Press Releases Archive

Howard Raber

Director - Investment Sales

Ariel Property Advisors

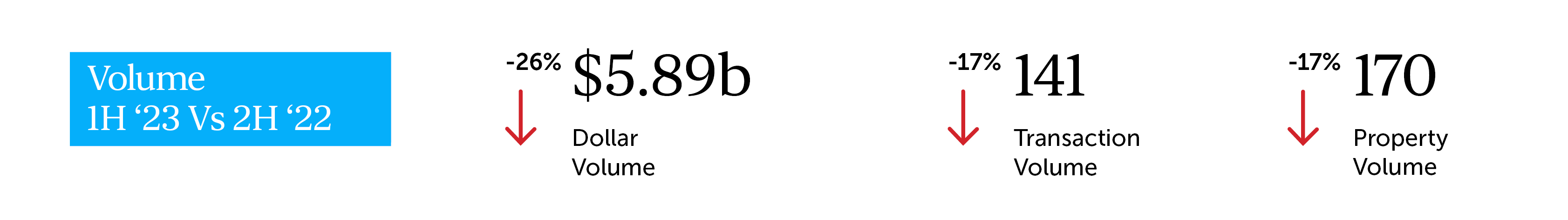

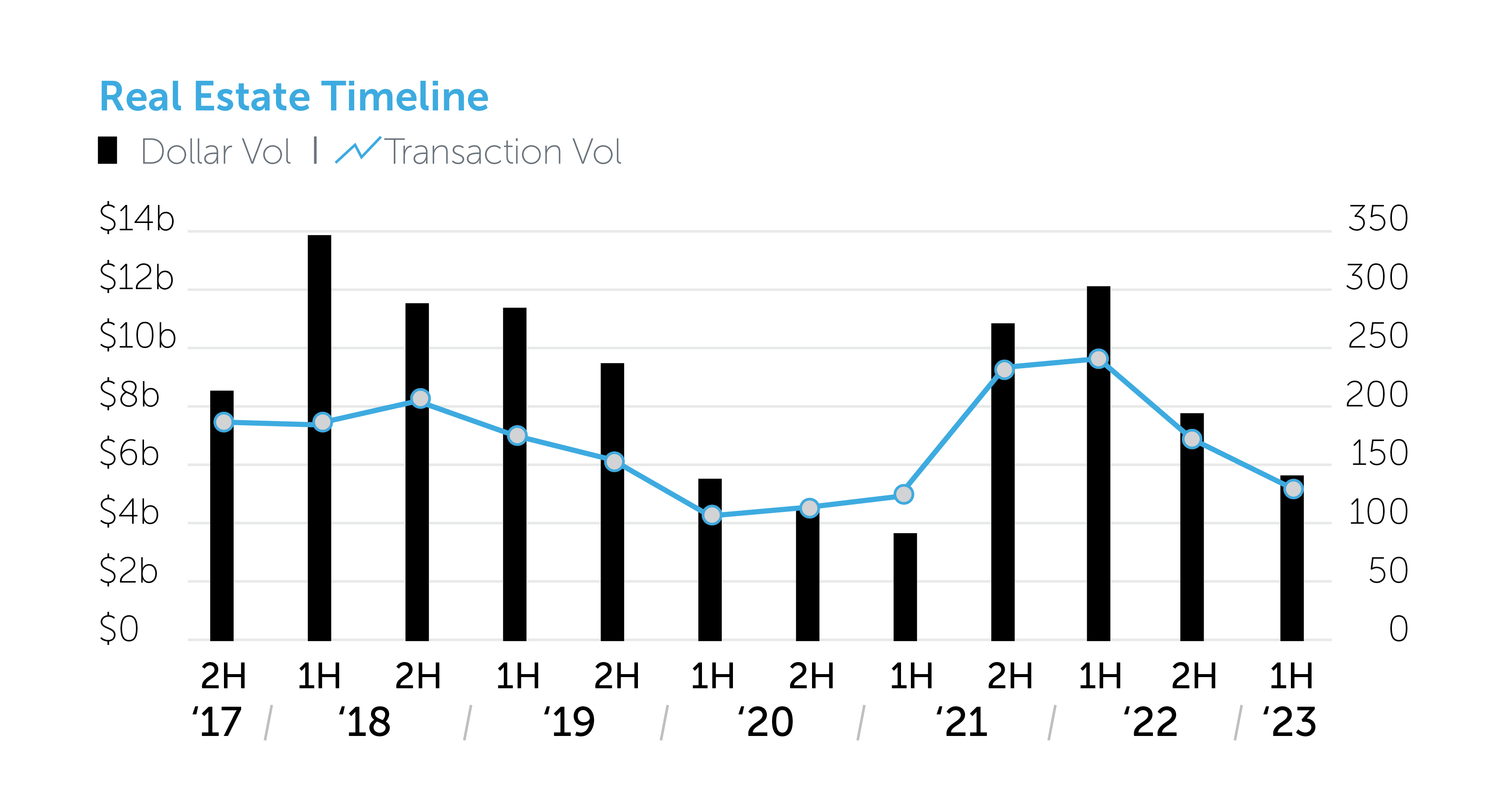

NEW YORK, NY – July 25, 2023 – The first half of 2023 saw investors taking a more measured approach to the market with an eye on higher interest rates and rising expenses. As such, Manhattan experienced a decline in investment property transactions during 1H 2023 with only $5.89 billion spent in the borough, a 26% percent drop from the previous six months and a 51% decrease compared to 1H 2022, according to Ariel Property Advisors’ Manhattan 2023 Mid-Year Commercial Real Estate Trends report. Transactions totaling 141 also fell 17% from 1H 2022 and 43% year-over-year.

"Multifamily remained the most transactional asset class in Manhattan in 1H 2023 and of these deals, free-market and 421a buildings accounted for 90% of the multifamily dollar volume," said Howard Raber, a Director in Investment Sales at Ariel Property Advisors. "Strong rents for unregulated apartments have given landlords and investors confidence in the Manhattan market as they continue to seek cash flowing assets with limited regulation."

Highlights from the report by asset class include:

Multifamily.

Commercial.

Office.

Development.

To read Ariel Property Advisors’ Manhattan 2023 Mid-Year Commercial Real Estate Trends report, please click here.

For more information, please contact: Gail Donovan at 212.544.9500 ext. 19 or gdonovan@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.