Press Releases Archive

Michael A. Tortorici

Founding Partner

Ariel Property Advisors

Alix Curtin

Associate Director - Investment Sales

Ariel Property Advisors

Alexander Taic

Director - Investment Sales

Ariel Property Advisors

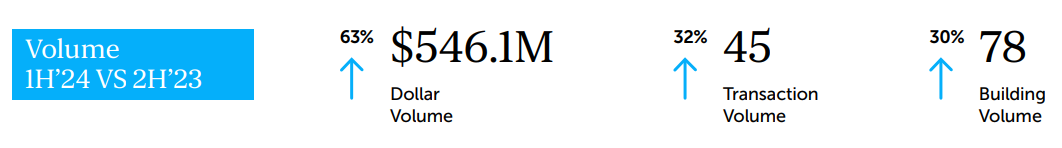

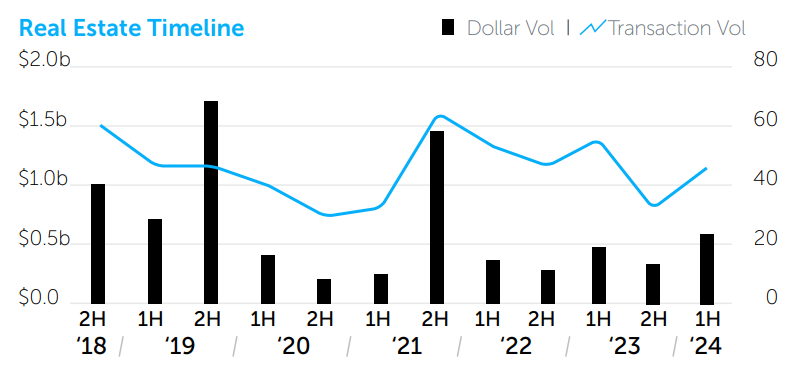

NEW YORK, NY – July 30, 2024 – The dollar volume of investment sales in Northern Manhattan jumped 63% to $546.1 million in 1H 2024 compared to 2H 2023, according to Ariel Property Advisors’ Northern Manhattan 2024 Mid-Year Commercial Real Estate Trends report. Transactions also rose 32% to 45 over the period.

“Investment sales activity in Northern Manhattan showed strong improvement compared to the second half of 2023 driven in large part by two large sales,” said Ariel Property Advisors Founding Partner Mike Tortorici. “One was the $172 million sale of 1760 3rd Avenue, a dormitory that will be converted to affordable housing, and the other was the $38 million sale of 97 Claremont Avenue, which is a dormitory that is expected to be converted to luxury student housing."

Ariel Associate Director Alix Curtin noted, “In the rent stabilized segment of the multifamily market, elevated interest rates and the lasting impact of the Housing Stability and Tenant Protection Act of 2019 (HSTPA) put downward pressure on valuations resulting in most of these buildings trading at an average of $116/SF and $95,757/unit, which represents a 33% and 40% decline compared to 2023 levels.

“In the development market, only four sites traded in Northern Manhattan in 1H 2024,” said Ariel Director Alexander Taic. “However, we expect to see an uptick in activity because of the state’s recent approval of a new housing policy that included the 485-x, a tax incentive for affordable housing development. In fact, Ariel currently has three development sites in contract in Northern Manhattan that will benefit from the new policy.”

The following is a summary of the performance the asset classes in Northern Manhattan in 1H 2024:

Multifamily

Development

Ariel Property Advisors’ Northern Manhattan 2024 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.