Press Releases Archive

Shimon Shkury

President and Founder

Ariel Property Advisors

Victor Sozio

Founding Partner

Ariel Property Advisors

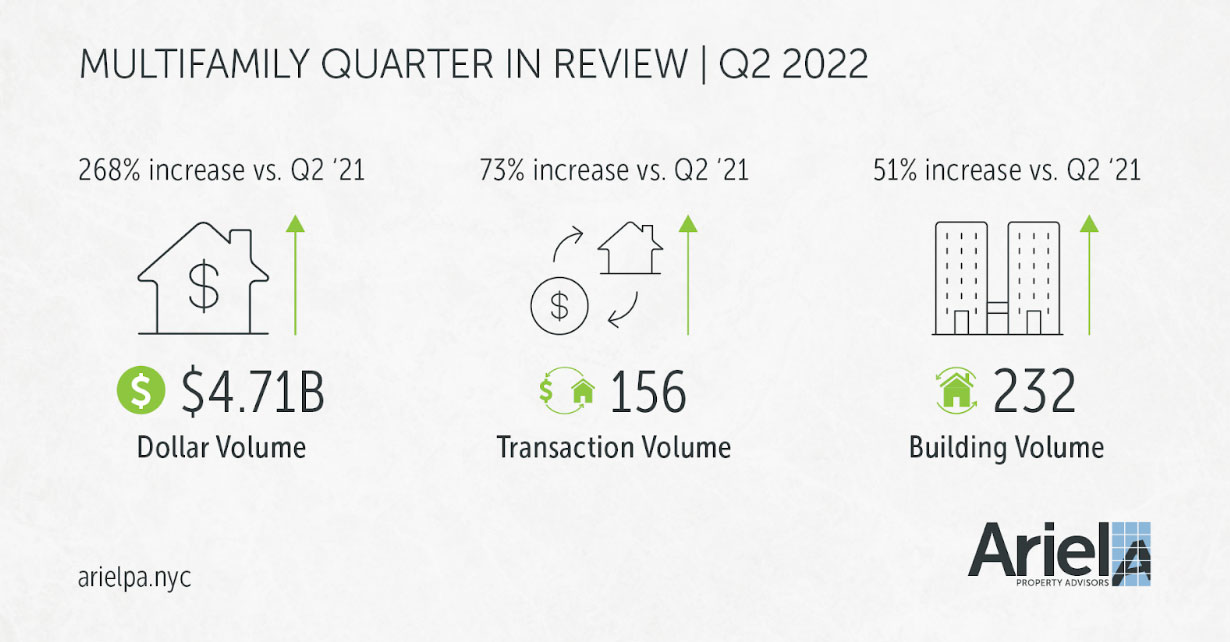

NEW YORK, NY – August 2, 2022 – The dollar volume for multifamily buildings with 10 or more units totaled $4.7 billion in Q2 2022, a 77% increase over Q1 2022 and 268% increase over Q2 2021, according to Ariel Property Advisors’ Q2 2022 Multifamily Quarter in Review. The second quarter’s transaction volume totaled 156, a 33% increase compared to the first quarter and 73% increase year-over-year.

“Compared to the first half of 2021, pricing metrics have improved across all boroughs, however, the average price per square foot citywide is lower than during the same time period in 2019, which was before the passage of the Housing Stability & Tenant Protection Act of 2019 (HSTPA) and Covid-19 Pandemic,” said Shimon Shkury, Founder and President of Ariel Property Advisors. “Notably, the average cap rate citywide, was higher than the national cap rate for major markets and, as a result, investors are selling in other states and bringing their capital back to the city.”

Victor Sozio, Founding Partner, added, “As a percentage of dollar volume in the multifamily market, rent stabilized buildings accounted for only 17% in the second quarter, which was a decline from 25% in the first quarter. With institutional capital shying away from rent stabilized properties, high net worth individuals and family offices have become the dominant buyers of this asset class.”

Findings from the report include:

8 Spruce and American Copper Buildings Lead a Historic 3 Months

The Blackstone Group’s $930 million purchase of the residential condo portion of 8 Spruce from Brookfield Properties and Black Spruce’s $837 million purchase of the American Copper Buildings from JDS Development Group accounted for 37% of the $4.7 billion transacted in the second quarter of 2022. The quarter represented the highest dollar volume since the fourth quarter of 2015, which itself was skewed from The Blackstone Group’s $5.46 billion purchase of the Stuy-town Portfolio from Fortress Investment Group. Additionally, transaction volume was the highest in a quarter since the second quarter of 2016.

Inflation and High-Interest Rates Impact Sub-Segments Differently

Free market buildings such as 8 Spruce and The American Copper Buildings accounted for approximately 75% of the dollar volume in the multifamily market over the first half of the year and 67% over the second quarter. In the New York City rental market, there is a lack of supply due to a slowdown in construction over the past few years coupled with owners removing approximately 43,000 rent-stabilized units in need of renovation out of circulation in response to the HSTPA. Additionally, there is rising demand for rental housing as almost as many people who left the city during the pandemic came rushing back in, helping rents, especially in Manhattan, hit all-time highs on a monthly basis. However when it comes to owners, the demand is also there due to the ability of free-market buildings to offset rising expenses such as cost of debt, oil, salaries, repairs & maintenance, and property taxes. The other sub-segments, predominantly rent-stabilized and affordable housing buildings, did not fare as well in the second quarter of 2022.

To read the full Q2 2022 Multifamily Quarter in Review, which includes data for buildings with 10 or more units, please click here. To read and access Northern Manhattan report and access reports for the other submarkets—Manhattan, the Bronx, Brooklyn, Queens—and the, please click here.

For more information, please contact: Sarah Berman at 212.450.7300 or sberman@bermangrp.com.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.