Originally Published in

May 17, 2016

By Shimon Shkury, Ariel Property Advisors

Read The Article on New York Real Estate Journal

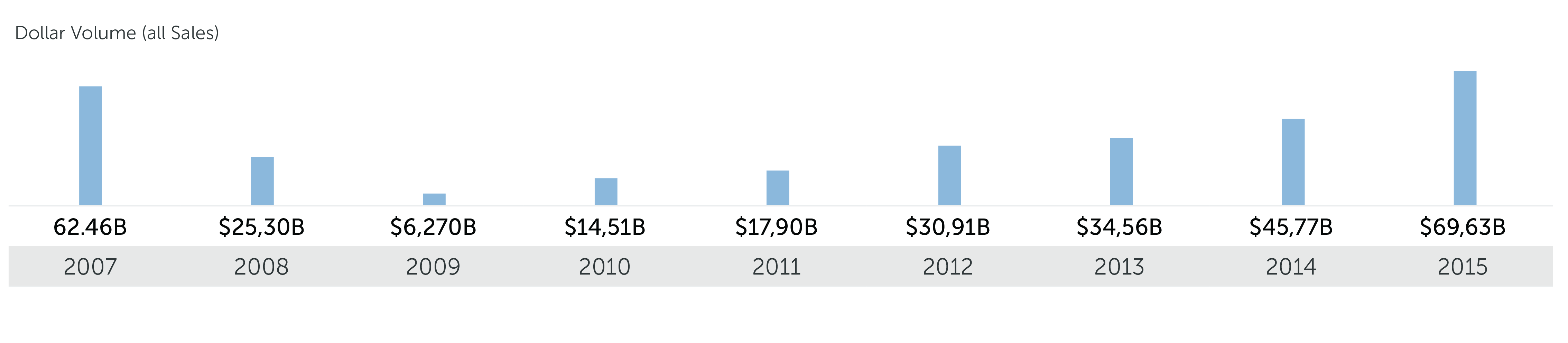

New York City investment property sales experienced a tremendous 2015 as sales metrics on several fronts surpassed the highs seen during the last cycle’s peak in 2007.

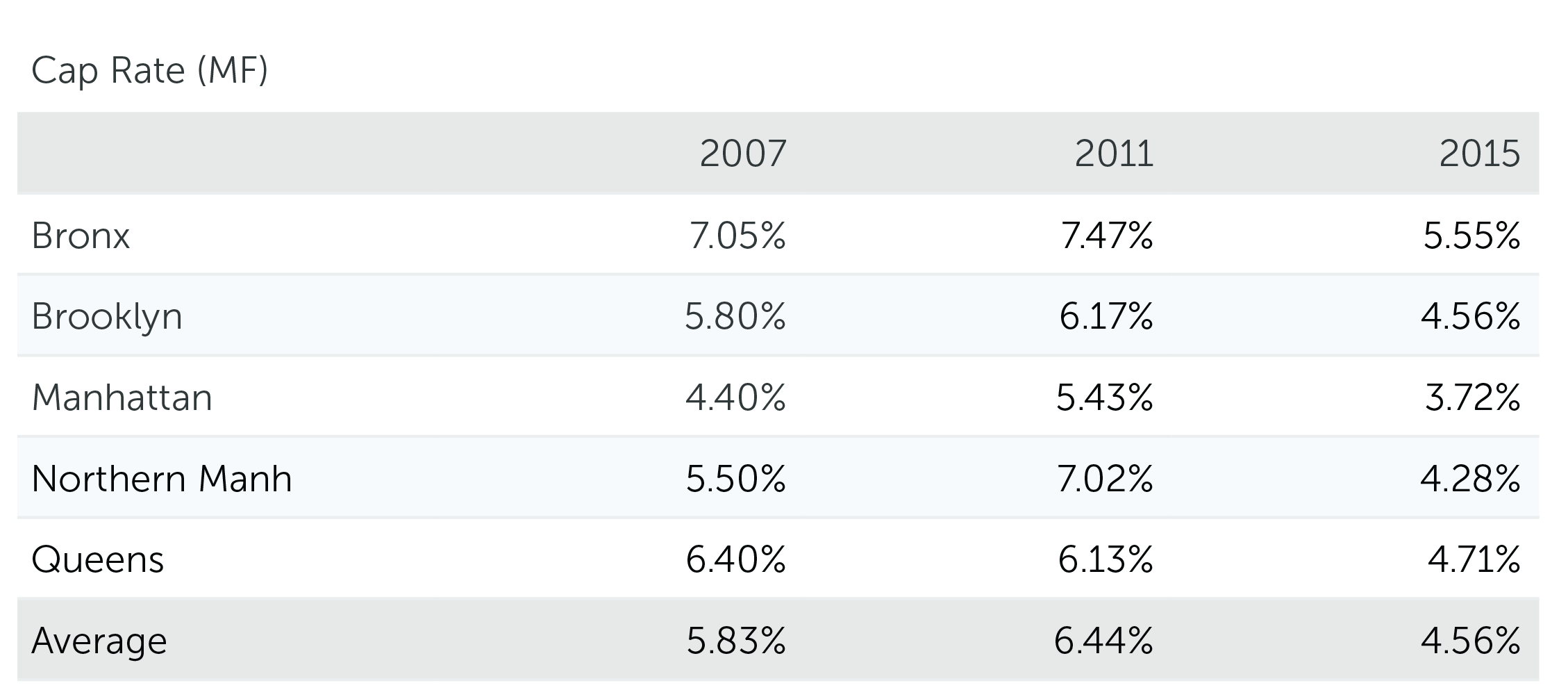

The year ended with $69.62 billion in dollar volume across 3,576 transactions, which represents an 11.48% increase in dollar volume compared to 2007. Pricing strengthened across several product types as multifamily properties command record low capitalization rates and development sites are consistently purchased by developers forecasting record condominium sellouts citywide.

The market conditions that drove 2015 New York City commercial real estate sales differ in several striking ways, however. This article explores five key factors impacting 2015 real estate that were not present during the last peak.

The Outer Boroughs Changed the Game

Core Manhattan, below 96th Street, has traditionally dominated the majority of the City’s large and institutional-sized deals. The outer boroughs, on the other hand, saw many transactions at affordable prices, making it an ideal market for real estate entrepreneurs to get their start.

Comparing 2015 to 2007 highs, attention must be paid to the enormous role the outer boroughs have played. Not only have the outer boroughs' dollar volume spiked in 2015 vs. 2007 - Brooklyn and Queens' dollar volumes are respectively up 152% and 98% - but they also claimed a larger market share. Brooklyn accounted for 14% of citywide dollar volume in 2015, versus a 6% share in 2007. Queens accounted for 6% of city market share in 2015, which is almost double the 3.5% in 2007.

Offering lower pricing and a convenient commute to Manhattan, it’s no surprise that a growing number of neighborhoods within the outer boroughs have become real estate magnets during the past eight years such as Williamsburg, Long Island City and in recent years, the South Bronx.

In 2015, 24 out of 46 multifamily transactions over $50 million traded outside of core Manhattan, compared to only 18 out of 44 deals in 2014. Even at the very top of the market, 10 out of 21 multifamily deals over $100 million took place outside of core Manhattan in 2015. Further, the boroughs are attracting institutional real estate investors like Extell, Savanna and Kushner Companies - firms that until this cycle exclusively invested in Manhattan.

New York City investment property sales experienced a tremendous 2015 as sales metrics on several fronts surpassed the highs seen during the last cycle’s peak in 2007.

A Growing Technology Wave

Following the Bloomberg administration’s smart push to diversify New York City’s economy, New York City’s technology industry has significantly expanded during the past eight years. In 2011, the technology industry received a jolt when former Mayor Bloomberg selected Roosevelt Island as the destination of the new Cornell Tech campus, created by a partnership between Cornell and Israel’s Technion University. This $2 billion and 30-year endeavor encompasses an ambitious plan, which will result in an innovative and highly sustainable campus comprising dynamic academic space, housing and public open areas. The first phase of development is targeted to be completed in 2017 and is expected to draw in the world’s top technology mavens. Currently, some of its programs are being run out of Google's Manhattan office and are grooming top developers and programmers in very high profile fields.

The plans for the Cornell Tech campus created a springboard for both start-up and established technology companies like Google who opened another office in Midtown South, Facebook and other Silicon Valley companies to clamor for a New York City presence. The TAMI industry (Technology, Advertising, Media and Information) has grown so rapidly that it has started to be priced out of Manhattan. Aside from DUMBO, TAMI companies have opened their doors in areas like Bushwick, the South Bronx and Long Island City.

In addition to the highly paying traditional industries which have dominated New York City for decades such as finance and professional services firms like the Big Four, the growing technology sector has made New York City home to a different, yet rapidly growing demographic of well-paid entrepreneurs and creative personalities. In 2015, there were close to 350,000 technology jobs commanded in New York City. Additionally, a slew of shared economy companies have set up shop in New York City at a dizzying pace such as WeWork, Airbnb and Uber, making it no surprise that a report by PricewaterhouseCoopers predicts that this global industry could grow up to $335 billion by 2025.

The Impact of Rezoning

In 2004, the former Bloomberg administration initiated a large rezoning initiative of nearly 40% of the City, paving the way for new development along subway lines while preserving neighborhoods, which included Long Island City (2004), Hunters Point South (2004), Williamsburg (2005), Greenpoint (2005) and Hudson Yards (2005).

Rezoning initiatives, however, take years to implement and since most of the rezoning efforts were finally approved as the recession hit in 2007, their dramatic impact have largely been seen during the 2010-15 real estate cycle.

New towers rising in Long Island City, Hunters Point South, Williamsburg, Downtown Brooklyn, and Hudson Yards are a testament to this as it’s been over ten years since these neighborhoods were rezoned and New Yorkers are now seeing these fruits being harvested. Areas are undergoing major transformations and we’ve seen a sharp uptick in real estate activity across product types. An example is Williamsburg, which in prime areas is seeing retail rents match or top popular areas of Manhattan.

A 2014 article by REBNY stated that the rezoning of Downtown Brooklyn, along with other targeted public improvements, “unleashed tremendous private investment in the area and highly appreciated the area.” Public investment of $300 million resulted in private investment of $10.5 billion – which significantly enhanced the economy and gave important momentum for other projects such as the creation of Brooklyn Bridge Park, Atlantic Yards, and the expansion of academic institutions throughout the area.

In 2015, Mayor deBlasio announced a comprehensive rezoning initiative, which will add a mix of market, moderate income and affordable housing and trigger investment in neighborhoods that include East New York, East Harlem, Flushing and along the Jerome Avenue Corridor in the Bronx.

New York City investment property sales experienced a tremendous 2015 as sales metrics on several fronts surpassed the highs seen during the last cycle’s peak in 2007.

Little New Construction Drives Prices

An aggressive need for more rental apartments in the City began with the sub-prime mortgage crisis, which sparked the 2008 – 2009 recession. Limited available mortgage financing and falling prices led to a short term surplus of overpriced and unaffordable condos, a wave of renters and no new construction until 2010. The tight supply caused the economy to pick up and drove up rental rates.

Rental pricing is based on supply and demand and even though there was a hastened amount of development, newly created units were quickly absorbed. The urgent need to rent coupled with not enough apartments resulted in surging prices, chiefly in big cities. Americans spent $535 billion on rent in 2015, up from $451 billion in 2011, according to Zillow.com. Last year, the number of renters in the U.S. rose to 43 million, up from 34 million a decade earlier, according to a report from the Joint Center for Housing Studies of Harvard University.

Higher rents result in higher property values, which led to an upsurge in real estate trades, further nourishing the market. During 2007 – 2015, the total property volume of all sales leaped by over 51% in Manhattan. The price per square foot for multifamily buildings in New York City surged by over 80% and cap rates reduced by nearly 22% during this timeframe.

Favorable Macroeconomic Environment

Even with the Federal Reserve’s most recent rate hike, commercial real estate has greatly benefitted record low interest rates.

With rising property values, investors made use of the low rates by avoiding getting locked into long-term debt with expensive yield maintenance or prepayment penalties. Instead, investors had the flexibility to be able to sell or refinance their property to access newfound equity. In recent years, the low rates gave investors the option to choose short-term adjustable rate mortgages of 5 years, or even more exotic, interest only loans since cap rates had been dropping and rents were increasing.

New York remains a top destination for global capital seeking refuge in a tumultuous economic landscape. Investors, skittish about the ramifications of low oil prices and a slow-growth Chinese economy continue to pour money into New York, where rents largely remain stable and condominium values – particularly in the $1-5 million range – are holding. This is buoyed by US GDP growth and comparatively low unemployment.

What’s Next?

With the 1Q16 now behind us, the City’s fundamentals remain strong. Steady job growth is ongoing, the market is stable and continues to draw significant capital as a ‘safe haven’ investment. We believe several of the factors seen over the last eight years will continue to positively impact New York City and its ever evolving landscape.

Mr. Shkury and Mr. Orlofsky can be reached at 212-544-9500.

More information is available from Shimon Shkury at 212.544.9500 ext.11 or e-mail sshkury@arielpa.com.