Press Releases Archive

Sean R. Kelly, Esq.

Partner

Ariel Property Advisors

Stephen Vorvolakos

Director - Investment Sales

Ariel Property Advisors

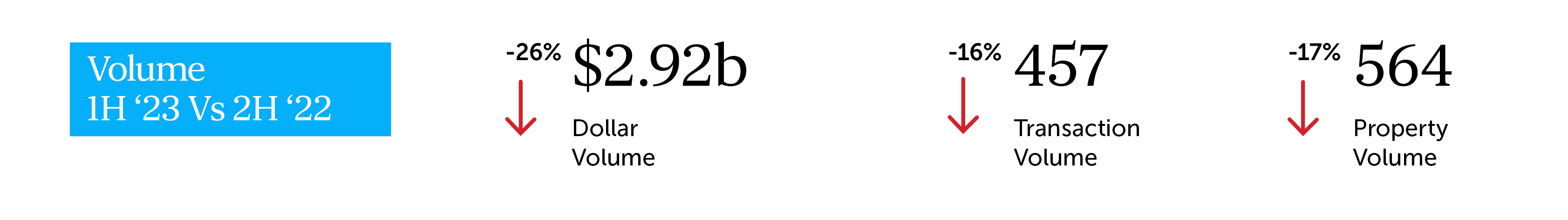

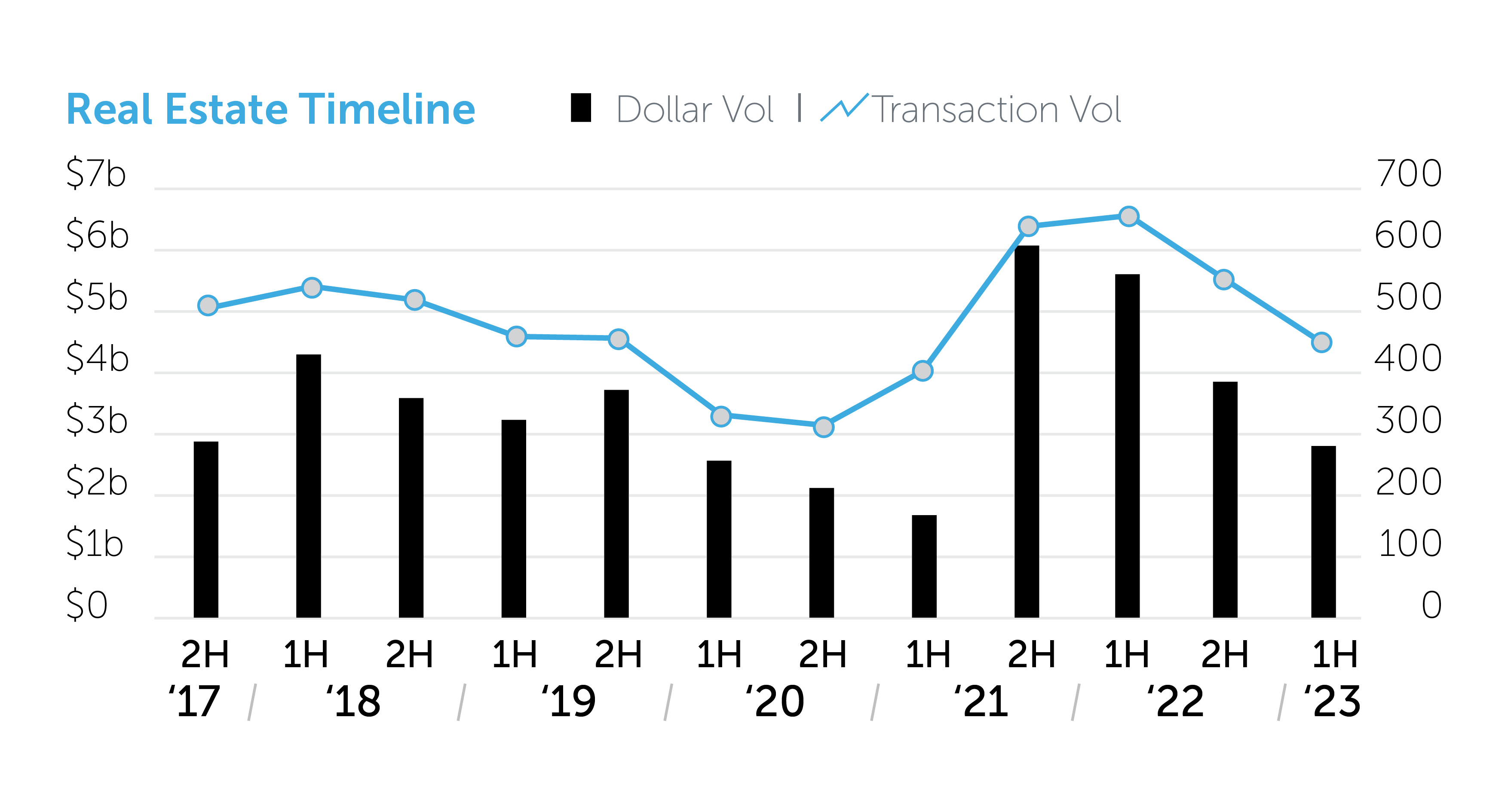

NEW YORK, NY – July 26, 2023 – After a record-breaking 2022 that saw Brooklyn’s investment sales market top $9.53 billion in dollar volume for the very first time, 2023 struggled to keep pace. During the first six months of the year, Brooklyn saw 457 transactions totaling $2.92 billion dollars, which represents 16% and 26% decreases respectively compared to 2H 2022 and declines of 31% in transactions and 47% in dollar volume compared to 1H 2022, according to Ariel Property Advisors’ Brooklyn 2023 Mid-Year Commercial Real Estate Trends report.

“The multifamily market in Brooklyn slowed considerably in the first half of 2023 following an incredible post-Covid boom that began during 2H 2021 and continued through 2022,” said Ariel Partner Sean Kelly, Esq. “We did see, however, that affordable multifamily gained notable interest from investors, which resulted in affordable housing accounting for approximately 30% of the multifamily dollar volume for the borough in the first six months of the year, the third highest percentage for a half-year in affordable housing since 2010.”

In the development market, Director Stephen Vorvolakos observed, “Despite the expiration of 421a/Affordable New York tax abatement in June 2022 and increased construction costs, Brooklyn’s development market received a boost in investment through several large acquisitions. Most notable was the concentration of development site sales. Of the total trades recorded in 1H 2023, 53% of the transactions took place in Greater Downtown Brooklyn, Park Slope, and Gowanus.”

Highlights from the report by asset class include:

Multifamily.

Development.

Commercial.

Industrial/Warehouse/Self Storage

To read Ariel Property Advisors’ Brooklyn 2023 Mid-Year Commercial Real Estate Trends report, please click here.

For more information, please contact: Gail Donovan at 212.544.9500 ext. 19 or gdonovan@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.