NEW YORK, NY – February 17, 2016 – Northern Manhattan investment property sales in 2015 saw sharply rising prices across all product types despite a modest pullback in sales volume, according to Ariel Property Advisors’ “Northern Manhattan 2015 Year-End Sales Report.”

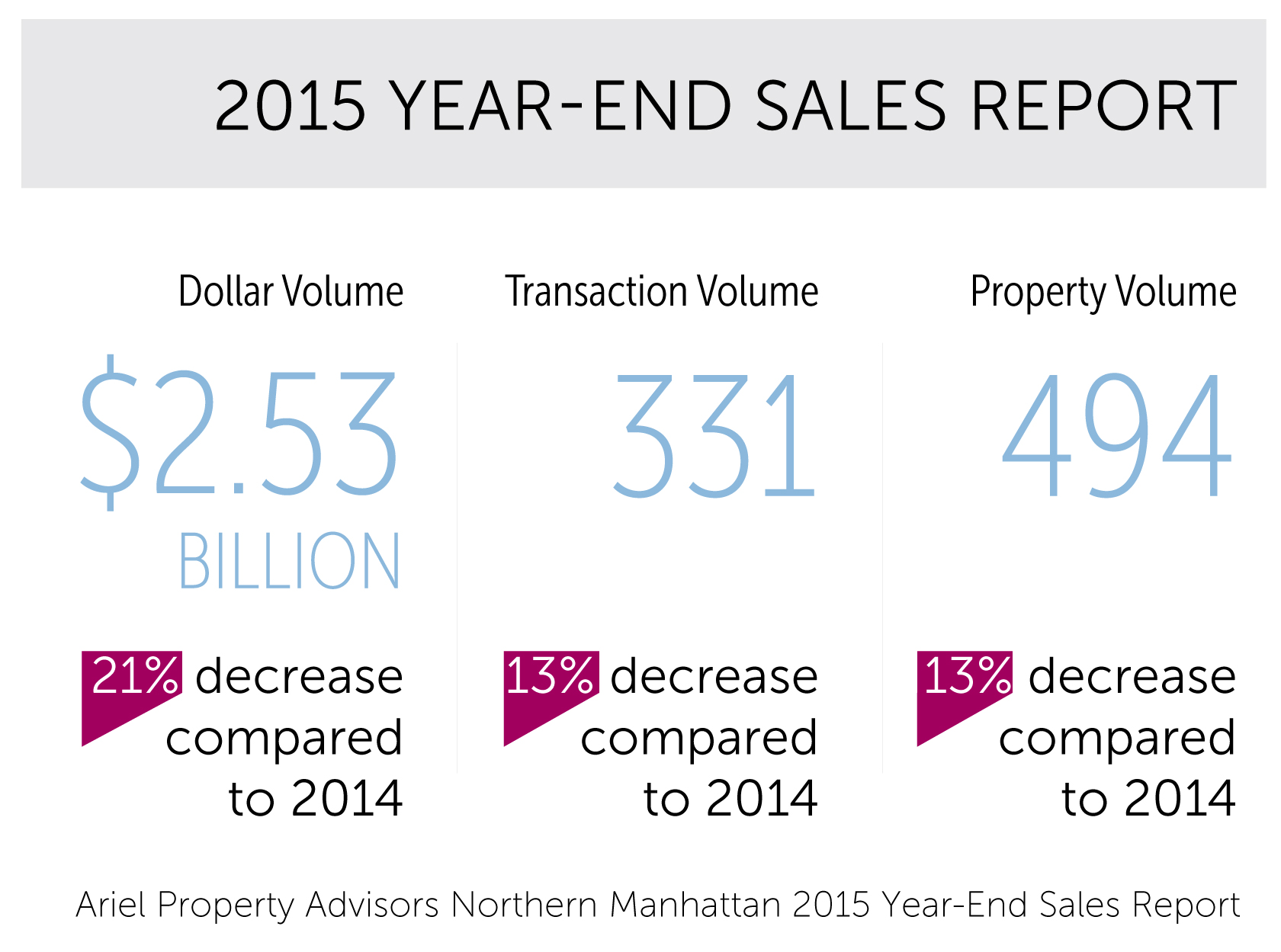

For the year, the submarket saw $2.53 billion in gross consideration across 331 transactions and 494 properties. These figures represent a modest 21% decline in dollar volume, a 13% decrease in transaction volume and a 13% decrease in property sales volume compared to 2014. However, the report notes that much of the decline in dollar volume can be attributed to the $1.04 billion sale of the Urban American East Harlem Portfolio, which accounted for nearly one third of sales activity in 2014. Without this major outlier, 2015’s dollar volume would have exceeded 2014’s total of $3.21 billion by an increase of 16%.

The report emphasizes price appreciation across product types. The average price per square foot for multifamily assets reached $337, a 24% increase year-over-year. On the development side, the average price per buildable square foot rose an impressive 47%, year-over-year, hitting $199.

Office building sales also had a prominent role in 2015 investment property sales as three buildings sold for $183 million in gross consideration. The average price per square foot for commercial / retail spaces rose to $635, surpassing the 2014 average of $496 per square foot.

“Institutional caliber equity partners and investors continued to deploy significant capital into Northern Manhattan multifamily transactions,” said Victor Sozio, Executive Vice President, Ariel Property Advisors. “Many owners capitalized on the area’s tremendous demand and rapid appreciation by selling assets last acquired between 2012-14.”

The largest sale to take place in Northern Manhattan was a 24-building, 586-unit portfolio for $148.5 million. Spanning from West 135th Street to West 173rd Street, with most of the buildings situated between Broadway and Amsterdam, the portfolio secured $250,000 per unit.

The Harlem commercial market saw several new entrants with strong track records purchased citywide along the 125th Street corridor. One example is Thor Equities’ purchase of 2080-82 Lexington Avenue, a 103,000 square foot retail building for $75,500,000 or $733 per square foot. One significant office transaction to note was the recapitalization of 55 West 125th Street & 215 West 126th Street, a large office portfolio that traded for $117 million or $292 per square foot.

The report also maintains a relatively positive outlook for 2016. “We may see development site prices stabilize after making such dramatic leaps in 2015, but the underlying fundamentals are strong especially when you consider the of transformative major projects, like the Columbia University expansion and Whole Foods on Lenox Avenue, that are just around the corner,” said Michael A. Tortorici, Executive Vice President of Ariel Property Advisors. “The submarket remains a major destination for capital seeking stable returns with big upside potential.”

The report also maintains a relatively positive outlook for 2016. “We may see development site prices stabilize after making such dramatic leaps in 2015, but the underlying fundamentals are strong especially when you consider the of transformative major projects, like the Columbia University expansion and Whole Foods on Lenox Avenue, that are just around the corner,” said Michael A. Tortorici, Executive Vice President of Ariel Property Advisors. “The submarket remains a major destination for capital seeking stable returns with big upside potential.”

The report highlights several key transactions for the year, including:

• 129 West 112th Street—a rare 60’ development site in Central Harlem that sold for $6.7 million or $321 per buildable square foot

• 223-229 Saint Nicholas Avenue, a development site in Central Harlem, sold for $17.5 million or $270 per buildable square foot.

• 658 West 188th Street, an 88-unit multifamily building was purchased by Newcastle Realty Services for $23.1 million, which translates to $262,500 per unit and approximately $235 per square foot.

Ariel Property Advisors’ Northern Manhattan 2015 Year-End Sales Report” is available by clicking the following link: http://arielpa.nyc/research/report-APA-N-Man-2015-Sales-Report

More information is available from the exclusive agents at 212-544-9500: Victor Sozio, ext. 12, vsozio@arielpa.com ; Shimon Shkury, ext. 11, sshkury@arielpa.com; Michael A. Tortorici, ext. 13, mtortorici@arielpa.com; Josh Berkowitz, ext. 41, jberkowitz@arielpa.com; Matthew Gillis, ext. 42, mgillis@arielpa.com; and Josh Kwilecki, ext. 51, jkwilecki@arielpa.com.

Ariel Property Advisors is a commercial real estate services and advisory company located in New York City. The company covers all major commercial asset types throughout the NY metropolitan area, while maintaining a very sharp focus on multifamily, mixed-use and development properties. Ariel’s Research Division produces a variety of market reports that are referenced throughout the industry.

For press inquiries, please contact our Public Relations Department at 212.544.9500 ext. 19 or via mploc@arielpa.com

The information contained herein has either been given to us by the owner of the property or obtained from sources that we deem reliable. We have no reason to doubt its accuracy but we do not guarantee the accuracy of any information provided herein. As an example, all zoning information, buildable footage estimates and indicated uses must be independently verified. Vacancy factors used herein are an arbitrary percentage used only as an example, and does not necessarily relate to actual vacancy, if any. The value of this prospective investment is dependent upon these estimates and assumptions made above, as well as the investment income, the tax bracket, and other factors which your tax advisor and/or legal counsel should evaluate. The prospective buyer should carefully verify each item of income, and all other information contained herein.