Press Releases Archive

Sean R. Kelly, Esq.

Partner

Ariel Property Advisors

Stephen Vorvolakos

Director - Investment Sales

Ariel Property Advisors

Nicole Daniggelis

Associate Director - Investment Sales

Ariel Property Advisors

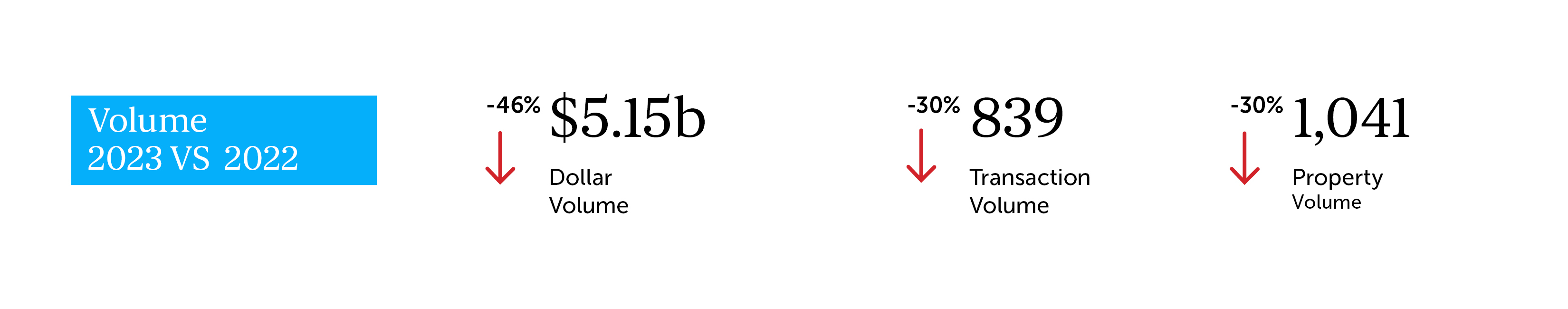

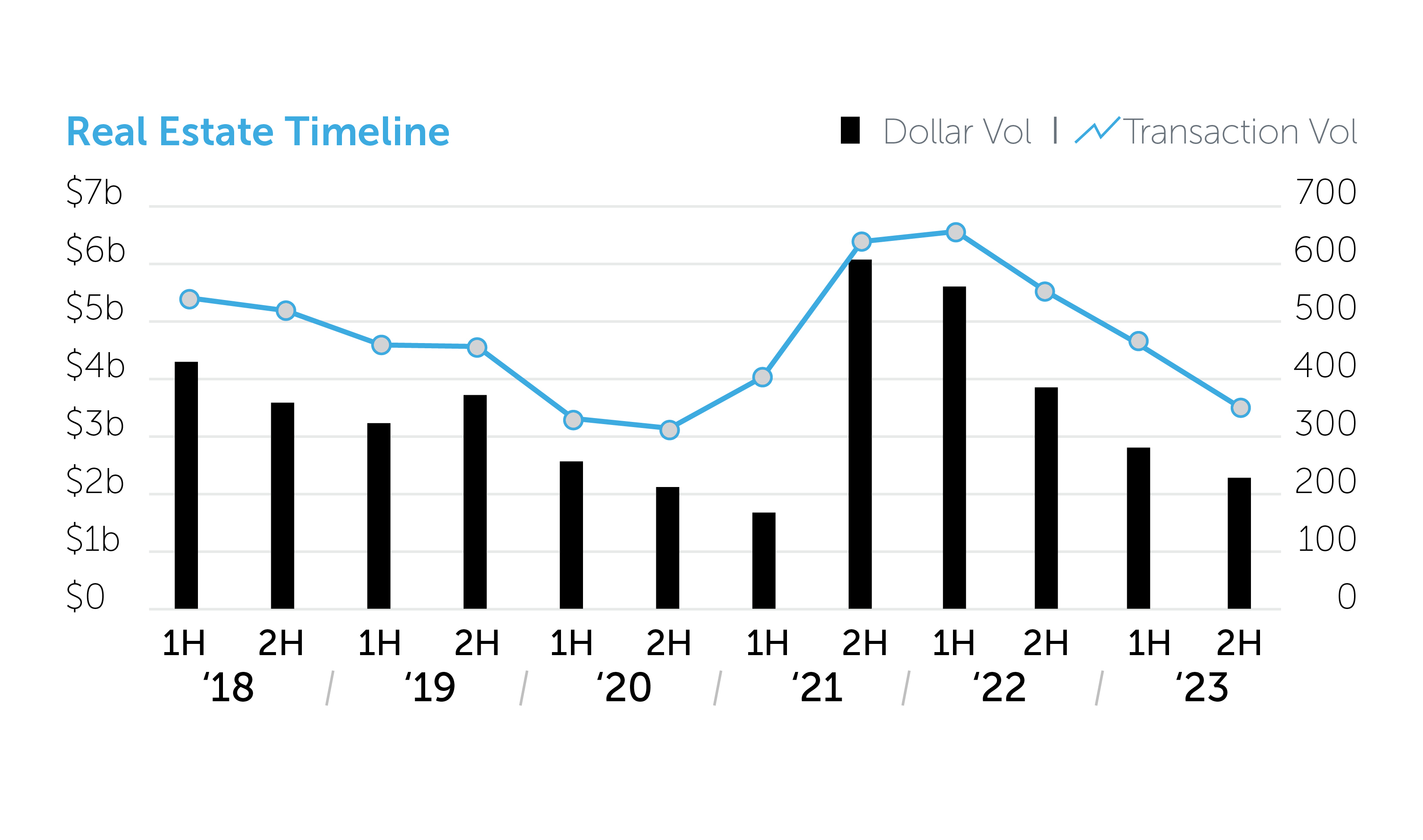

NEW YORK, NY – January 26, 2024 – Brooklyn finished 2023 with investment sales totaling $5.15 billion, a 46% decline from the record-breaking 2022, which saw dollar volume top $9.5 billion, according to Ariel Property Advisors’ Brooklyn 2023 Year-End Commercial Real Estate Trends report. Transactions also fell 30% to 839 compared to 1,206 the year before.

“The high interest rate environment resulted in Brooklyn registering the lowest dollar and transaction volume since 2013,” said Sean Kelly, a Partner at Ariel Property Advisors. “The commercial/retail market was the only asset class in Brooklyn that saw an increase in dollar volume, up 60% to $773.7 million, thanks in part to two large hotel purchases and institutional capital reentering the market after a quiet three years post-Covid.”

Stephen A. Vorvolakos ,Director, Investment Sales, continued, “In Brooklyn’s development market, rising construction costs and interest rates played a role in the 22% year-over-year decline in dollar volume to $1.24 billion. However, the price per buildable square foot reached $280, the highest ever for any of the outer boroughs. This is a clear indication that there is strong demand, but we’re not producing enough housing opportunities in New York City.”

Nicole Daniggelis, Associate Director, Investment Sales, added, “Despite the decline in multifamily activity, which fell 56% to $2.2 billion, we are continuing to see the shift of investors looking for smaller, tax class protected, primarily free-market value-add opportunities that are not subject to rent stabilization.”

The following is a summary of the performance of each asset class in Brooklyn in 2023:

Multifamily

Development

Commercial

Industrial

The full report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.