September 19, 2019

By Matthew Dzbanek and Remi Mandell; Ariel Property Advisors

The Federal Reserve, as widely expected, cut short-term interest rates for a second time this year on Wednesday. The central bank lowered its benchmark interest rate by a quarter-point to between 1.75% and 2.00%. In a statement following a two-day policy-setting meeting, the Federal Open Market Committee said, “it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.” Officials also left the door open for potential additional rate cuts this year.

At its July meeting, the Fed cut borrowing costs for the first time since 2008 to buffer the impact of slowing growth overseas and the effect of an ongoing trade war between the U.S. and China. The economy is currently in its longest expansion in history, but growth has decelerated in recent months, which can partly be attributed to trade actions. Inflation-adjusted gross domestic product grew at a 2% annualized rate in the second quarter, down from the first quarter’s robust 3.1% pace. However, it is important to note that consumer spending, which accounts for nearly two-thirds of the economy, grew 4.7%, which was the largest gain since 2014.

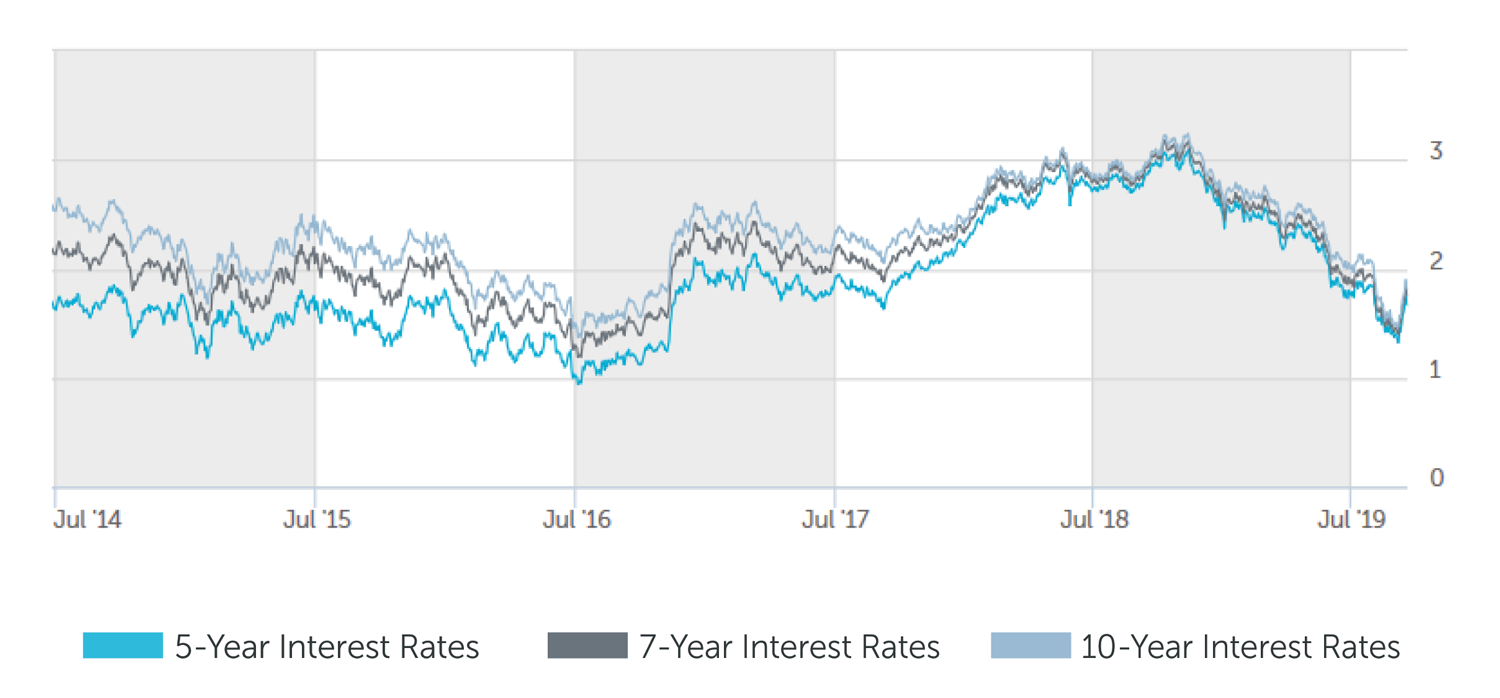

The yield on 10-year Treasuries – which influences everything from mortgage rates and small business loans to state/government bonds and corporate loans – last traded at 1.75%, significantly above a three-year low of 1.46% reached in early September, but about 100 basis points below 2019’s peak. Uncertainty regarding trade wars, the potential of the Fed lowering rates and zero/negative interest rates in international economies had caused the rate to drop in recent weeks. As of September 2019, interest rates on ten-year multifamily loans are roughly 100-150 basis points lower than where they were in September 2018.

“The perceived strength of the U.S. economy coupled with global economic factors has been driving treasury rates, and in turn lending rates, close to all-time lows. Even with the slight increase in yields we have seen over the past few weeks, current bank rates are still very appealing, allowing borrowers to achieve very attractive loans,” said Matthew Dzbanek, Director of Capital Services at Ariel Property Advisors.

Signals of a global slowdown have sent yields on long-term Treasury bonds dramatically lower this year, but they have bounced in recent weeks on supply pressures caused by a cascade of government and corporate bond sales, as well as signs that firming inflation. The producer-price index rose 0.1% in August, above what economists expected. Inflation hurts the value of long-term bonds because it chips away at their value. At the same time, while Treasury yields have fallen, they remain far above other developed economies, such as Germany, Japan and France. The U.S. dollar has recently been trading at historic highs against the currencies of other trading partners, which should weigh on exports. Lower rates abroad tend to weaken their currencies by making them less attractive to investors questing yield.

Looking forward, while the economy faces plenty of headwinds, both domestically and abroad, the current climate for real estate financing is accommodating. Interest rates are alluring for every asset class and sub-market in New York City. The market is awash with opportunities for investors seeking strong, stable assets and there is an excess of capital waiting to be deployed.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.375% - 3.625% |

| 7 Year | 3.625% - 3.875% |

| 10 Year | 3.875% - 4.00% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.00% - 4.25% |

| 7 Year | 4.125% - 4.375% |

| 10 Year | 4.25% - 4.50% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.00% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 4.00% - 4.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 7.50% |

| Stabilized | 6.25% - 7.75% |

| Value Add | 6.75% - 8.75% |

| Re-Position | 7.00% - 10.75% |

Pricing current as of September 19, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.69% |

| 7-Year Treasury | 1.77% |

| 10-Year Treasury | 1.75% |

| Prime Rate | 5.25% |

| 1-Month LIBOR | 2.04% |

| Term | Interest Rates |

| 3-Year Swap | 1.66% |

| 5-Year Swap | 1.62% |

| 7-Year Swap | 1.64% |

| 10-Year Swap | 1.71% |

Pricing current as of September 19, 2019

TREASURY RATES

More information is available from Matthew Dzbanek at 212.544.9500 ext.48 or e-mail mdzbanek@arielpa.com.