October 31, 2019

By Matthew Swerdlow and Remi Mandell; Ariel Property Advisors

The Federal Reserve, as widely expected, cut short-term interest rates for a third time in four months on Wednesday but suggested they may hit the pause button on further monetary policy. The Fed lowered its benchmark interest rate by a quarter-point to between 1.50% and 1.75%. In a statement following a two-day policy-setting meeting, the Federal Open Market Committee removed its key clause that promised to “act as appropriate to sustain the expansion” but added it would also continue to monitor incoming economic data to determine the appropriate path for the federal funds rate.

While the central bank typically cuts rates because of negative economic developments, policymakers also take this action to protect the economy against rising risks, which is the current scenario. The Fed has been reducing interest rates since its July meeting to buffer the impact of slowing global growth and geopolitical threats. The United Kingdom and the European Union are still trying to hash out terms for the United Kingdom’s exit from the bloc, and trade talks continue between the U.S. and China, the world’s second-largest economy.

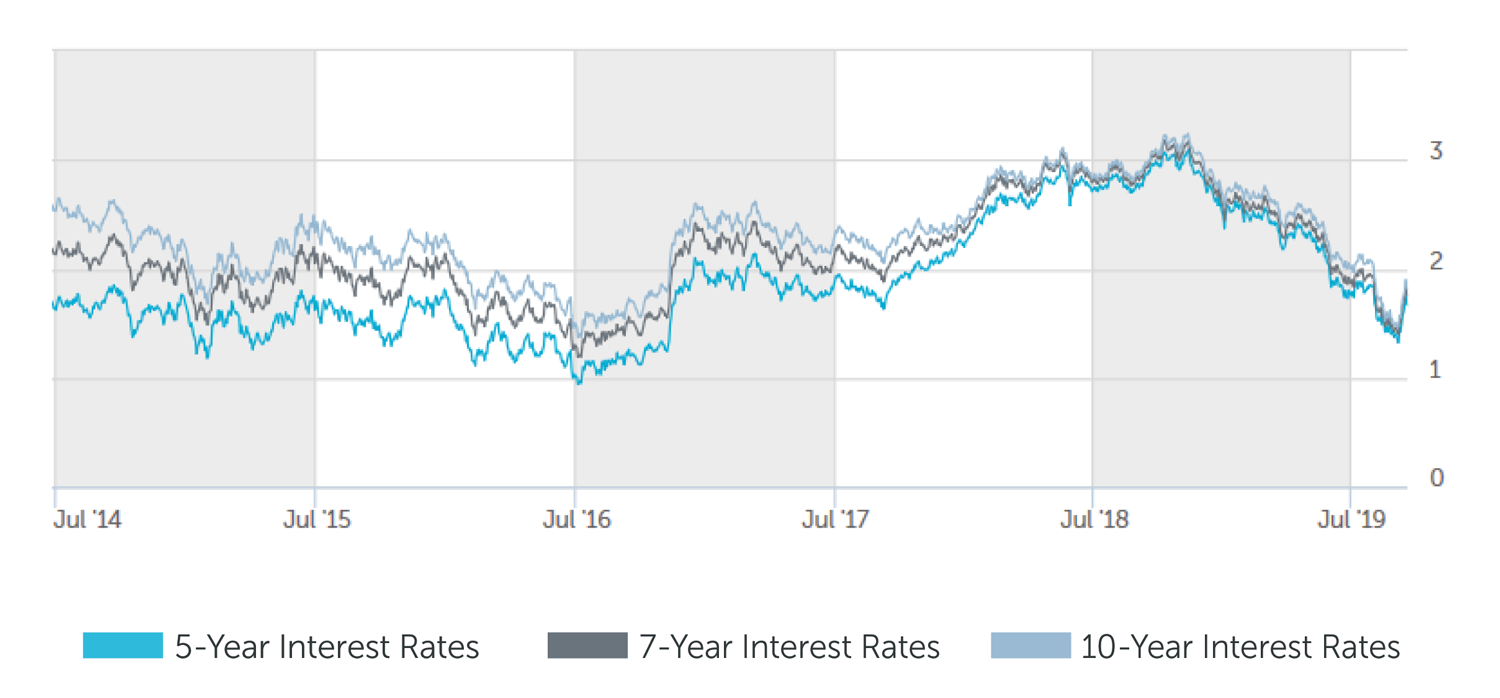

The 10-year U.S. Treasury reflected this geopolitical uncertainty earlier this month when positive news stemming from the UK’s Brexit negotiations prompted bond investors to pull out of U.S. Treasuries pushing yields up. Fortunately, the immediate result to real estate investors was bearable as the 10-year Treasury index is still well below 2019’s peak.

Following the Fed’s announcement, the yield on the aforementioned 10-year Treasury closed at 1.775%, slightly above where it was the last time the Fed met, but about 105 basis points below 2019’s peak. In context, commercial interest rates on ten-year multifamily loans, for example, are roughly 75-100 basis points lower than where they were in October 2018.

“In today’s capital markets environment, we’re advising clients to the merits of refinancing existing loans into longer term positions. The marginal difference between interest rates of 10-year financing versus 5-year financing is extremely tight and capital providers are still very bullish about commercial real estate assets,” said Matthew Swerdlow, Director of Capital Services at Ariel Property Advisors. “In New York City, as multifamily borrowers extend their investment horizons or restructure for a possible downturn, the debt markets are perfectly complementing this strategy for 7 – 10-year fixed rate financing.”

The economy is currently in its 11th year of expansion, the longest in history. Growth has decelerated in recent months, which can partly be attributed to meaningful malaise in the manufacturing sector. Earlier this month, the Institute for Supply Management said its measure of national manufacturing activity slumped in September to its lowest level since June 2009. At the same time, the Commerce Department reported retail sales, which gauges purchases at stores, restaurants and online, fell to a seasonally adjusted 0.3% in September from August, marking the first monthly drop since February. Consumer spending accounts for more than two-thirds of economic output and is one of several indicators for economic strength. Nevertheless, the labor market remains firm as the unemployment rate fell to a half-century low and jobs gains from previous months were upwardly revised.

Varying signs of a global economic slowdown sent yields on long-term Treasury bonds dramatically lower this year, but they have bounced back in recent months as trade talk optimism and strong corporate earnings prompted investors to shed safe-haven Treasuries and embrace riskier assets, such as publically traded equities.

Looking ahead, while the economy faces headwinds, both domestically and overseas, the current environment is extremely conducive for commercial real estate financing. Interest rates are not far from record lows for every asset class in New York City. The market is brimming with opportunities for investors seeking strong, stable returns and there is an abundance of capital awaiting deployment.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.25% - 3.50% |

| 7 Year | 3.50% - 3.875% |

| 10 Year | 3.875% - 4.00% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.625% - 3.875% |

| 7 Year | 3.875% - 3.90% |

| 10 Year | 3.90% - 4.125% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.75% - 4.00% |

| 7 Year | 3.875% - 4.125% |

| 10 Year | 3.785% - 4.25% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.00% - 7.50% |

| Stabilized | 5.00% - 7.75% |

| Value Add | 6.00% - 8.75% |

| Re-Position | 6.50% - 10.75% |

Pricing current as of October 30, 2019 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 1.66% |

| 7-Year Treasury | 1.74% |

| 10-Year Treasury | 1.84% |

| Prime Rate | 4.75% |

| 1-Month LIBOR | 1.82% |

| Term | Interest Rates |

| 3-Year Swap | 1.63% |

| 5-Year Swap | 1.62% |

| 7-Year Swap | 1.66% |

| 10-Year Swap | 1.74% |

Pricing current as of October 30, 2019

TREASURY RATES

More information is available from Matthew Swerdlow at 212.544.9500 ext.56 or e-mail mswerdlow@arielpa.com.