July 30, 2020

By Matthew Dzbanek and Matthew Swerdlow; Ariel Property Advisors

The Federal Reserve met yesterday in Washington, DC. Chairman Jerome Powell noted that the Fed would continue to take aggressive lending measures to keep the market active and afloat. However, the Fed also noted the long road to recovery ahead, and that the country’s economic health is tied to how well the U.S. can contain and mitigate the coronavirus pandemic. Powell noted, “The path of the economy is going to depend to a very high extent on the course of the virus, on the measures that we take to keep it in check.”

He did go on to note that social distancing is not in competition with reopening businesses, and that the federal government would need to make impactful policy decisions in the days ahead, as “[f]iscal policy can address things [the Fed] can’t address.” He noted that the Fed has “lending powers, not spending powers.”

“The Fed acted swiftly and aggressively months ago by lowering rates to near zero and lenders have followed suit with historically low rates—and it’s worked, for the most part,” said Matt Dzbanek, Director of Capital Services at Ariel Property Advisors. “We’re seeing lender activity and, in New York, where the virus has been mostly contained in recent weeks, business activity is on the upswing.”

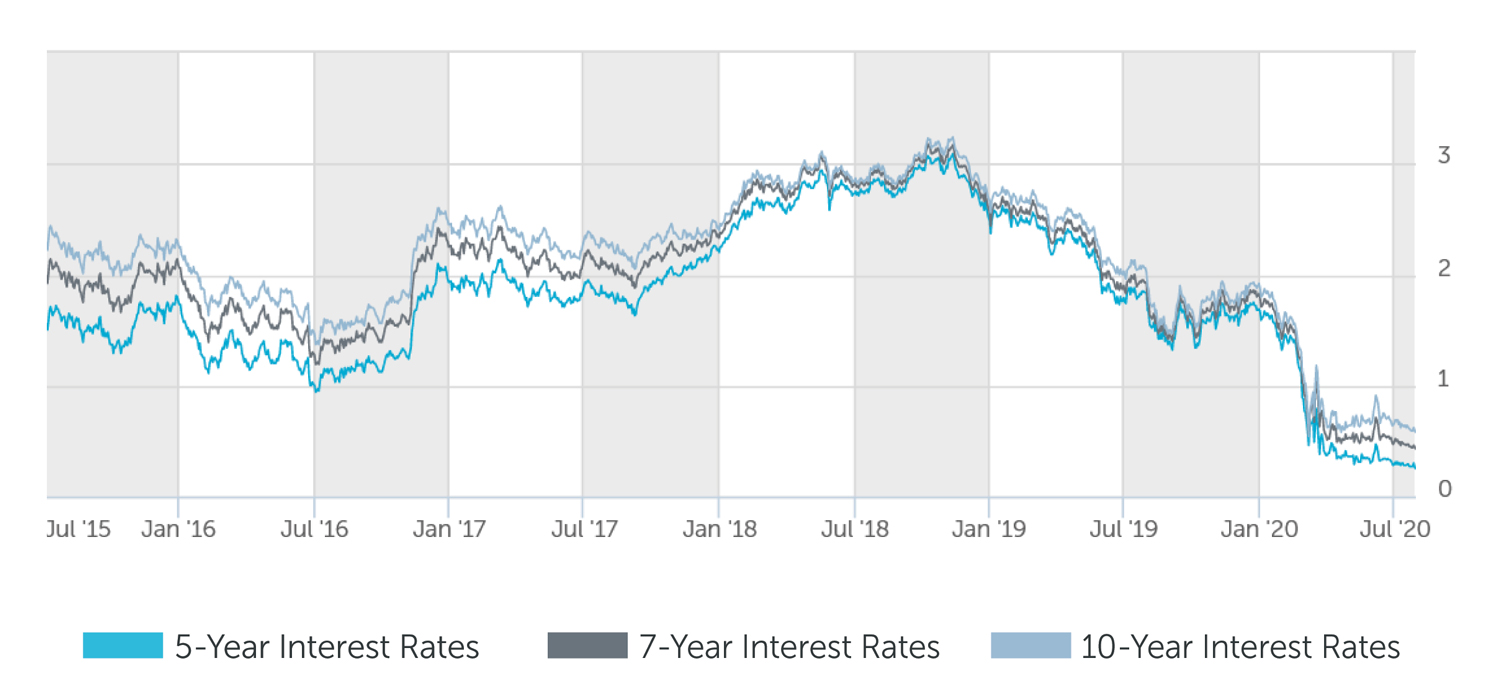

Some of this activity can be attributed to Treasury note yields at or near record lows. The 10-Year Treasury note, which tends to dictate mortgage rates, was at 0.577% on Wednesday evening, and had reached a historic low earlier in the day of 0.565%, according to the Dow Jones.

In May and June, the U.S. stock market dip was followed by a quick bounceback, but the recovery is happening in the midst of uncertainty. As the New York metropolitan area and the Northeast have largely curbed the spread of the virus and are now well-advanced into phased reopenings, much of the rest of the U.S. is in the midst of a spike in the curve. Given the Fed’s statement and current deliberations between Congress and the White House, it is highly likely that that the federal government will also extend or expand on current stimulus and relief measures that will continue to help businesses weather the pandemic.

“The government is demonstrating a commitment to keeping the economy moving forward as states work to implement more extensive safety measures. The key for an investor is to keep their eyes on the long term,” said Dzbanek. “The U.S. commercial real estate sector is still backed by strong fundamentals independent of the pandemic, especially in a city like New York, where we just experienced a decade of historically robust growth. Given the low interest rates, investing now in the property sector or refinancing on an existing asset could be a savvy long-term move.”

The upcoming elections bring a further degree of uncertainty; in addition to the presidential election, a number of Senate races are hotly contested right now, which could result in a majority shift in parties. Geopolitical pressures are also a factor, with the UK transitioning out of the EU and US-Chinese relations becoming increasingly polarized, as the US ordered the shutdown of China’s consulate in Houston last week over security concerns.

Still, the US government remains focused on stabilizing the economy, and investors should continue to monitor the course of the pandemic and what additional bailouts the legislature proposes in the near future. For the Fed’s part, Powell’s response regarding interest rates does indicate an ongoing commitment to promoting business activity.

“We’re not even thinking about thinking about thinking about raising rates,” said Powell.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 3.25% - 3.50% |

| 7 Year | 3.50% - 3.75% |

| 10 Year | 3.75% - 4.00% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 2.70% - 3.25% |

| 7 Year | 2.55% - 3.05% |

| 10 Year | 2.60% - 3.20% |

*12 and 15 year terms available as well

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 3.50% - 4.00% |

| 7 Year | 3.75% - 4.25% |

| 10 Year* | 3.85% - 4.75% |

| *full-term interest only available | |

| Construction / Development / Bridge (Floating Over 1-Month LIBOR) | |

| Term | Interest Rates |

| Stabilized / Core | 2.50% - 4.00% |

| Value Add / Core Plus | 4.25% - 5.50% |

| Re-Position / Opportunistic | 7.00% - 9.00% |

| Construction / Development | 4.25% - 5.75% |

Pricing current as of July 30, 2020 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 0.25% |

| 7-Year Treasury | 0.43% |

| 10-Year Treasury | 0.58% |

| Prime Rate | 3.25% |

| 1-Month LIBOR | 0.17% |

| Term | Interest Rates |

| 3-Year Swap | 0.21% |

| 5-Year Swap | 0.29% |

| 7-Year Swap | 0.41% |

| 10-Year Swap | 0.56% |

Pricing current as of July 30, 2020

TREASURY RATES

More information is available from Matthew Dzbanek at 212.544.9500 ext.48 or e-mail mdzbanek@arielpa.com.