Press Releases Archive

Sean R. Kelly, Esq.

Partner

Ariel Property Advisors

Stephen Vorvolakos

Director - Investment Sales

Ariel Property Advisors

Nicole Daniggelis

Associate Director - Investment Sales

Ariel Property Advisors

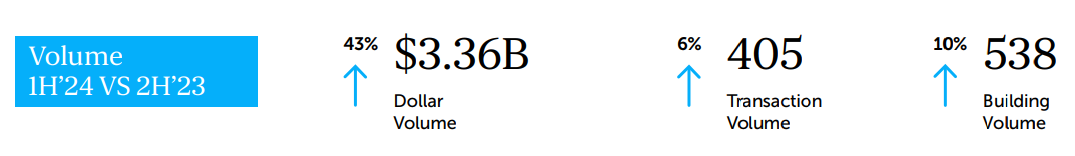

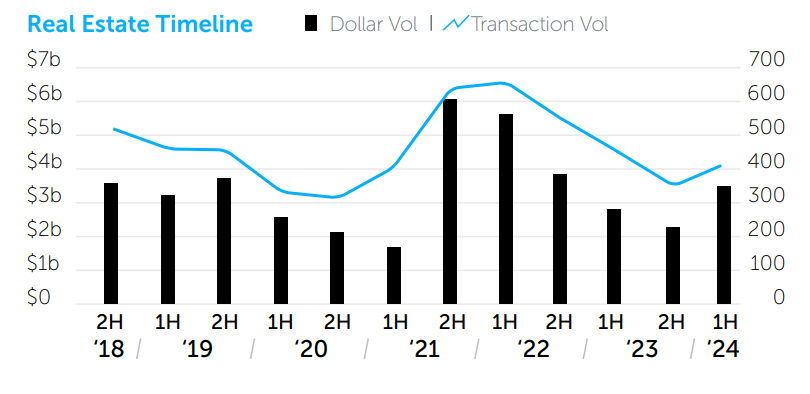

NEW YORK, NY – July 30, 2024 – Investment sales in Brooklyn rose to $3.36 billion in 1H 2024, a 43% increase compared to 2H 2023 and 18% increase compared to 1H 2023, according to Ariel Property Advisors’ Brooklyn 2024 Mid-Year Commercial Real Estate Trends report.

In the development market, Brooklyn ended 1H 2024 with 59 transactions totaling $585 million, a 26% increase in dollar volume over 2H 2023, but 21% decline compared to 1H 2023.

“The expiration of the 421a tax abatement in June 2022 sent many rental developers to the sidelines, which resulted in the sale of mostly smaller sites in the first half of this year,” said Ariel Partner Sean Kelly. “However, we’re expecting that the 485-x tax incentive in the state’s recently approved housing policy will revive the development sector and encourage an influx of new projects in the borough.”

Director Stephen Vorvolakos added that the absence of a tax abatement for nearly two years affected pricing metrics for Brooklyn’s development sites. “The average price per buildable square foot dropped from $280 in 2023 to $231 during 1H 2024, which is the lowest average in Brooklyn since 2014,” he said. “With pricing depressed, sellers were forced to either wait it out or sell their land at a significant discount.”

An uptick in workouts and forced transactions contributed to the increase in dollar and transaction volume in Brooklyn, especially in the multifamily market where dollar volume rose to $1.8 billion in 1H 2024, a 103% jump from 2H 2023 and 38% increase from 1H 2023.

“The borough’s robust multifamily market in the first six months of the year was due in part to a notable forced sale that also happened to be the largest transaction in the borough,” said Nicole Daniggelis, Associate Director. “In this deal, Silverstein Capital Partners acquired 9 Dekalb Avenue for $672 million through a deed in lieu of foreclosure.”

The following is a summary of the performance of each asset class in Brooklyn in 1H 2024:

Multifamily

Development

Industrial/Warehouse/Storage

Retail

Ariel Property Advisors’ Brooklyn 2024 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.