Originally Published in

August 11, 2015

Executive interview with Shimon Shkury, Ariel Property Advisors

Read The Article on New York Real Estate Journal

NYREJ recently sat down with Shimon Shkury, president of Ariel Property Advisors, a New York City investment property sales firm, who shared some of the highlights from Ariel Property Advisors' Multifamily Quarter in Review New York City: Q2 2015.

Q: How did the multifamily market perform in the second quarter?

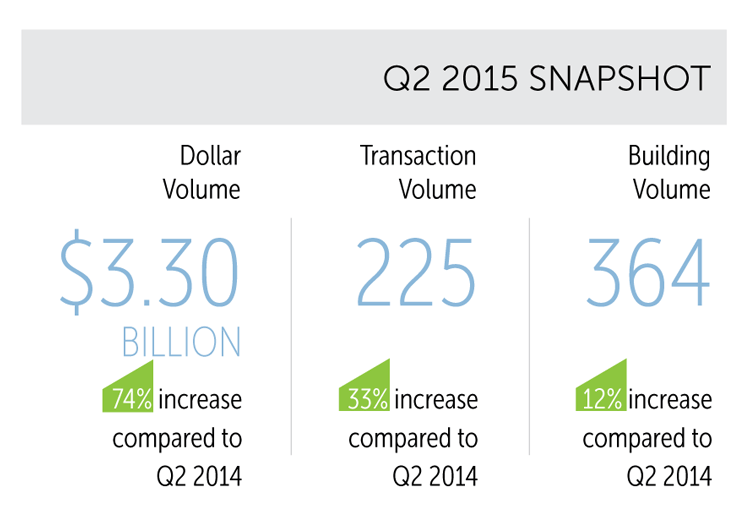

A: The second quarter was able to continue the momentum of 2015's first quarter and generate an impressive $3.30 billion in gross consideration. The quarter also saw 364 properties trade over 225 transactions, which is a 33% increase in transaction volume compared to the same quarter last year.

Q: What contributed to the big gains in this quarter?

A: Both Brooklyn and Manhattan saw a number of institutional and portfolio deals again this quarter. Of the trades in Manhattan, the top 10% made up approximately 73% of Manhattans dollar volume and 4 of the 5 largest multifamily transactions to occur in NYC happened in Brooklyn which contributed to both submarkets ending the quarter with dollar volume above $1 billion for the second time in as many quarters.

Q: What pricing trends are you seeing?

A: Pricing throughout the city continues to evolve by most measures. If we look at the 6-month trailing average, we can see gross rent multiples have increased by 1.4 year-over-year and the average price per square foot in Manhattan has eclipsed $900 per square foot. Compared to last year, average capitalization rates were down 60 basis points in The Bronx as well as being down in Manhattan, Brooklyn and Northern Manhattan. These are the signs of solid fundamentals in the market.

Q: How did the submarkets perform in the second quarter?

A: Institutional caliber multifamily deals had a big 2Q in Brooklyn as the borough saw 6 transactions trade for more than $35 million—two of which surpassed $150 million each. Leading the way was Kushner Companies and LIVWRK, who purchased 184 Kent Ave., a 374,274 square foot luxury rental building, for $275 million, or $792 per square foot. The partnership plans to convert the building to condominiums, following a trend more commonly seen in large Manhattan multifamily trades. In Crown Heights, a 200-unit elevatored building at 805 Saint Marks Ave. exchanged hands for $44 million - double what the seller paid for the property in 2013 and highlighting the neighborhood's rapid appreciation.

Manhattan continues to attract investors from all over the world, as both institutional funds and small investors alike look to take advantage of the sub-market's safe-haven. Akelius Real Estate Management, the U.S. branch of a Swedish investment firm, made a large splash this quarter with the $167.5 million dollar purchase of 362-372 Second Ave., a 211-unit elevatored building in Gramercy. The property last traded hands in the 1940s and sold for just north of $900 per square foot. In the East Village, an 80/20 program building constructed in 1997 sold for $60 million, or $654 per square foot.

Although transaction, building and unit volume were down year-over-year, Northern Manhattan's dollar volume jumped 24% compared to the 2Q14 as pricing in the sub-market has heated up and more single-asset trades occurred. One highlight was the sale of 1501 Lexington Ave. at the border of East Harlem and Carnegie Hill, just one block north of the 96th St. subway stop. The 161 mixeduse elevatored building sold for $92 million, which translates to approximately to $690 per square foot. In Hamilton Heights, 3621-3629 Broadway, a 65,050 square foot mixed-use building sold for $25.5 million, or $392 per square foot.

The Bronx had a very strong quarter, experiencing gains in both quarter-to-quarter and year-overyear figures. The borough saw 79 buildings trade across 52 transactions totaling $420.861 million in gross consideration, which equates to a 73% increase in dollar volume, a 30% increase in building volume and a 24% increase in transaction volume compared to 2Q14. The borough's largest trade for the quarter took place at 1749 Grand Concourse, a 423,500 square foot elevatored building, which sold for $49.5 million, or $178,000 per unit. The sale marked the third time the asset has traded since 2010.

Two large multifamily transactions pushed Queens dollar volume up on a quarter-to-quarter and year-over-year basis. The borough's largest transaction took place in southern Astoria, where a pair of elevatored buildings located at 11-15 Broadway and 30-50 21st St. sold for $72 million, which is 20% above the price paid for the same assets in 2013. In Sunnyside, 43-31 45th St., a 79,830 square foot mixed-use elevatored building, sold for $27.5 million, or $344 per square foot. Nearly all other transactions during the quarter were under $5 million, which somewhat explains the light number of units sold.

Q: What do you see on the horizon for the multifamily market this year?

A: Well for starters we are finally returning to the point we were at in 2007 in terms of investor confidence. That confidence coupled with the looming hike in interest rates will almost definitely have a positive impact on the multifamily market. So far, halfway through the year, the market has showed no signs of slowing down and we believe that is a testament to the strong fundamentals within the market, and the overwhelmingly positive macro influences such as job creation and an encouraging stock market.

Q: Where can we get a copy of Ariel Property Advisors' Multifamily Quarter in Review New York City: Q2 2015?

A: Copies of the Multifamily Quarter in Review New York City: Q2 2015 and all of our research reports are available on our website at arielpa.nyc/investor-relations/research-reports.

Shimon Shkury is founder and president of Ariel Property Advisors, New York, N.Y.

More information is available from Shimon Shkury at 212.544.9500 ext.11 or e-mail sshkury@arielpa.com.

For a copy of the report, please see http://arielpa.nyc/research/report-MFQIR-Q2-2015.