December 11, 2019

By Remi Mandell, Ariel Property Advisors

The Federal Reserve, as widely expected, left its benchmark short-term interest rates unchanged at between 1.50% and 1.75% on Wednesday. In a statement following a two-day policy-setting meeting, the Federal Open Market Committee said, “The committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong hiring conditions and stable prices.”

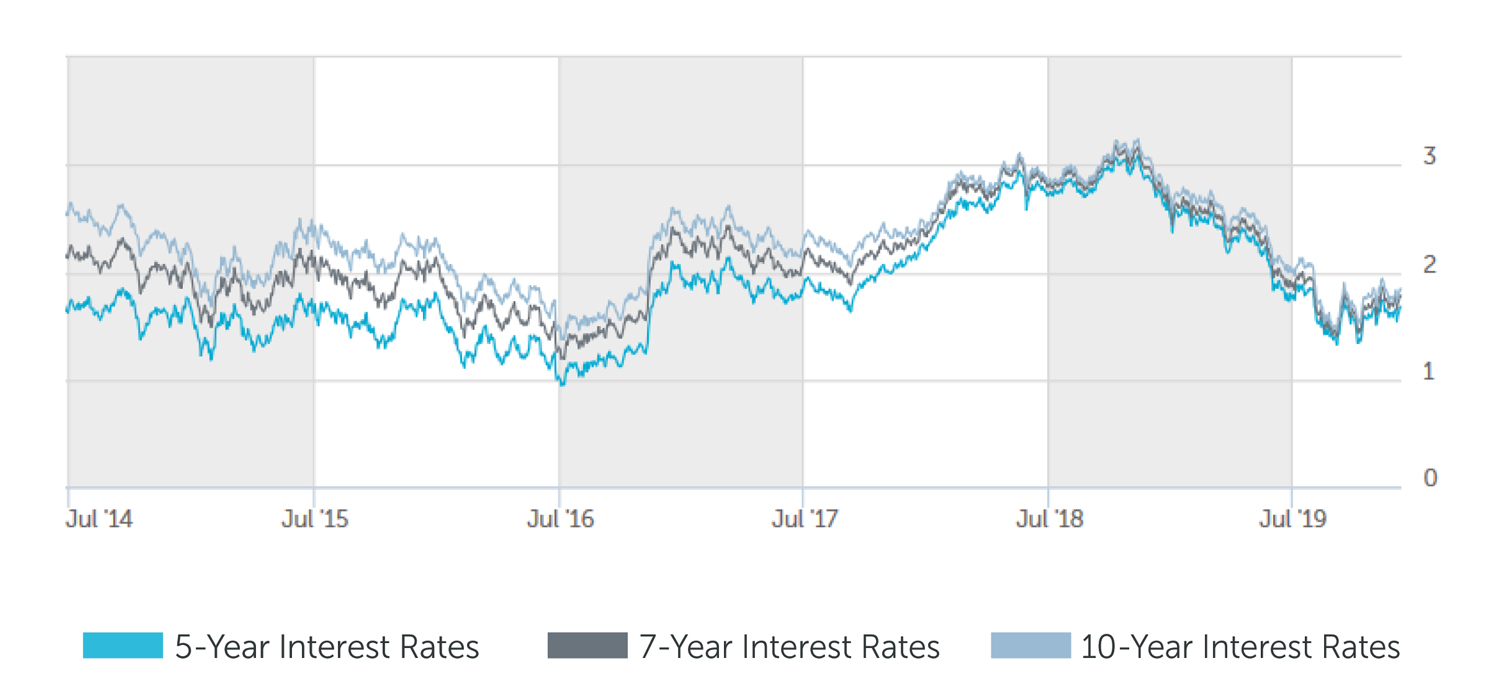

According to new economic projections, 13 of 17 Fed policymakers foresee no change in interest rates until at least 2021, while the remaining 4 expect only one rate hike in 2020. A stellar November jobs report corroborated the Fed’s decision, with payrolls far outpacing expectations. A record 158 million people were in the workforce last month and the unemployment rate dipped to 3.5%, matching a 50-year low. The central bank reduced interest rates three times in 2019, with its first rate cut in over a decade occurring in July. The Fed opted to implement tighter monetary policy on concerns that weakness overseas and a trade war with China could disrupt the economy’s longest expansion in history.

“We are in an ideal situation for borrowers, with rates likely to stay low for the foreseeable future and at the same time, there is plenty of debt capital waiting to be deployed,” said Eli Weisblum, Director of Capital Services at Ariel Property Advisors.

Following the Fed’s announcement, the yield on the 10-year Treasury note traded at 1.81%, slightly above where it was the last time the Fed met, but about 110 basis points below 2019’s peak. Put into context, commercial interest rates on ten-year multifamily loans are roughly 75-100 basis points below where they were in December 2018.

Varying signs of a global economic slowdown sent yields on long-term Treasury bonds lower earlier this year, but they rose in recent months as trade talk optimism and strong corporate earnings prompted investors to sell safe-haven government-backed Treasuries and buy riskier assets, namely equities. The S&P 500 index is up about 25% this year, its best performance in 5 years.

“Our clients in New York City and across the U.S. are able to find attractive investments and complement them with cheap capital to yield strong risk-adjusted returns. Going into 2020, investors should have an optimistic outlook towards the acquisition of real estate, as well as looking for options to refinance their current portfolios,” said Weisblum.

A tight labor market and rising wages have buoyed consumer spending, which accounts for more than two-thirds of economic output. In a sign of confidence, shoppers increased their spending by 16% year-over-year over the five-day period between Thanksgiving Day and Cyber Monday. U.S. factory activity, however, cooled this year due to trade tensions and a global manufacturing slowdown. The Institute of Supply Management’s widely watched manufacturing index decreased to 48.1 in November from 48.3 in October, its fourth straight sub-50 reading. Readings below 50 indicate contraction.

Economic growth has slowed since the start of the year, with gross domestic product at 2.1% in the third quarter, down from the first quarter’s 3.1% pace and 2018’s rate of 2.9%. The economy has been remarkably resilient to the U.S-China trade war, but data out of China this week shows it is making an impact. China’s shipments to the U.S. plunged 23%, the worst result for exports to the U.S. since February and the 12th straight monthly decline. A fresh round of tariffs on Chinese imports is scheduled to begin December 15.

Looking ahead, next year’s presidential and congressional elections will undoubtedly spur market volatility and the economy certainly faces headwinds, particularly if the U.S.-China dispute continues. However, the current low rate environment is conducive for commercial real estate financing for every asset class. The market is overflowing with opportunities for investors seeking strong, steady returns and there is an abundance of capital awaiting distribution.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.375% - 3.625% |

| 7 Year | 3.625% - 4.00% |

| 10 Year | 4.00% - 4.125% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.625% - 3.875% |

| 7 Year | 3.875% - 3.90% |

| 10 Year | 3.90% - 4.125% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.00% |

| 7 Year | 3.875% - 4.125% |

| 10 Year* | 3.785% - 4.25% |

| *full-term interest only available | |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 7.50% |

| Stabilized | 5.00% - 7.75% |

| Value Add | 6.00% - 8.75% |

| Re-Position | 6.50% - 10.75% |

Pricing current as of December 11, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.68% |

| 7-Year Treasury | 1.78% |

| 10-Year Treasury | 1.81% |

| Prime Rate | 4.75% |

| 1-Month LIBOR | 1.70% |

| Term | Interest Rates |

| 3-Year Swap | 1.63% |

| 5-Year Swap | 1.64% |

| 7-Year Swap | 1.68% |

| 10-Year Swap | 1.75% |

Pricing current as of December 11, 2019

TREASURY RATES

More information is available from Remi Mandell at 212.544.9500 ext.33 or e-mail rmandell@arielpa.com.