Press Releases Archive

Shimon Shkury

President and Founder

Ariel Property Advisors

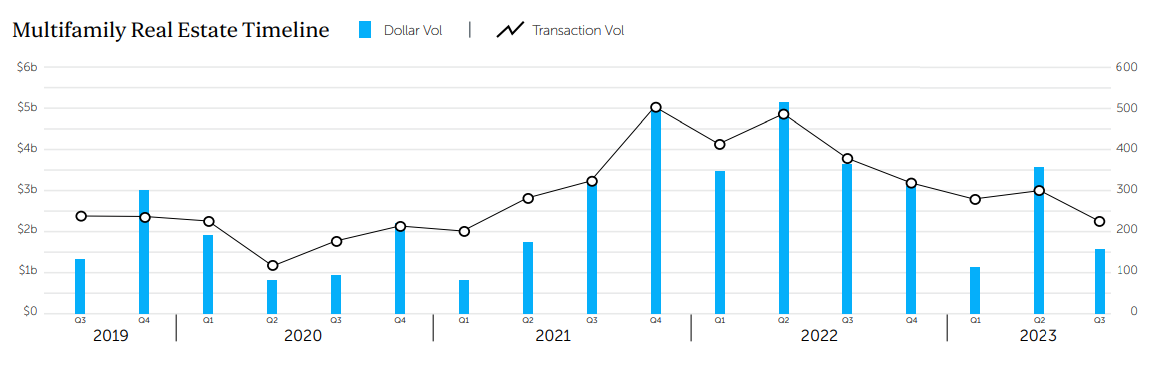

NEW YORK, NY – October 23, 2023 – New York City recorded $1.55 billion in multifamily sales in Q3 2023, a 56% decline from the second quarter, according to Ariel Property Advisors’ Q3 2023 Multifamily Quarter In Review New York City. Transaction volume also fell by 24% to 227 quarter-over-quarter.

Free market and 421a buildings accounted for 81% of the total dollar volume, with rent stabilized buildings capturing 16% and affordable housing accounting for 4%, substantially lower than the sector’s second quarter market share of 43%, which included several large transactions including Omni’s 5,900-unit portfolio sale to Nuveen for close to $1 billion.

“In the third quarter, higher interest rates and mortgage maturities continued to disrupt the market at a time when regional and larger financial institutions are pulling back,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “However, the FDIC is in the process of marketing Signature Bank's substantial multifamily loan portfolio, which increases the likelihood of much higher activity in the sector in the coming months.”

Submarket Highlights:

For more information and to read the full report, please click here.

For more information, please contact: Gail Donovan at 212.544.9500 ext. 19 or gdonovan@arielpa.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.