Press Releases Archive

Howard Raber

Director - Investment Sales

Ariel Property Advisors

Chris Brodhead

Senior Director - Investment Sales

Ariel Property Advisors

Michael A. Tortorici

Founding Partner

Ariel Property Advisors

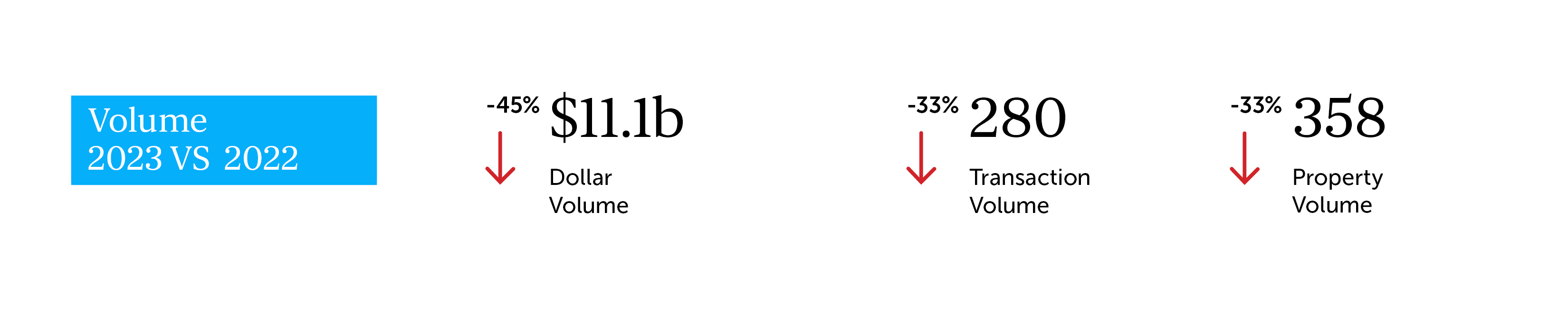

NEW YORK, NY – January 31, 2024 – January 31, 2024 – Manhattan saw $11.1 billion in investment property sales in 2023, a 45% decline from 2022 and the worst year in the past decade, excluding 2020, according to Ariel Property Advisors’ Manhattan 2023 Year-End Commercial Real Estate Trends report. Transactions also fell 33% year-over-year to 280.

“Looking back at 2023, investors maintained the same conservative approach to the market as they’ve held since 2021, expressing concern about higher interest rates, rising expenses, and apprehension over the potential expansion of residential rent regulation,” said Howard Raber, Director, Investment Sales, for Ariel Property Advisors. “Development site sales volume remains very light and the price per buildable square foot is hovering around levels that make this asset class attractive to those looking to capitalize on record residential demand amidst persistent underbuilding.”

Senior Director Chris Brodhead added, “Hotel sales were a bright spot in 2023 with the highest level of sales and pricing since 2019. The robust performance of the hotel sector is coming at a time when average daily rates peaked in October/November at $362 (up sharply from $291 for the same period in 2019). The driving forces for the hotel market may be attributed to an increase in tourism as well as supply constraints due to the special permit requirements for new hotel construction, regulations for Airbnbs, and housing for incoming migrants.”

Founding Partner Mike Tortorici added, “The Manhattan office market saw a 58% year-over-year decline in dollar volume to $2.87 billion across only 24 transactions, and the price per square foot fell 22% to $848. Although office occupancy has risen citywide, Class A+ buildings are proving to be the most resilient, showing average visitation rates of 72% of pre pandemic levels.”

Commercial

Office

Multifamily

Development

To read the full report, please click here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.