Press Releases Archive

Jason M. Gold

Senior Director - Investment Sales

Ariel Property Advisors

Daniel Mahfar

Director - Investment Sales

Ariel Property Advisors

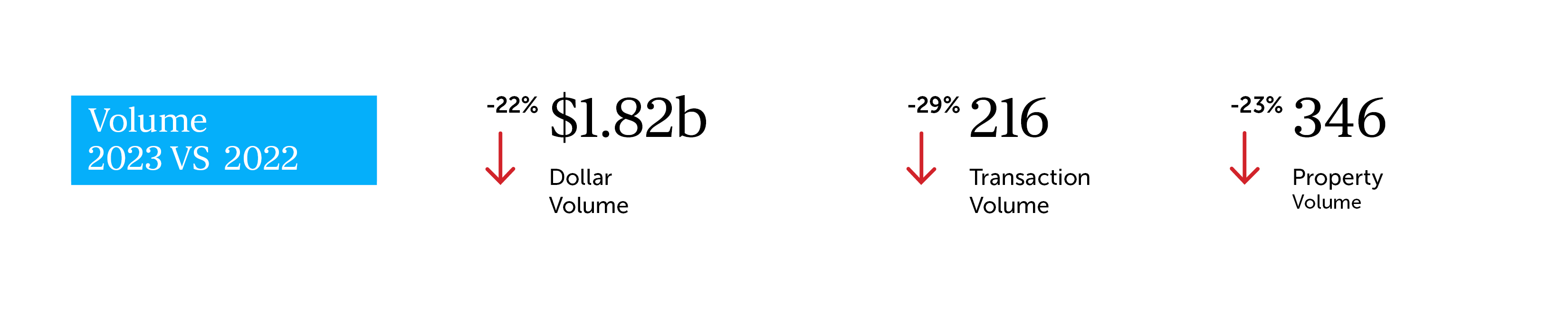

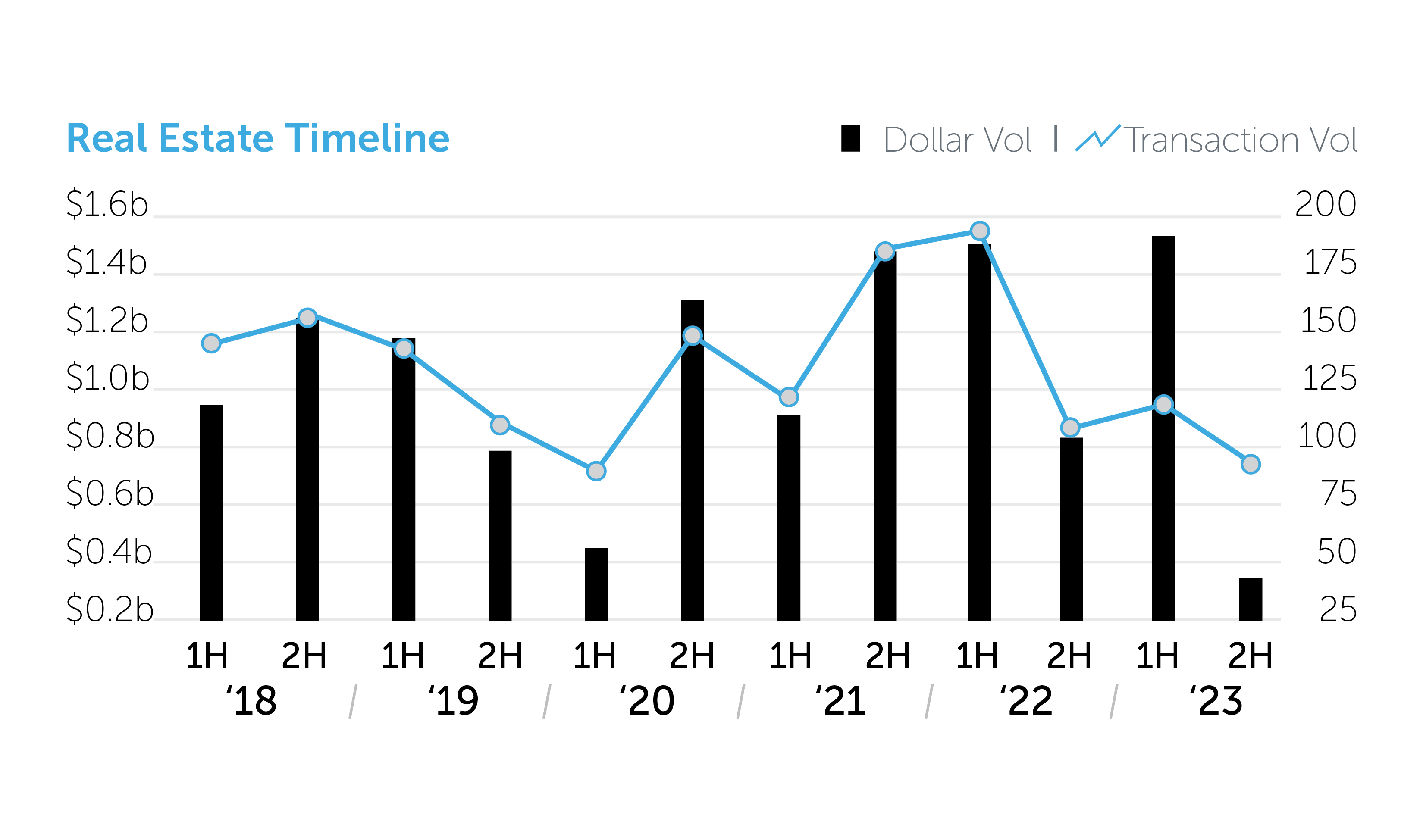

NEW YORK, NY – February 5, 2024 – In 2023, the Bronx investment sales market saw $1.82 billion trade across 216 transactions, down 22% and 29% respectively, compared to 2022, according to Ariel Property Advisors’ Bronx 2023 Year-End Commercial Real Estate Trends report.

“Affordable housing was a bright spot in the investment sales market in the Bronx in 2023,” said Jason M. Gold, Senior Director in Investment Sales for Ariel. “The most significant transaction of the year was Nuveen’s partial interest acquisition of the Omni Affordable Housing Portfolio. The Bronx portion of the portfolio was valued at $635.3 million and included about 66% of the package’s total units.”

Daniel Mahfar, Director, added that the development market also showed positive metrics last year. “Pricing for development sites reached a record high of $98/BSF, and the borough is expected to attract more investment as the City seeks to create 6,000 new homes by rezoning parts of the East Bronx near Metro-North commuter rail stops,” he said.

The following is a summary of the performance of each asset class in the Bronx in 2023:

Multifamily

Development

Industrial

Commercial

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.