Press Releases Archive

Victor Sozio

Founding Partner

Ariel Property Advisors

Jason M. Gold

Senior Director - Investment Sales

Ariel Property Advisors

Daniel Mahfar

Director - Investment Sales

Ariel Property Advisors

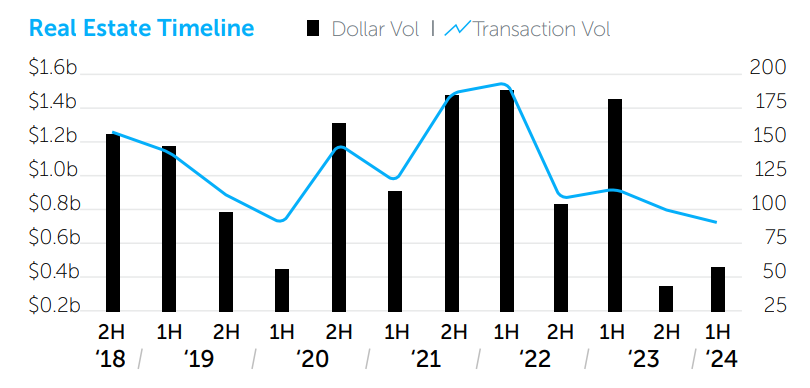

NEW YORK, NY – August 2, 2024 – The dollar volume of investment sales in the Bronx rose 13% to $445 million in 1H 2024 compared to 2H 2023, according to Ariel Property Advisors’ Bronx 2024 Mid-Year Commercial Real Estate Trends report. Transactions fell 10% to 90 for this period

“The multifamily market in the Bronx continued to face challenges in the first six months of the year as evidenced by total dollar volume coming in below $500 million,” said Ariel Property Advisors Founding Partner Victor Sozio. “Rising expenses, especially insurance costs, combined with high interest rates and regulations hurt all multifamily owners but especially those with predominantly rent-stabilized buildings.”

Ariel Senior Director Jason Gold added, “In the multifamily market, buildings with at least 75% rent-stabilized units accounted for approximately 53% of dollar volume and 67% of transaction volume, the highest in both categories since H1 2021. In many cases, these transactions were driven by mortgage maturities.”

“The development market saw 33 transactions in 1H 2024, approximately 37% of the total transaction volume in the Bronx in the first half of this year, which is a new record for the borough,” Ariel Director Daniel Mahfar said. “We expect this trend to continue as the Bronx offers developers a low basis for new construction projects that will also benefit from the recently approved 485-x tax exemption.”

The report noted that a major rezoning in the Bronx is expected to produce new housing along 46 blocks surrounding the new Metro North stations in the Parkchester, Van Nest, and Morris Park neighborhoods. Expected to be finalized by 2027, the rezoning will yield 7,000 apartments, 300,000 SF of retail space, 1.6 million SF of life science space, and 1.2 million SF of community facility space.

The following is a summary of the performance asset classes in the Bronx in 1H 2024:

Multifamily

Development

Industrial/Warehouse/Storage

Ariel Property Advisors’ Bronx 2024 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.