Press Releases Archive

Jason M. Gold

Senior Director - Investment Sales

Ariel Property Advisors

Daniel Mahfar

Director - Investment Sales

Ariel Property Advisors

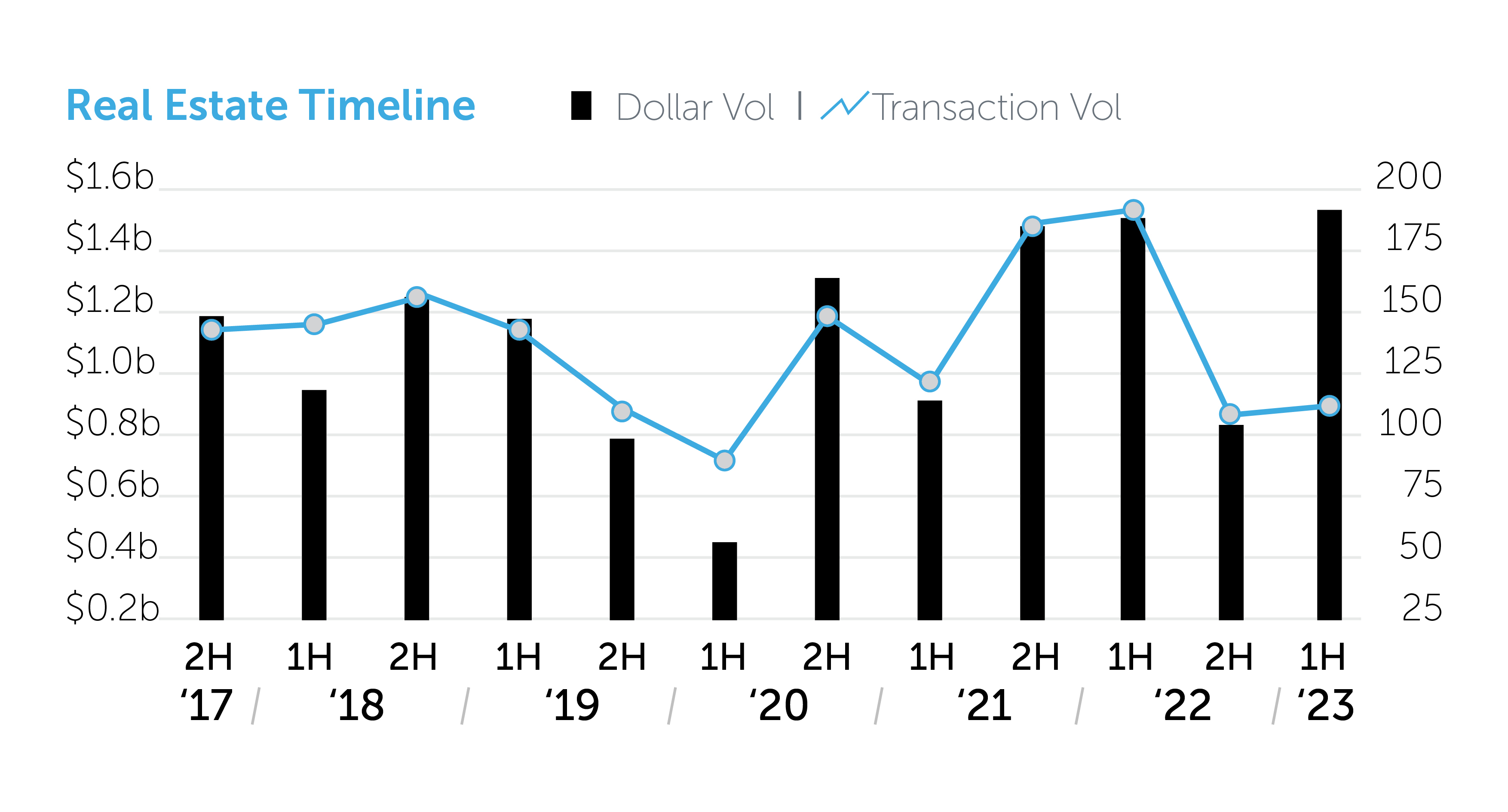

NEW YORK, NY – July 27, 2023 – Dollar volume in the Bronx investment sales market jumped 86% to $1.51 billion in 1H 2023 compared to 2H 2022, while transaction volume for the period remained steady, increasing a modest 3% to 111 transactions, according to Ariel Property Advisors’ Bronx 2023 Mid-Year Commercial Real Estate Trends report.

“The rise in dollar volume can be directly attributed to Nuveen’s purchase of the Omni Affordable Housing Portfolio,” said Senior Director Jason Gold. “The entire portfolio traded for a total capitalization of approximately $956 million, with about 66% of the units valued at $593 million located in the Bronx.”

Daniel Mahfar, Director, added that metrics improved across several asset classes in the Bronx in the first half of 2023. “Development set a new record at $103/BSF as more developers weighed building affordable housing and land-banking in anticipation of Mayor Adams’ proposed rezoning of areas surrounding Metro-North stations,” he said. “Additionally, at $400/GSF, industrial pricing 1H 2023 was higher than any other year on record except for 2022 due to strong underlying fundamentals including rent growth and stable, low vacancy rates.”

Multifamily

Industrial/Warehouse/Self Storage

Development

Commercial

To read Ariel Property Advisors’ Bronx 2023 Mid-Year Commercial Real Estate Trends report, please click here.

For more information, please contact: Gail Donovan at 212.544.9500 ext. 19 or gdonovan@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.