December 20, 2018

By Matthew Dzbanek and Remi Mandell; Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, raised its benchmark short-term interest rate by a quarter-percentage point to a range of 2.25% to 2.50% on Wednesday, its fourth increase this year and ninth since December 2015. At the end of its two-day policy-setting meeting, Federal Reserve officials reduced the number of rate hikes they foresee in 2019 from three increases down to two.

In a statement, Fed Chairman Powell and policymakers said ''economic activity has been rising at a strong rate'' but noted obstacles from a softening world economy. Many expect economic growth to decelerate from this year's robust pace, with slowing economies in Europe and China fueling that mindset. Central bank officials next year are widely expected to become more reliant on fresh incoming reports that gauge the economy.

''By focusing on new data, the Fed is allotting itself more flexibility with monetary policy, which makes sense given the current climate, but it also sets the stage for more market volatility next year,'' said Matt Dzbanek, Director of Capital Services.

Powell cited positives for the economy such as a strong labor market and wage gains. Indeed, the labor market is by far the economy's biggest bright spot. The jobless rate in November remained at a 49-year low of 3.7%. In fact, the job market is so tight that the amount of available jobs far exceeds the number of people seeking employment. Meanwhile, recent data on retail sales and industrial-production surpassed forecasts. Nevertheless, there are certainly pockets of weakness in the economy, namely the housing market, with new and existing home sales showing softness in the sector.

Gross domestic product - the broadest measure of goods and services produced in the U.S. - was 3.5% in the third quarter, below the second quarter's 4.2%, but significantly above the first quarter's 2.2%. Historically, for the past decade, GDP had been running at around 2%. The Federal Reserve Bank of Atlanta's ''GDP Now,'' widely viewed as one of the most reliable predictors of GDP, is currently forecasting 2.9% growth in the fourth quarter.

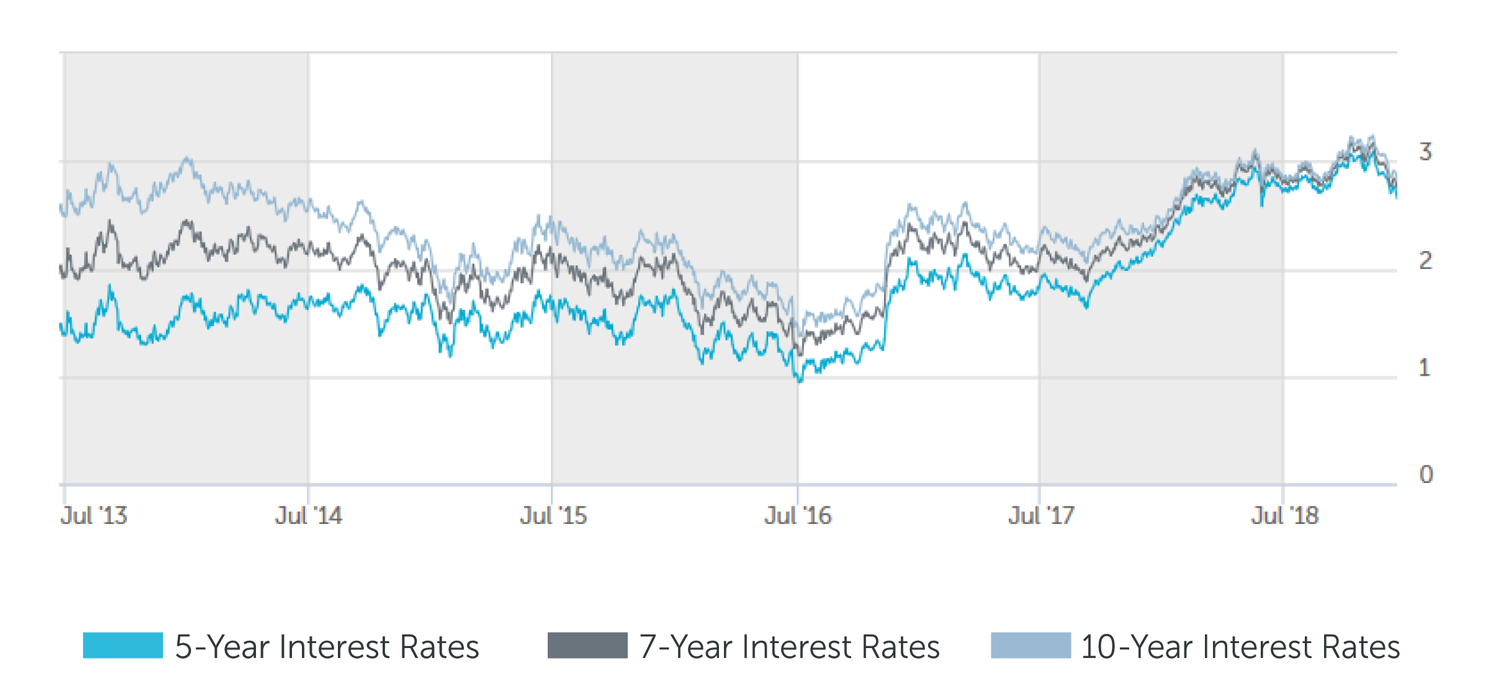

A flurry of factors, namely U.S.-China trade disputes, a steep sell-off in the stock market and weak overseas data, have buoyed safe-haven Treasuries in recent weeks. The 10-year Treasury yield, last trading at 2.83%, has fallen dramatically since hitting a seven-year high of 3.23% in November. Long-term Treasury yields influence everything from mortgage rates and small business loans to state/government bonds and corporate loans.

''The silver lining is that it has become less expensive to finance real estate transactions, but investors are still being forced to raise more equity than the last cycle,'' Dzbanek said.

Overall, uncertainty abounds as we enter 2019, but the Fed remains optimistic about the economy at this juncture. While higher borrowing costs have created a more challenging lending environment, that is being offset by looser bank regulations. At the same time, interest rates remain historically low, and new alternative lenders, both individual and institutional, have emerged with an intense desire to extend credit. We therefore expect capital markets to remain active, allowing investors unencumbered access to attractive and reliable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.125% - 4.375% |

| 7 Year | 4.375% - 4.625% |

| 10 Year | 4.625% - 4.875% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

Pricing current as of 12-19-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50%-8.00% |

| Re-Position | 9.00%-11.00% |

Pricing current as of 12-19-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.65% |

| 7-Year Treasury | 2.73% |

| 10-Year Treasury | 2.81% |

| Prime Rate | 5.25% |

| Term | Interest Rates |

| 3-Year Swap | 2.79% |

| 5-Year Swap | 2.78% |

| 7-Year Swap | 2.81% |

| 10-Year Swap | 2.88% |

Pricing current as of 12-19-2018

TREASURY RATES

More information is available from Matthew Dzbanek at 212.544.9500 ext.48 or e-mail mdzbanek@arielpa.com.