November 9, 2018

By Paul McCormick, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, left its benchmark short-term interest rate unchanged at between 2.00% to 2.25% on Thursday, and remained on course for another rate hike at its December meeting. At the end of its two-day policy-setting meeting, central bank officials said, “economic activity has been rising at a strong rate” and job gains “have been strong.”

The Fed reiterated its outlook for “further gradual” rate increases, according to its November statement.

The U.S. economy is unquestionably on firm footing, which should keep the central bank on track to continue raising rates in 2019. The labor market is by far the economy’s biggest bright spot, with October data showing employers hired workers for a record 97 straight months, while the unemployment rate held steady at a 49-year low of 3.7%.

The job market is so robust right now that the amount of available jobs exceeded the number of people seeking employment by more than one million on the last business day of September, according to a newly released Labor Department survey. This tightness is making an impact on paychecks, with average hourly earnings in October recording the largest annual gain since 2009.

“An acceleration in wages could create inflationary pressures, but for now inflation remains within the Fed’s comfort zone, signifying little need for them to shift their slow-but-steady stance on interest rate hikes at this juncture,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services.

Indeed, inflation remains contained, with the personal-consumption price index rising a mere 0.1% in September from August, the fourth consecutive month in which the Fed’s preferred inflation gauge fell below the 0.165% monthly pace required to meet its annual target of 2%.

Gross domestic product – the broadest measure of goods and services produced in the U.S. – grew at a 3.5% annual rate in the third quarter, according to the Commerce Department’s first reading. That’s below the second quarter’s 4.2%, which was the strongest since the third quarter of 2014, but sharply above the first quarter’s 2.2%. GDP ran at a tepid 2% pace for most of the past decade.

Meanwhile, a key measure of consumer confidence rose to an 18-year high last month. Optimism about the economy helped push the 10-year Treasury yield, last trading at around 3.186%, to a 7-year high in early October. Treasury securities over the past month have come under pressure due to a barrage of government debt sales, stock market volatility, and geopolitical concerns. Treasury yields could head higher should inflation, which diminishes the value of the fixed-payments made on long-dated bonds, accelerate.

To be sure, pockets of weakness have emerged in certain sectors of the economy, with higher mortgage rates making an impact on the housing market, one of the largest contributors to U.S. growth.

It has undeniably become more expensive to finance real estate transactions, but balance sheet lenders have already reflected higher rates. However, the prime rate – used for an array of credit, such as student loans, auto loans, home loans, credit cards, construction loans and some bridge loans - is pegged to the Fed’s benchmark lending rate by 300 basis points.

“Every interest rate hike by the Fed is making a negative impact on the cost of living, something to be wary of in the year ahead,” McCormick said.

Overall, Fed monetary tightening indicates confidence in the economy and while rising borrowing costs have created a more challenging lending environment, this is being offset by a booming economy and looser bank regulations. The financing spigot remains wide open as new alternative lenders, both individual and institutional, have emerged with an enthusiastic appetite to extend credit.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.375% - 4.625% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 4.875% - 5.125% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.75% - 5.00% |

| 7 Year | 4.875% - 5.125% |

| 10 Year | 5.00% - 5.25% |

Pricing current as of 11-8-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 5.00% - 5.25% |

| 7 Year | 5.25% - 5.50% |

| 10 Year | 5.50% - 5.75% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50%-8.00% |

| Re-Position | 9.00%-11.00% |

Pricing current as of 11-8-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 3.03% |

| 7-Year Treasury | 3.12% |

| 10-Year Treasury | 3.20% |

| Prime Rate | 5.25% |

| Term | Interest Rates |

| 3-Year Swap | 3.17% |

| 5-Year Swap | 3.18% |

| 7-Year Swap | 3.20% |

| 10-Year Swap | 3.25% |

Pricing current as of 11-8-2018

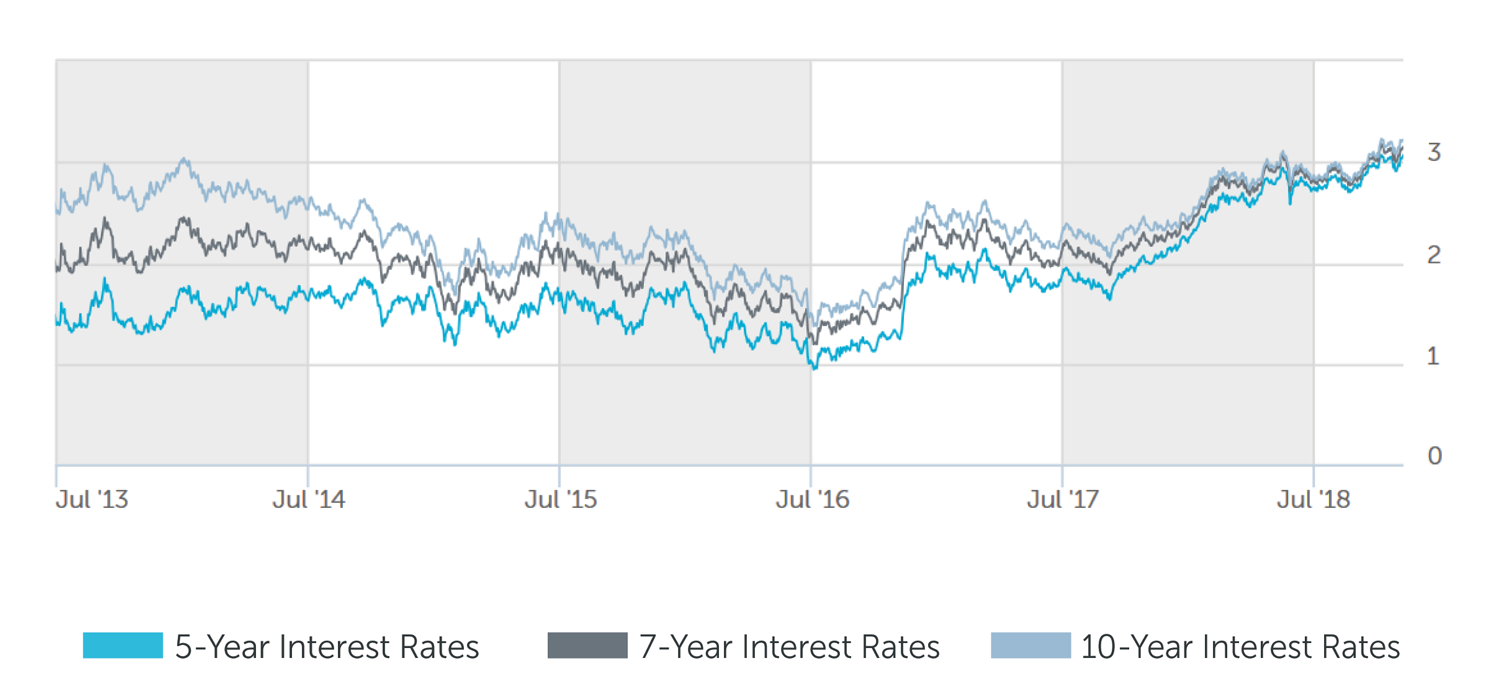

TREASURY RATES

More information is available from Paul McCormick at 212.544.9500 ext.45 or e-mail pmccormick@arielpa.com.