Press Releases Archive

Michael A. Tortorici

Founding Partner

Ariel Property Advisors

Alexander Taic

Director - Investment Sales

Ariel Property Advisors

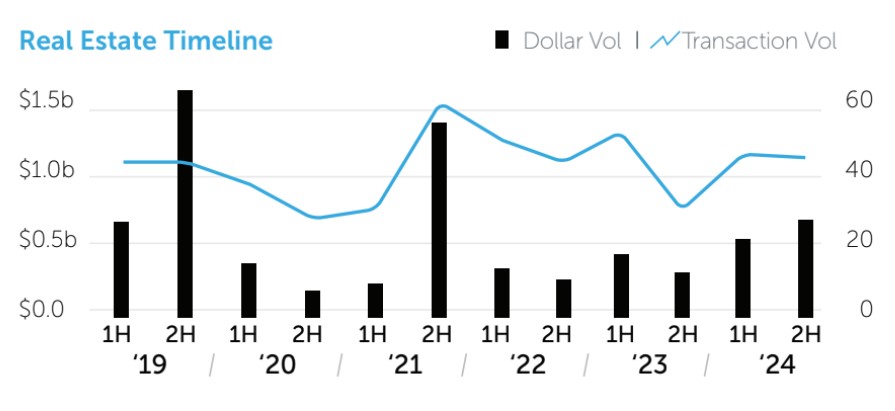

NEW YORK, NY – February 13, 2025 – The Northern Manhattan investment sales market recorded $1.26 billion in sales across 98 transactions in 2024, a 51% rise in dollar volume and 10% growth in transactions from the previous year, according to Ariel Property Advisors’ Northern Manhattan 2024 Year-End Commercial Real Estate Trends report.

“Northern Manhattan’s investment property market was bolstered by a rebound in development site sales, which rose by 168% year-over-year to $189.9 million in 2024,” said Ariel Founding Partner Michael Tortorici,. “While the number of transactions remains low, the fact that several large deals over $20 million sold represents growing confidence from investors, especially with recent pro-housing policies like the 485x tax exemption, vested 421a extension and City of Yes initiative.”

Ariel Director Alexander Taic added, “In the multifamily market, buildings with at least 75% rent-stabilized units saw their transaction volume rise from 36% in 2023 to 48% in 2024, an increase largely driven by sellers coming down on price vis a vis elevated interest rates, mortgage maturities and adjustments needed with the 2019 HSTPA.”

Multifamily Highlights

Development Highlights

Ariel Property Advisors’ Northern Manhattan 2024 Year-End Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.