January 30, 2019

By Matthew Swerdlow and Remi Mandell; Ariel Property Advisors

The U.S. Federal Reserve, in the aftermath of a 35-day partial government shutdown, left its benchmark short-term interest rate unchanged at between 2.25% to 2.50% on Wednesday. The decision to hold rates steady was widely expected, but the central bank said it would take a wait-and-see approach for raising interest rates further in 2019.

In a statement after a two-day policy-setting meeting, the Federal Open Market Committee said it ''will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support a strong labor market and inflation near 2 percent.'' The Fed raised rates four times last year and has penciled in two increases in 2019 but concerns about the government shutdown's impact on the economy and slowing international growth has some expecting a more cautious central bank. Moreover, the shutdown, which was temporarily lifted last week, delayed the publication of several reports that are used by the FOMC.

As the Federal Reserve takes time to thoroughly analyze what stage the economy is in, real estate investors are forging ahead. Borrowers have the luxury of choosing from a myriad of capital providers, while also benefitting from a likely short-term reprieve from rising borrowing costs. Those in floating rate positions will continue to stabilize their transitional assets, while many are breaking prepayment penalties on existing debt in exchange for long-term, fixed-rate financing.

The economy is widely expected to decelerate in 2019 from last year's robust pace, due largely to slowing economies overseas. The International Monetary Fund recently lowered its 2019 forecast for global growth. That news came on the heels of fresh data from China showing the world's second-largest economy grew at the slowest annual pace since 1990. The slowdown can be attributed to trade disputes with the U.S. and China's need to balance high debt levels while maintaining economic growth.

Central bank officials have signaled in recent months that they will be more reliant on fresh incoming reports that gauge the economy.

''By setting their sights on new incoming data, the Fed is giving itself leeway with monetary policy, which is a warranted decision given the current environment,'' said Matthew Swerdlow, Director of Capital Services.

Real estate investors should pay close attention because many balance sheet lenders price their loans daily, based off a spread over the corresponding UST. As global market factors further push Treasury yields down, real estate investors can acquire financing with a relatively attractive cost compared to where many expected rates to be.

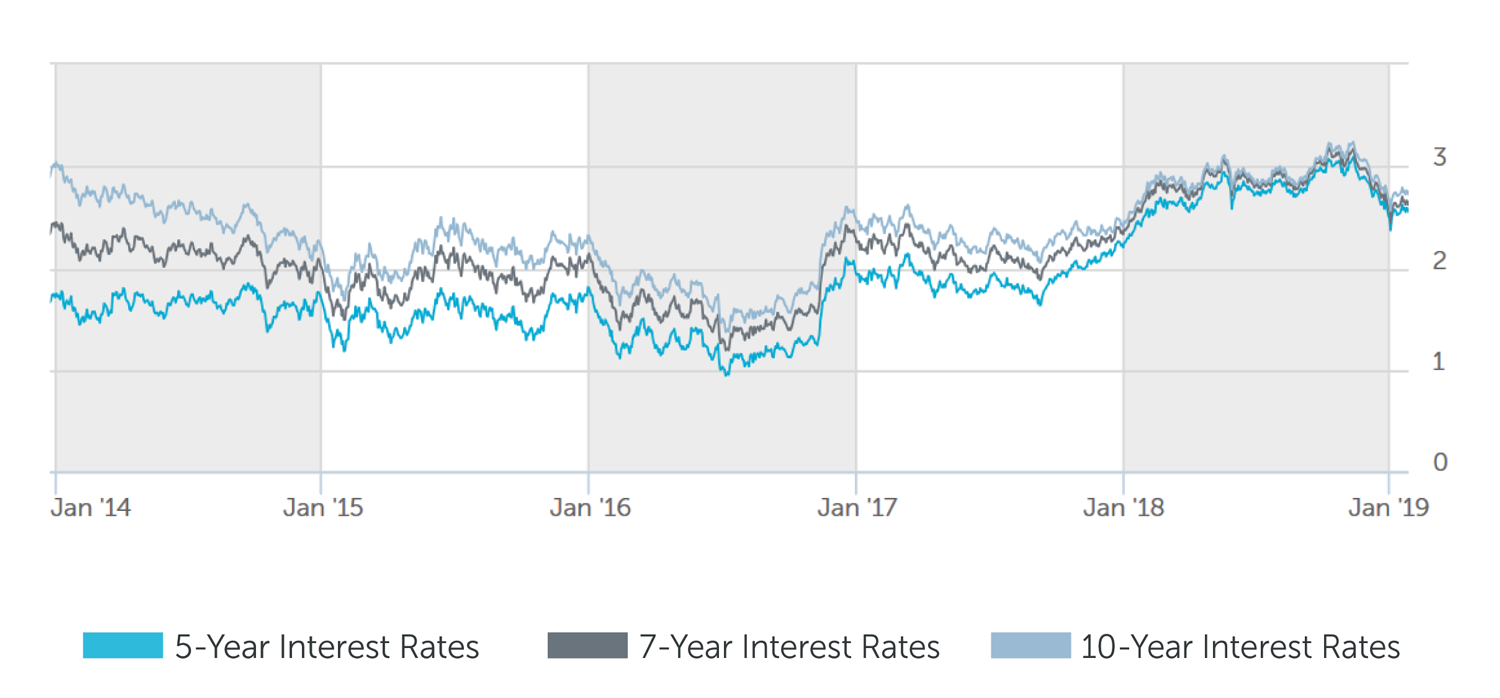

In December, a slew of factors, namely U.S.-China trade disputes, spurred a dramatic sell-off in the stock market that buoyed demand for safe-haven assets, such as Treasuries. However, an improved outlook on trade and better-than-expected corporate earnings has lifted investor sentiment in recent weeks. Treasuries also remain swayed by the Fed's tapering of its portfolio of Treasury and mortgage bonds. The 10-y-year Treasury yield, last trading at 2.75%, is down almost 50 basis points since hitting a seven-year high of 3.23% last November.

''The positive is that borrowing costs for commercial real estate loans have come down and lending activity shows no sign of stopping,'' Swerdlow said.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.125% - 4.375% |

| 7 Year | 4.375% - 4.625%% |

| 10 Year | 4.625% - 4.875% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.375% - 4.625% |

| 7 Year | 4.625% - 4.875% |

| 10 Year | 4.875% - 5.00% |

Pricing current as of 1-30-2019 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50% - 8.00% |

| Value Add | 7.00% - 9.00% |

| Re-Position | 9.00% - 11.00% |

Pricing current as of 1-30-2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.58% |

| 7-Year Treasury | 2.65% |

| 10-Year Treasury | 2.75% |

| Prime Rate | 5.50% |

| 1-Month LIBOR | 2.52% |

| Term | Interest Rates |

| 3-Year Swap | 2.658% |

| 5-Year Swap | 2.638% |

| 7-Year Swap | 2.675% |

| 10-Year Swap | 2.754% |

Pricing current as of 1-30-2019

TREASURY RATES

More information is available from Matthew Swerdlow at 212.544.9500 ext.56 or e-mail mswerdlow@arielpa.com.