perspective. Developers have lately shown a strong interest in buying land but are only willing to pay up to $500 per buildable square foot, which is available in the Hudson Yards neighborhood, but unattainable in the Plaza District. In fact, over the last 12 months, land in the Plaza District, which runs from 42nd Street to 59th Street between 3rd Avenue and 7th Avenue, averaged over $660 per buildable square foot.

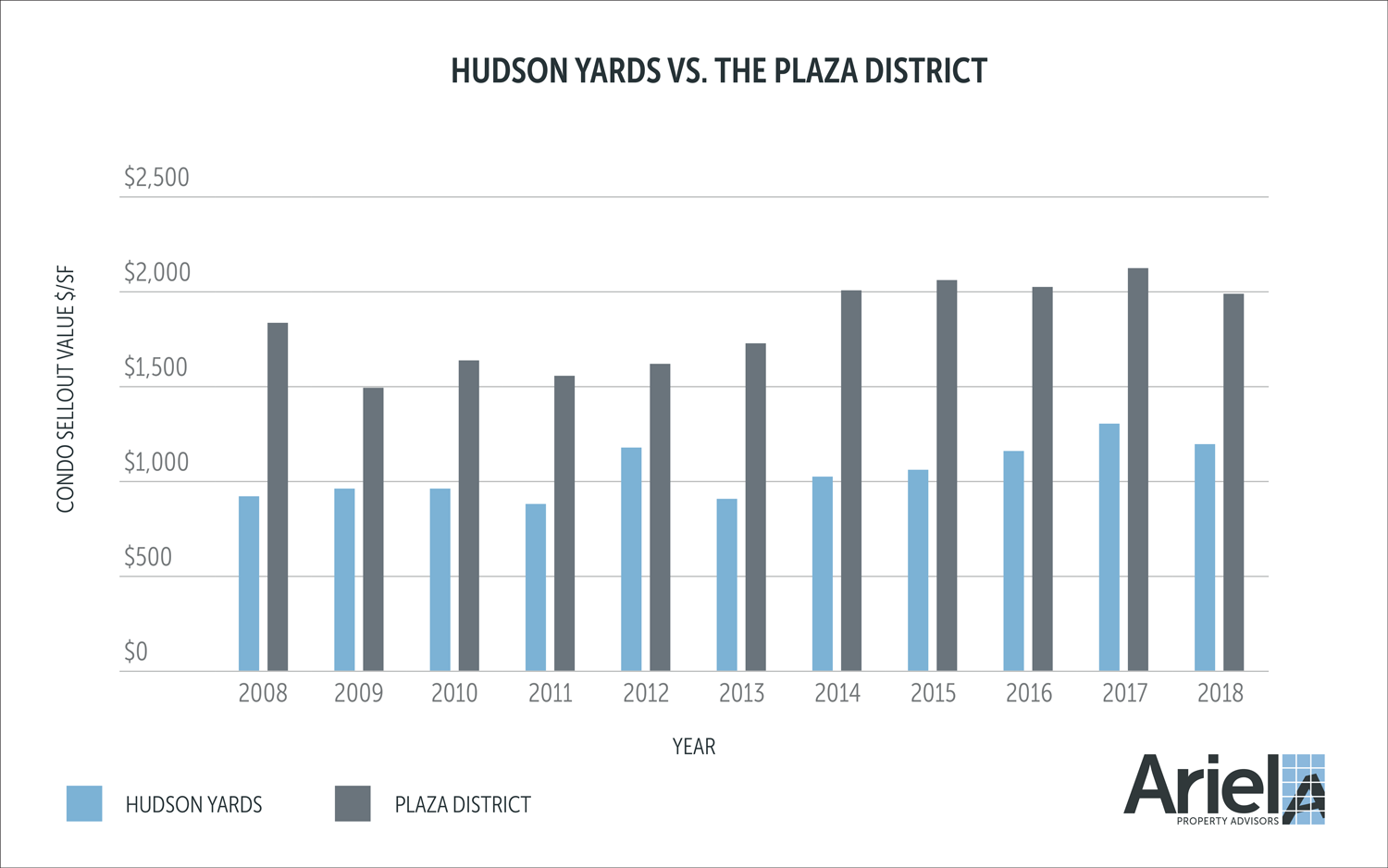

At the same time, condos around Hudson Yards are currently fetching around $1,208 per square foot, a remarkable 40% below the Plaza District’s average of $1,998 per square foot. While pricing in the Hudson Yards neighborhood will undoubtedly increase as new luxury condos start selling, there is a large, untapped demographic that, while priced out of the high-end, will still want to live close to their workplace.

Nonetheless, developers have already begun to take advantage of Hudson Yards’ growth potential. In fact, 5 mixed-use development projects are currently under construction and expected to be completed by the end of 2018, consisting of 1.12 million square feet of residential square feet, according to data collected by Recity.

An additional 1.76 million square feet of new residential development consisting of 1,324 apartment units and 760 condo units are under construction or are planned to be developed this year. Interestingly, most of the new condo development coming to the area has been geared toward the luxury market. Therefore, a dearth of middle-market supply essentially ensures price appreciation on projects focused on this homeowner base.

Lastly, once sorely lacking in transportation options, the extension of the 7 subway line several years ago has been a game-changer for Hudson Yards. The development would not have been feasible without easy access to mass transit as it opened the floodgates for real estate investment in the region.

Looking ahead, the size and scope of Hudson Yards cannot be overstated. As the project nears completion, this monumental endeavor will continue to lure businesses to the neighborhood and an onslaught of new residents should follow suit. There is plenty of fertile ground for the development of mid-priced condo buildings, so demand for these units are positioned to strengthen in the years, and decades, to come.