May 1, 2019

By Matthew Dzbanek and Remi Mandell; Ariel Property Advisors

The Federal Reserve continues to take a patient approach, with the central bank, as widely expected, keeping its benchmark short-term interest rate unchanged at between 2.25% to 2.50% on Wednesday. In a statement following a two-day policy-setting meeting, the Federal Open Market Committee said it “will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate.”

Data last week showed the economy was on much firmer footing than predicted in the first quarter. Despite a dour start to the year when a partial government shutdown and stock market volatility had many forecasting slower growth, the Commerce Department’s first reading of gross domestic product – the value of all goods and services produced in the U.S. – rose at a seasonally and inflation-adjusted 3.2% rate in the first three months of 2019. GDP was a full percentage point higher than economists were expecting and it was the highest rate of first quarter growth since 2015.

A rise in exports and an increase in inventory investment were largely behind the first quarter’s robust growth, handily countering soft consumer and business spending. However, a report this week showed consumer spending, which accounts for about 70% of the economy, bounced back last month. Purchases in March rose 0.9% versus February’s paltry gain of 0.1%.

“Trade tensions have eased, corporate earnings have been solid if not strong, and the global economic backdrop has markedly improved, so there is no reason to believe that the present rate of expansion will not continue for the foreseeable future,” said Matthew Dzbanek, Director of Capital Services. “The U.S economy is humming along, which should keep the Fed in its holding pattern, especially if inflation remains subdued.”

Excluding food and energy, the Fed’s preferred inflation gauge, the price index for personal-consumption expenditures, barely budged in March and was up 1.6% from a year earlier, which was the slowest since January of last year. Inflation remains below the Fed’s 2% goal despite a tight labor market where the unemployment rate has been hovering around a 50-year low.

Meanwhile, concerns about global growth have abated since the beginning of the year, due largely to action taken by several major economies to bolster growth. In recent months, the European Central Bank launched a new monetary stimulus, Japan approved a fiscal stimulus package, and China passed tax cuts and loosened credit to certain borrowers.

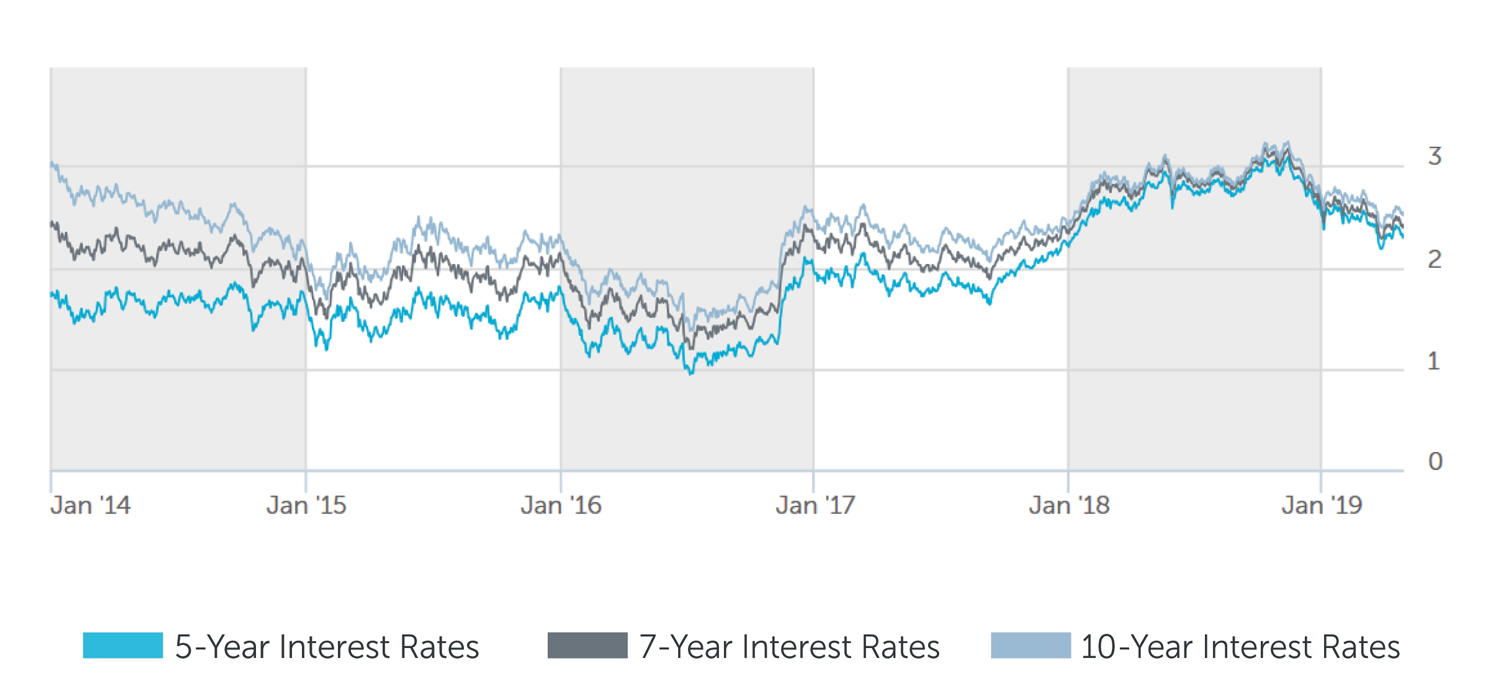

The 10-year Treasury yield – which influences everything from mortgage rates and small business loans to state/government bonds and corporate loans – has been trading in a narrow range over the past month. Nevertheless, the yield, last trading at 2.51%, is about 80 basis points below a seven-year high hit last November. Yields could head higher should inflation, which diminishes the value of the fixed-payments made on long-dated bonds, pick up.

“Long term stability in the interest rate market will allow buyers to better predict their cost of capital, allowing them to underwrite more accurately and make more informed investment decisions,“ Dzbanek said.

When it comes to the Fed, patience is a virtue right now, and with the lending environment vibrant, real estate investors remain interested in financing. Borrowers from coast-to-coast, buying an array of asset classes, can pick from a seemingly limitless amount of capital providers, while continuing to benefit from relatively low rates.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.00% |

| 7 Year | 4.00% - 4.375% |

| 10 Year | 4.375% - 4.75% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.875% - 4.125% |

| 7 Year | 4.125% - 4.375% |

| 10 Year | 4.375% - 4.50% |

Pricing current as of May 1, 2019 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.50% - 4.75% |

| 7 Year | 4.75% - 5.00% |

| 10 Year | 5.00% - 5.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50% - 8.00% |

| Value Add | 7.00% - 9.00% |

| Re-Position | 9.00% - 11.00% |

Pricing current as of May 1, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.28% |

| 7-Year Treasury | 2.39% |

| 10-Year Treasury | 2.51% |

| Prime Rate | 5.50% |

| 1-Month LIBOR | 2.48% |

| Term | Interest Rates |

| 3-Year Swap | 2.33% |

| 5-Year Swap | 2.33% |

| 7-Year Swap | 2.39% |

| 10-Year Swap | 2.49% |

Pricing current as of May 1, 2019

TREASURY RATES

More information is available from Matthew Dzbanek at 212.544.9500 ext.48 or e-mail mdzbanek@arielpa.com.