July 31, 2019

By Remi Mandell, Ariel Property Advisors

The Federal Reserve cut short-term interest rates for the first time since 2008 on Wednesday, with the central bank lowering its benchmark interest rate by a quarter-point to between 2.00% to 2.25%. In a statement following the two-day policy-setting meeting, the Federal Open Market Committee said its decision to decrease rates was “in light of the implications of global developments for the economic outlook as well as muted inflation pressures.“

The central bank also opened the door for more interest rate cuts, saying it “will act as appropriate to sustain the expansion.“ Economic growth is currently in its 10th year, the longest in history. Just a few weeks ago, a half-point rate cut was expected, but last week's Commerce Department data on second quarter gross domestic product curbed those expectations because growth slowed less than anticipated. GDP expanded at a 2.1% annualized rate from April through June, beating forecasts for 1.8% growth. Nevertheless, growth decelerated from the first quarter's robust 3.1% pace.

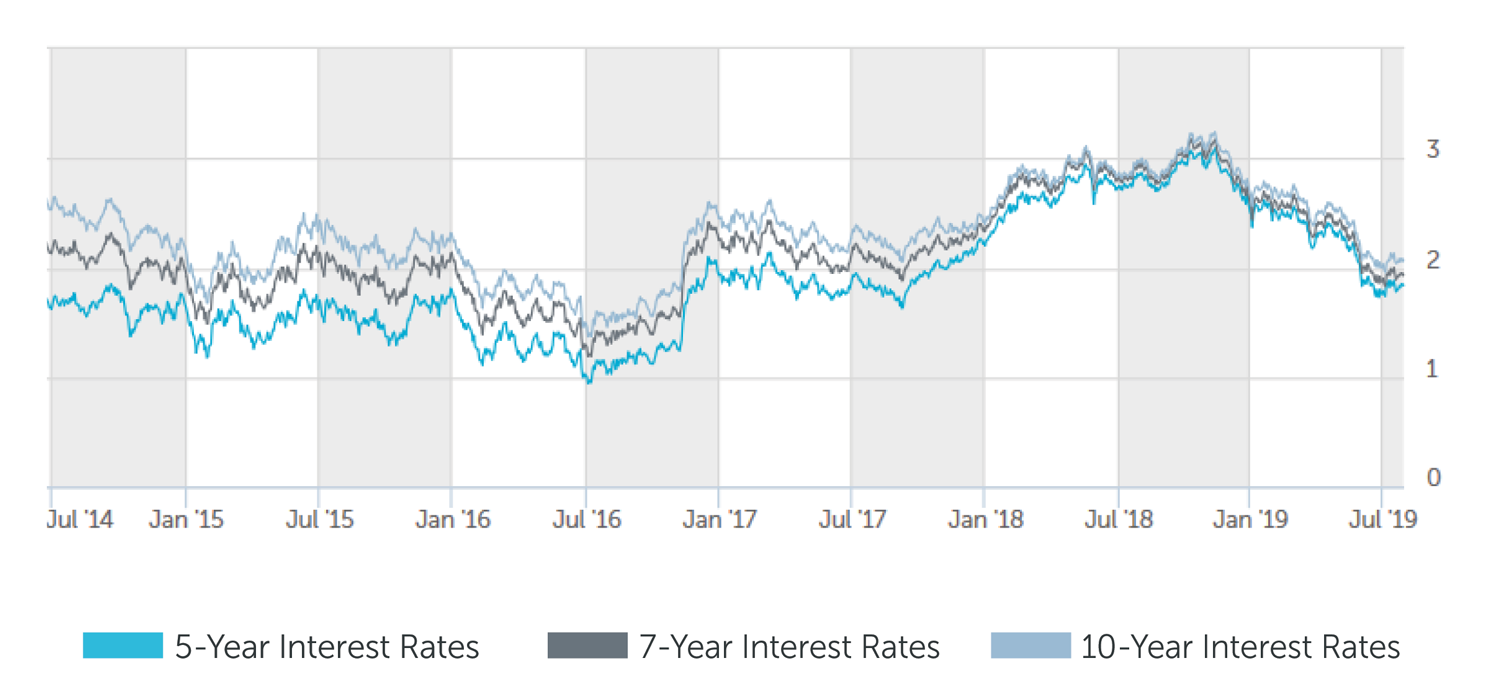

The yield on safe-haven 10-year Treasuries – which influences everything from mortgage rates and small business loans to state/government bonds and corporate loans – last traded at 2.03%, about 120 basis points below a seven-year high hit last October and around 75 basis points below 2019's peak. As of July, interest rates on ten-year multifamily loans are roughly 50-75 basis points lower than they were a year ago.

“Current and potential commercial borrowers can significantly benefit from lower interest rates at this point of time. With rates trending downwards and debt service decreasing, borrowers can net more in-proceeds than before,“ said Eli Weisblum, a Director at Ariel Property Advisors.

A notable bright spot in the GDP report was consumer spending, the largest contributor to the economy, which increased 4.3% in the second quarter. At the same time, nonresidential investment declined 0.6%, its first drop since 2015, and residential investment fell for a sixth straight quarter. Trade weighed on growth in the second quarter as exports fell at a 5.2% rate.

The Federal Reserve is not alone with its policy stance as leading global central banks, from Asia to Europe, have signaled a return to super-low rates. Low inflation, as well as headwinds from Brexit and trade tariffs, prompted the European Central Bank to recently indicate that it is preparing to cut short-term interest rates for the first time since 2016 and restart its bond-buying program, called quantitative easing. It is important to note that while 10-year U.S. Treasury yields have fallen, they remain more attractive than most of the world's developed economies. In fact, yields for 10-year government debt in Germany, Japan and France have recently traded below zero.

“Today, the most efficient debt capital can be found in 7- or 10-year terms, coupled with interest-only periods,“ Weisblum said. “Our company has long-standing relationships with regional and national lenders who are routinely underwriting higher leverage loans with longer interest-only periods than their competition.“

Looking forward, the outlook for real estate financing is decisively bright. Whether it be a cash-flowing building or a development site, interest rates are enticing for every asset class and sub-market in New York City. Right now, there are incredible opportunities for investors seeking strong risk-adjusted core/core plus returns for stable assets against the backdrop of a surplus of available capital.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.375% - 3.625% |

| 7 Year | 3.625% - 3.875% |

| 10 Year | 3.875% - 4.00% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.625% - 3.75% |

| 7 Year | 3.75% - 3.875% |

| 10 Year | 3.875% - 4.125% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.00% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.00% - 4.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.50% - 6.75% |

| Stabilized | 6.25% - 7.75% |

| Value Add | 6.75% - 8.75% |

| Re-Position | 8.75% - 10.75% |

Pricing current as of July 31, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.84% |

| 7-Year Treasury | 1.93% |

| 10-Year Treasury | 2.06% |

| Prime Rate | 5.50% |

| 1-Month LIBOR | 2.27% |

| Term | Interest Rates |

| 3-Year Swap | 1.81% |

| 5-Year Swap | 1.80% |

| 7-Year Swap | 1.86% |

| 10-Year Swap | 1.97% |

Pricing current as of July 31, 2019

TREASURY RATES

More information is available from Remi Mandell at 212.544.9500 ext.33 or e-mail rmandell@arielpa.com.