Originally Published in

May 12, 2015

Executive interview with Shimon Shkury, Ariel Property Advisors

Read The Article on New York Real Estate Journal

NYREJ recently sat down with Shimon Shkury, president of Ariel Property Advisors, a New York City investment property sales firm, who shared some of the highlights from Ariel Property Advisors' Multifamily Quarter in Review New York City: Q1 2015.

Q: How did the multifamily market perform in the first quarter?

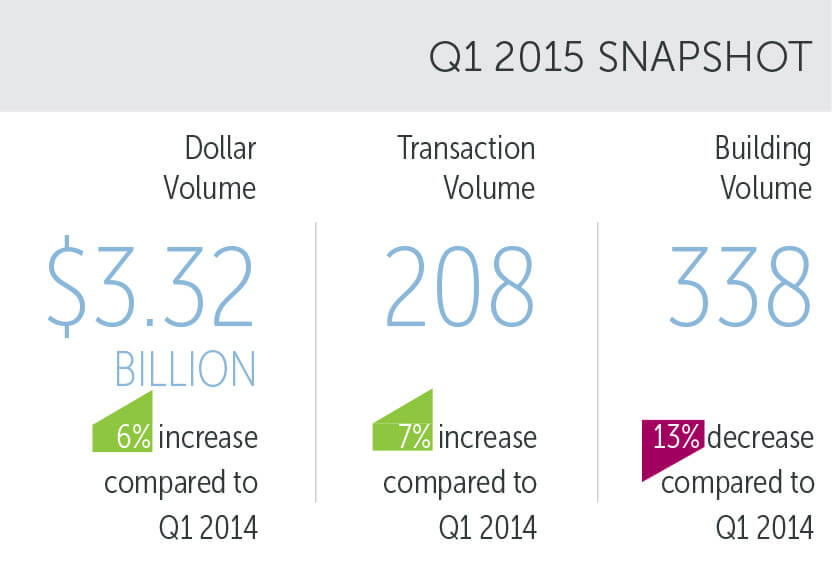

A: The year started off slow with dollar volume under $800 million in January and just over $600 million in February, but the market surged in March, which resulted in quarterly dollar volume rising 6% year-over-year to $3.324 billion. The quarter also saw 208 transactions, which is a 7% increase compared to the same quarter last year and a 9% increase compared to the fourth quarter 2014.

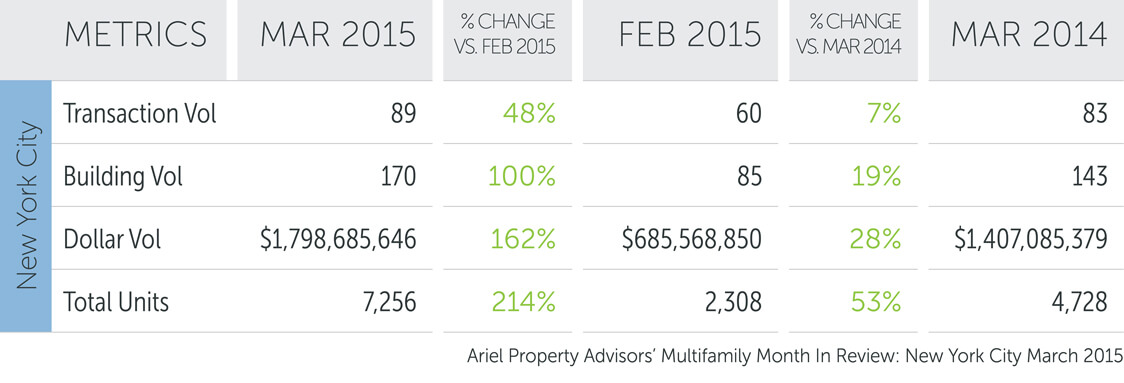

Q: What contributed to the big gains in March?

A: Both Brooklyn and Manhattan saw a number of institutional and portfolio deals in March, which contributed to each submarket ending the quarter with dollar volume above $1 billion. Of the trades in Manhattan, 86% were $20 million and above, and in Brooklyn, 64% were $20 million and above.

Q: What pricing trends are you seeing?

A: Multifamily prices continued to increase in the submarkets in the six months ended March 2015 compared to the same six-months last year. During this period, we saw gains in the Bronx where the capitalization rates fell below 6% to 5.64% and the average price per square foot rose 14% year-over-year to $135. In Manhattan, the average price per square foot approached $900 while average capitalization rates came in under 4%. Northern Manhattan, Brooklyn, and Queens also saw capitalization rates below 5%.

Q: How did the submarkets perform in the first quarter?

A: Brooklyn accounted for 34% of the city's multifamily transactions during the quarter, more than any other submarket. Two Brooklyn portfolios in East Flatbush and Brighton Beach drove the borough's first quarter activity, which consisted of 114 buildings, 63 transactions, and $1.079 billion in dollar volume. Dollar volume for the quarter almost doubled that of the fourth quarter 2014, and was 48% higher than the first quarter of last year.

Manhattan showed significant year-over-year gains in the first quarter. For the quarter, the borough saw 42 transactions across 69 buildings, totaling $1.333 billion in gross consideration, a 24%, 44%, and 9% increase over last year's totals, respectively. One of the notable sales was a five-building package that sold for over $1,500 per foot in NoLiTa on Elizabeth Street, one of the city's most rapidly appreciating areas.

Northern Manhattan was relatively stable quarter-to-quarter, with a strong uptick year-over-year. For the quarter, the area saw 34 trades across 50 buildings and just over $400 million in gross consideration. Compared to last year, these figures were up 21%, 22%, and 53%, respectively. The average price per foot surpassed $300 in the region this quarter, an all-time high. The submarket's continued growth is evident in the recent sale of 567-69 West 125th Street, which closed for $533 per square foot. In East Harlem, a newly constructed elevatored building sold for $465 per square foot.

The first quarter brought mixed results for The Bronx, showing a strong transaction and dollar volume compared to last quarter, but a decline from the big first quarter of 2014. The borough in total saw 49 sales across 68 buildings, and $340.240 million in gross consideration. The largest sale took place at 2001 Story Avenue in Castle Hill, for $66 million, or $156 per square foot.

In Queens, figures topped the fourth quarter of 2014, but fell short of the first quarter of 2014 figures. The 20 transactions, 37 buildings, and $169.237 million in gross consideration that traded represent quarter-to-quarter increases of 54%, 76%, and 21%, respectively. An Astoria portfolio purchased by Kushner Companies in January was the largest sale of the quarter, at $51 million, or $401 per square foot.

Q: What do you see on the horizon for the multifamily market this year?

A: Millions of people want to live and work in New York City and, as a result, we expect the demand for housing to continue unabated. In the four years between 2010 and July 1, 2014, the census shows that the city gained 315,946 new residents, bringing the population to 8,491,079. During that same period, the Department of Buildings approved only 50,000 permits for new housing units. We're seeing subway ridership at levels not seen since the post-World War II boom more than 65 years ago.

More than 500,000 students attend the city's 100-plus colleges and universities and the best and the brightest want to stay here and work. Employers added more than 107,000 jobs between March 2014 and March 2015 alone, bringing the city's total job count to 4,155,000. Companies like Google, Yahoo, and LinkedIn are expanding in New York City and adding tech jobs, which are among the city's highest paid positions with average salaries second only to Wall Street.

Because New York City real estate is viewed as a safe haven for capital from around the world, we expect that investments in the preservation and construction of housing will continue. However, the 421a tax abatement program, which is due to expire this summer, and clarity from the administration regarding future zoning initiatives is needed to encourage the development of affordable housing.

Q: Where can we get a copy of Ariel Property Advisors' Multifamily Quarter in Review New York City: Q1 2015?

A: Copies of the Multifamily Quarter in Review New York City: Q1 2015 and all of our research reports are available on our website at arielpa.nyc/investor-relations/research-reports.

Shimon Shkury is founder and president of Ariel Property Advisors, New York, N.Y.

More information is available from Shimon Shkury at 212.544.9500 ext.11 or e-mail sshkury@arielpa.com.

For a copy of the report, please see http://arielpa.nyc/research/report-MFQIR-Q1-2015.