Press Releases Archive

NEW YORK, NY – March 20, 2019 – The New York City multifamily market softened at the start of the year, with every volume metric registering a decline on a year-over-year basis. Pricing was a mixed bag, with the average price per square foot declining or holding steady.

The tepid demand In January also came on the heels of a robust 2018, a year in which every volume metric recorded a year-over-year gain and institutional investors reemerged. Uncertainty surrounding widely-expected reforms made to rent regulation laws likely kept some market participants sidelined in January. When clarity about these changes emerges in the months ahead, investors will become more informed about how they can underwrite rent regulated assets going forward, which may ignite an uptick in multifamily activity.

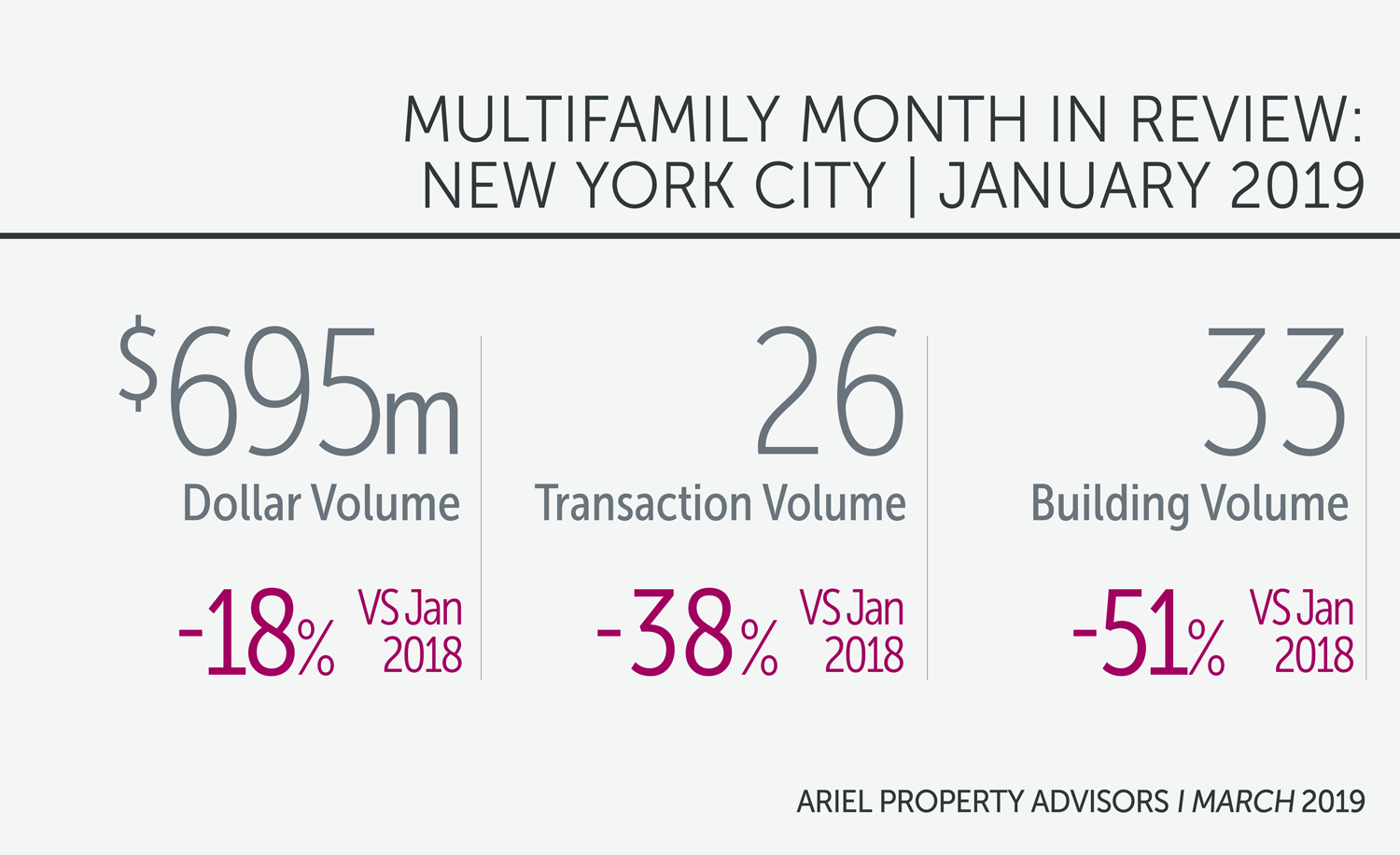

In January, the City saw $695 million in multifamily sales take place across 26 transactions and 33 buildings. When compared to the same month in 2018, dollar, transaction and building volume dropped 18%, 38% and 51%, respectively. Institutional investors stayed active in January, with the month witnessing three transactions exceeding $75 million.

Broken down by sub-market, Manhattan dominated NYC’s dollar volume, snaring a 61% share, followed by Brooklyn’s 22% stake. Manhattan also reigned in building volume, encompassing 33%, while Brooklyn was not far behind, comprising 30%.

Submarket Overview

Manhattan (Below 96th Street):

Manhattan, unsurprisingly, posted the highest dollar volume in NYC. The borough’s dollar volume, at $426.7 million, was down 11% on an annual basis. Transaction volume reached 10 trades, a 23% decrease versus January 2018.

The largest transaction of the month was the $227.2 million sale of 200 West 72nd Street, a 199-unit mixed-use elevator building.

The average price per square foot in Manhattan decreased. For Manhattan pricing metrics, see page 6 of APA’s report.

Northern Manhattan (Above 96th Street):

Northern Manhattan saw a significant slowdown in January, recording just one transaction, which was the $3.35 million sale of 26 Fort Charles Place, a 19-unit walk-up building in Marble Hill. When compared to January 2018, transaction volume slumped 80% and dollar volume plunged 97%.

With regards to pricing, most gauges saw declines. For Northern Manhattan pricing metrics, see page 6 of APA’s report.

The Bronx:

The Bronx fared comparatively well in January. The borough registered 7 sales for a total consideration of nearly $58 million, translating into flat transaction volume and an 18% increase in dollar volume.

The largest transaction was the $23.85 million sale of 201 East 146th Street, a 130-unit mixed-use elevator building in Concourse Village.

Pricing metrics in The Bronx mostly held steady. For the Bronx pricing metrics, see page 6 of APA’s report.

Brooklyn:

Brooklyn observed an annual increase in dollar volume in January, rising 27% to $152.4 million. The borough’s transaction volume fell 69% year-over-year to just 4 sales.

The most notable sale of the month was the $95.7 million sale of a 5-building multifamily portfolio situated across the neighborhoods of Bay Ridge, Midwood and Gravesend.

Pricing held firm, with both the average price per square foot and the average price per unit appreciating. For Brooklyn pricing metrics, see page 6 of APA’s report.

Queens:

Queens experienced a lukewarm month. During January, the borough saw 4 transactions for a gross consideration of $54.6 million. Transaction volume held steady, but dollar volume fell 21%.

Pricing mostly strengthened in the borough. For Queens pricing metrics, see page 6 of APA’s report.

Methodology For Report:

The multifamily transactions included in Ariel Property Advisors’ analysis occurred at a minimum sales price of $1 million, with a minimum gross area of 5,000 square feet and with a minimum of 10 units.

Pricing metrics are based on trailing 6 months averages.

To view the full report, please click here: http://arielpa.com/report/report-MFMIR-Jan-2019

For More information, please contact: Shimon Shkury 212.544.9500, ext. 11, sshkury@arielpa.com

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.