June 20, 2019

By Matthew Swerdlow and Remi Mandell; Ariel Property Advisors

The Federal Reserve held short-term interest rates steady on Wednesday, with the central bank keeping its benchmark short-term interest rate unchanged at between 2.25% to 2.50%. In a statement following the two-day policy-setting meeting, the Federal Open Market Committee cited “uncertainties” in their outlook for the economy.

The Fed is keeping a watchful eye on the economy’s trajectory right now. Fed Chairman Powell earlier this month indicated the central bank’s next move could be a rate cut if U.S. trade tariffs intensify to the point where it impacts the economy, which will mark its 10th year of expansion next month, the longest in history. At the same time, the global economic backdrop has softened, which increases the probability the Fed will lower interest rates at its July meeting.

Luckily, borrowers can rejoice given the tremendous borrowing opportunities found in today’s capital markets. Specifically, given the recent changes to New York’s rent regulation laws, borrowers who find themselves mid-business plan or struggling to sell a property, can tap the debt capital markets for some of the most aggressively priced credit at this stage of the business cycle.

“Since last week’s (rent regulation) announcement, our Capital Services team has been busy advising clients on the efficiencies found in longer-term loans. As owners start to underwrite cash flow instead of appreciation, we’ve found that borrowers are requesting loans that offer partial or interest-only periods with sub-4% rates to hit their return projections using cash flow rather than upside,“ said Matthew Swerdlow, Director of Capital Services. For more information regarding the rent regulation changes, please visit our Insights page.

Some say the new rent regulations will be detrimental to the NYC multifamily market, but this inflection point is merely a shift in methodology. Today, the most efficient debt capital can be found in longer-term notes, specifically with 7-, 10-, or 12-year terms. If multifamily cap rates begin to contract, borrowers will be able to achieve leverage on their acquisitions not seen since earlier in the cycle, coupled with interest-only periods and low interest rates. Business plans will start to mirror traditional 7- and 10-year horizons with the same stability and demand drivers that NYC investors have come to enjoy. The market will soon be inundated with incredible opportunities for investors who seek strong risk-adjusted core/core plus returns for stable assets in primary markets – bolstered by the surplus of available debt capital.

Meanwhile, concerns about a trade war with China, the world’s second-largest economy, and Mexico, have sent Treasury yields sharply lower over the past month as investors sought safe-haven assets. Early last month President Trump imposed additional tariffs of up to 25% on $200 billion of Chinese goods. A last-minute trade deal with Mexico averted tariffs, but a weak labor market report for May raised expectations of a rate cut. Nonfarm payrolls increased by just 75,000 jobs last month, far below the 185,000 jobs economists were expecting.

Nevertheless, the monthly payrolls report is well-known to be volatile and subject to sharp revisions, both on the upside and downside, and the job market remains one of the economy’s biggest bright spots. This was affirmed last week when the Labor Department reported that the number of job openings exceeded the number of people unemployed by the largest margin since record-keeping began in 2000.

Consumer spending, the largest engine of the economy, is another positive. Despite decelerating global growth and trade tensions, the Commerce Department said retail sales, which measures purchases at stores, restaurants and online shopping, rose a seasonally adjusted 0.5% in May from April.

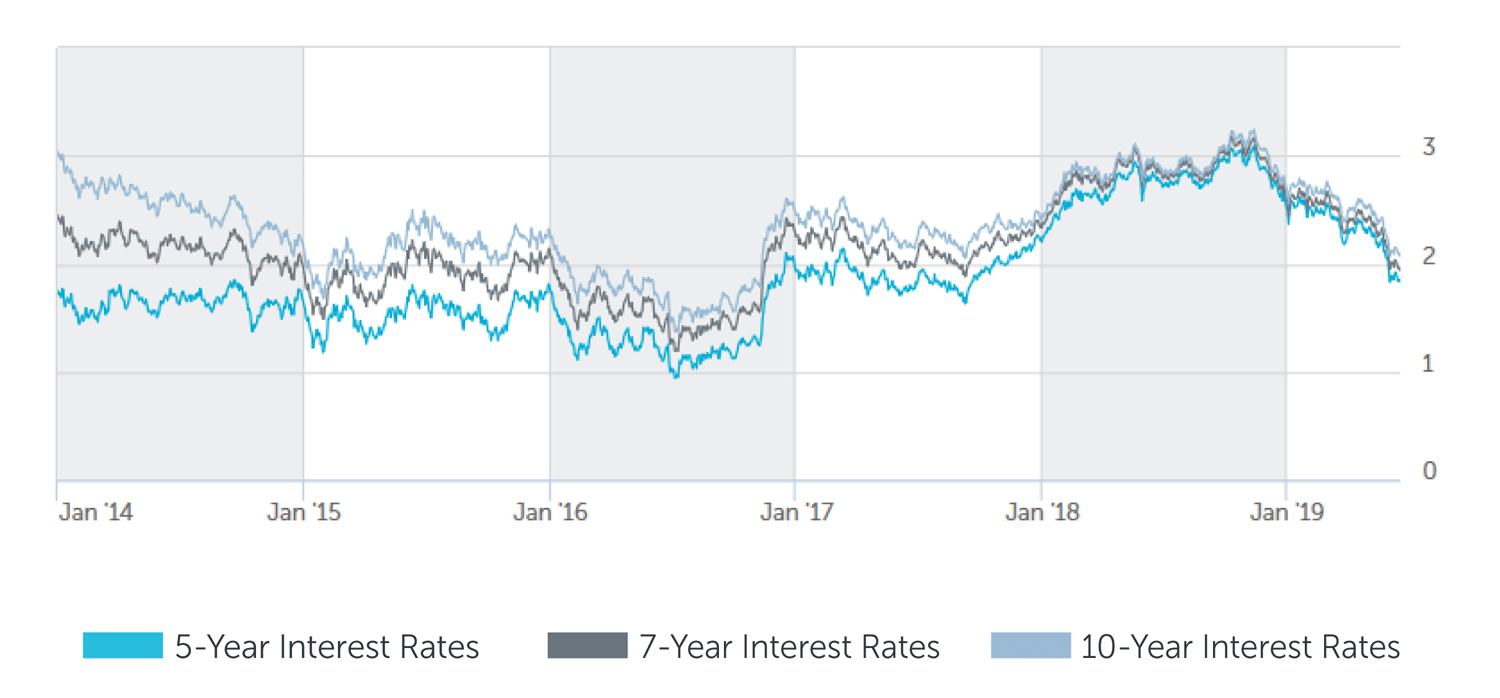

The 10-year Treasury yield – which influences everything from mortgage rates and small business loans to state/government bonds and corporate loans – has dropped sharply over the past month. The yield, last trading at 2.05%, is about 120 basis points below a seven-year high hit last October.

As far as refinancing, investors who acquired multifamily assets from 2015-2018 under the pretense of unit turnover and destabilization should immediately engage the capital markets and evaluate what refinancing options are on the table. Looking forward, borrowers should be hyper-aware of interest rate fluctuations as early rate locks and good timing may avoid a costly cash-in refinance. The long-term implications of the new rent regulation laws remain to be seen. However, it’s certain that borrowers can pick from a seemingly limitless amount of capital providers, at remarkably low rates.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.375% - 3.625% |

| 7 Year | 3.625% - 3.875% |

| 10 Year | 3.875% - 4.125% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 3.75% - 3.875% |

| 7 Year | 3.875% - 4.00% |

| 10 Year | 4.00% - 4.25% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 3.875% |

| 7 Year | 3.875% - 4.00% |

| 10 Year | 4.00% - 4.125% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% - 7.00% |

| Stabilized | 6.50% - 8.00% |

| Value Add | 7.00% - 9.00% |

| Re-Position | 9.00% - 11.00% |

Pricing current as of June 19, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.83% |

| 7-Year Treasury | 1.93% |

| 10-Year Treasury | 2.06% |

| Prime Rate | 5.50% |

| 1-Month LIBOR | 2.41% |

| Term | Interest Rates |

| 3-Year Swap | 1.87% |

| 5-Year Swap | 1.86% |

| 7-Year Swap | 1.93% |

| 10-Year Swap | 2.04% |

Pricing current as of June 19, 2019

TREASURY RATES

More information is available from Matthew Swerdlow at 212.544.9500 ext.56 or e-mail mswerdlow@arielpa.com.