Press Releases Archive

NEW YORK, NY – July 24, 2018 – Real estate investment properties in The Bronx remained in high demand during the first half of 2018, particularly multifamily buildings, where transaction and property volume leaped. Commercial properties were also favored, with all three volume metrics for the asset class recording significant gains.

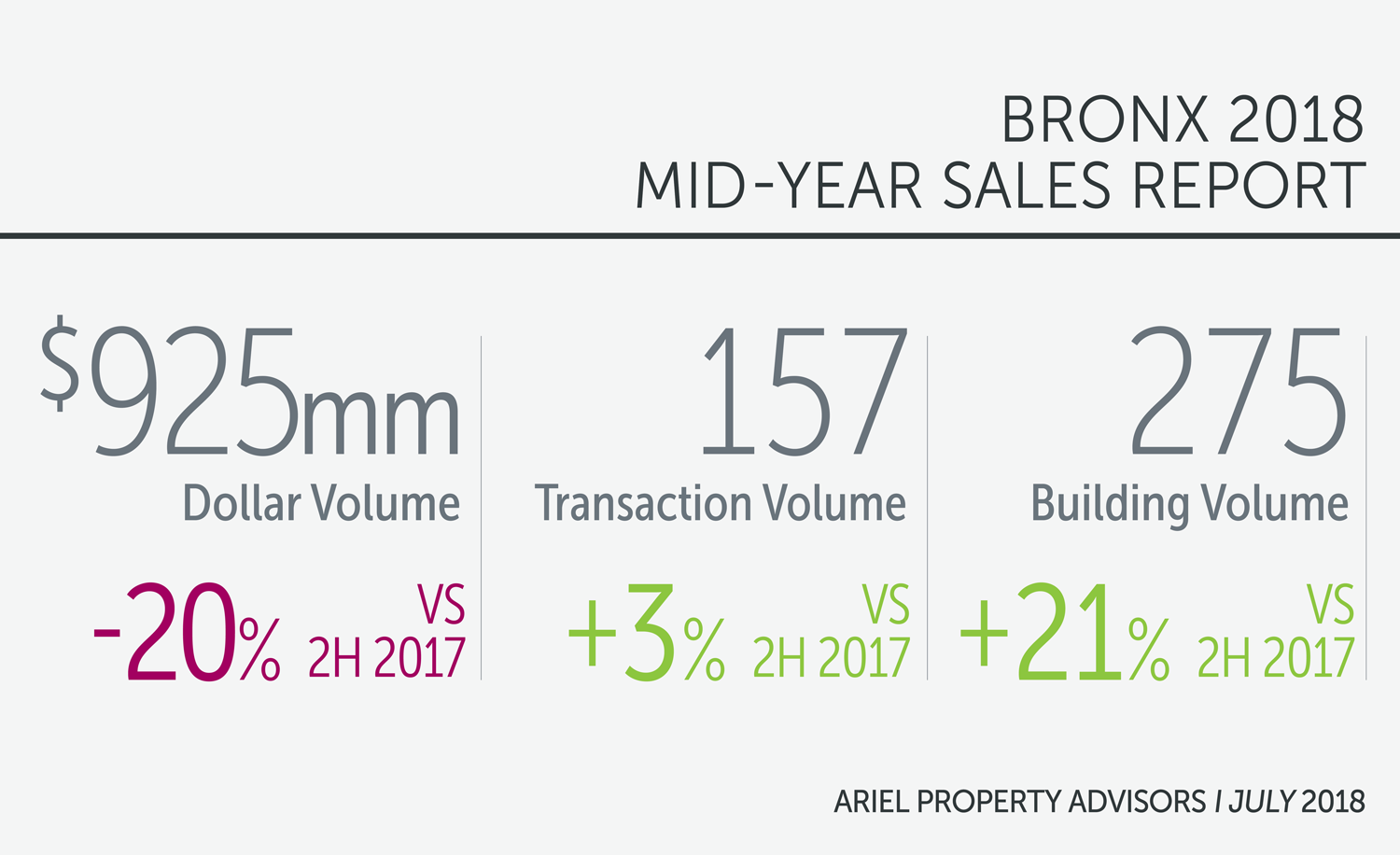

The Bronx’s investment sales market thrived in 1H18 as a rising interest rate environment prompted many investors to seek higher returns offered on buildings and land in the borough. During 1H18, The Bronx saw 157 transactions consisting of 275 properties, totaling approximately $951.75 million in gross consideration, according to Ariel Property Advisors’ newly released “Bronx 2018 Mid-Year Sales Report.”

Compared with 2H17, dollar volume dropped 20%, transaction volume rose 3%, and property volume leaped 21%. Versus 1H17, dollar volume fell 8%, transaction volume edged up 1%, and property volume soared 20%.

Geographically, the South Bronx captured the lion’s share of activity in the borough, seizing 45% of the dollar volume, 49% of the transaction volume, and 44% of the property volume. By property type, the multifamily asset class comprised 63% and 58% of The Bronx’s dollar and transaction volume, respectively. Development assets constituted far less, snaring 19% and 25% of the dollar and transaction volume, respectively.

The Bronx’s multifamily asset class saw increases across-the-board. Versus 2H17, dollar volume increased 14% to $600.50 million, transaction volume jumped 21% to 92 sales, and property volume soared 40% to 153 buildings.

“Demand continues to outpace supply in this asset class as multifamily pricing metrics experienced increases across-the-board,” said Jason M. Gold, Director at Ariel Property Advisors.

Indeed, compared to 2017 averages, the price per square foot climbed 13% to $221, the price per unit increased 9% to $192,000, and the gross rent multiple (GRM) rose 5% to 12.51 from 11.89. Cap rates remained relatively steady, increasing to 5.00% from 4.94%.

The largest multifamily transaction in the first half was The Related Companies’ sale of a 12 building, 368 unit multifamily portfolio for $71,000,000. Other notable transactions include ABJ Properties purchase of Emerald Equity Group’s 14 building, 288 unit portfolio for $61,525,000.

Meanwhile, commercial assets in The Bronx saw the most significant gains out of any asset category. Versus 2H17, dollar volume increased by 71%, followed by transaction and property volume, which jumped 25% and 68%, respectively. As volume rose, the price per square foot slipped 18% from 2017, to $364. A notable transaction was Chestnut Holdings acquisition of a large retail portfolio play for $46.5 million, where a majority of the 13 properties were low-rise retail properties with large development potential.

The Bronx’s $183.25 million in development site/industrial sales dropped 45% compared to 2H17, but rose 12% versus 1H17. At 39 sales, transaction volume dropped 19% versus 2H17 and fell 28% compared to 1H17. Broken down by neighborhood, development activity in Morrisania, Mott Haven and Norwood comprised 46% of total transactions. Pricing firmed in 1H18, with the average price per buildable square foot at $68, up from 2017’s average of $63.

“With the rezoning of Jerome Avenue officially underway, the Bronx will be seeing a significant uptick in demand for development opportunities similar to the 2016 market in the 2H18,” Gold said.

Looking ahead, strong economic fundamentals, elevated investor confidence seen in recent contract signings and plentiful amounts of capital looking to invest in New York City real estate bodes well for real estate in The Bronx and we expect volume to hold steady in the second half of 2018. While we are watchful of rising interest rates and the impact of macro-economic as well as political developments, the outlook for the balance of the year remains positive.

To view the full report, please click here: http://arielpa.com/report/report-APA-Bronx-mid2018-Sales-Report

For more information, please contact: Jason M. Gold, ext. 22, jgold@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.