Press Releases Archive

Michael A. Tortorici

Founding Partner

Ariel Property Advisors

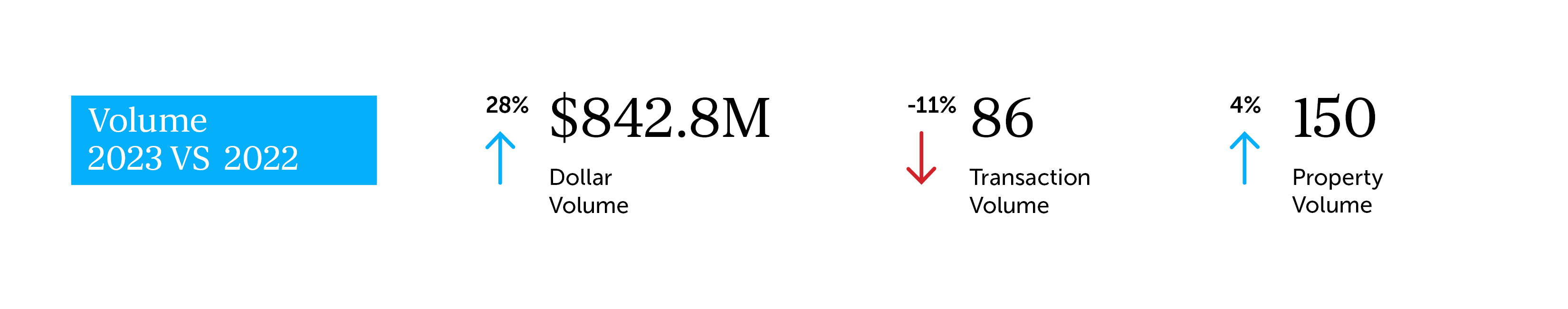

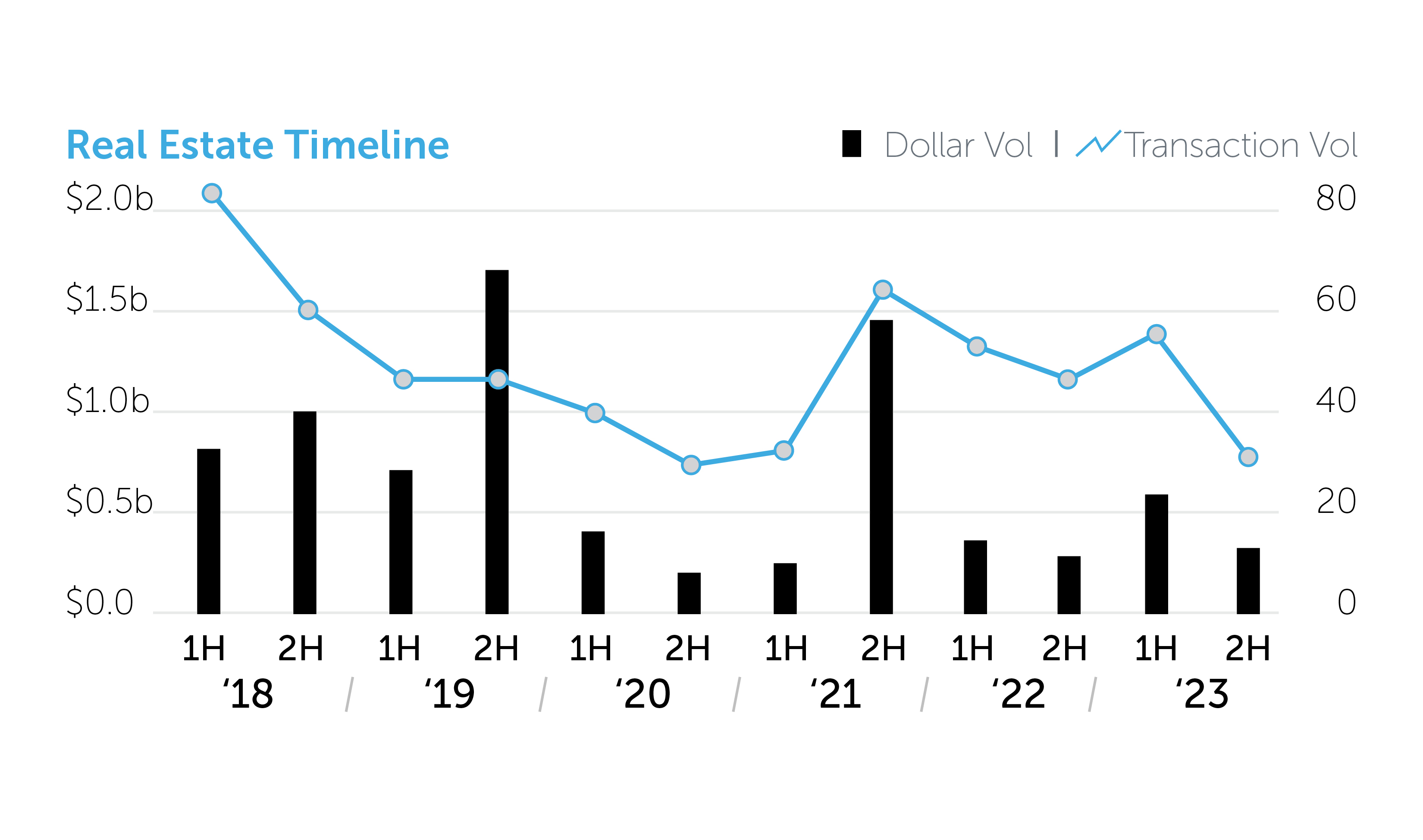

NEW YORK, NY – February 8, 2024 – The Northern Manhattan submarket finished 2023 with investment sales totaling $842.8 million, a 28% uptick from the previous year, and 150 properties traded, a 4% increase, making it the only New York City submarket to register gains in both dollar and property volume compared to 2022, according to Ariel Property Advisors’ Northern Manhattan 2023 Year-End Commercial Real Estate Trends report.

In Northern Manhattan’s multifamily market, the average cap rate rose to 6.34%, a +101 basis point increase from the 2022 average.

“The rapid rise of interest rates combined with the 2019 HSTPA rent law has forced a stark decline in multifamily property valuations, specifically in rent stabilized assets, forcing some owners to make the tough decision of selling their assets versus conducting a cash-in refinance,” said Mike Tortorici, Founding Partner at Ariel Property Advisors. “This trend is exemplified by the sale of a 16-building rent-stabilized portfolio in September 2023 for $47 million, which was a 44% discount from the $83.6 million price it saw in 2016.”

The following is a summary of the performance of each asset class in Northern Manhattan in 2023:

Multifamily

Development

The full report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.