Press Releases Archive

Sean R. Kelly, Esq.

Partner

Ariel Property Advisors

Stephen Vorvolakos

Director - Investment Sales

Ariel Property Advisors

Nicole Daniggelis

Associate Director - Investment Sales

Ariel Property Advisors

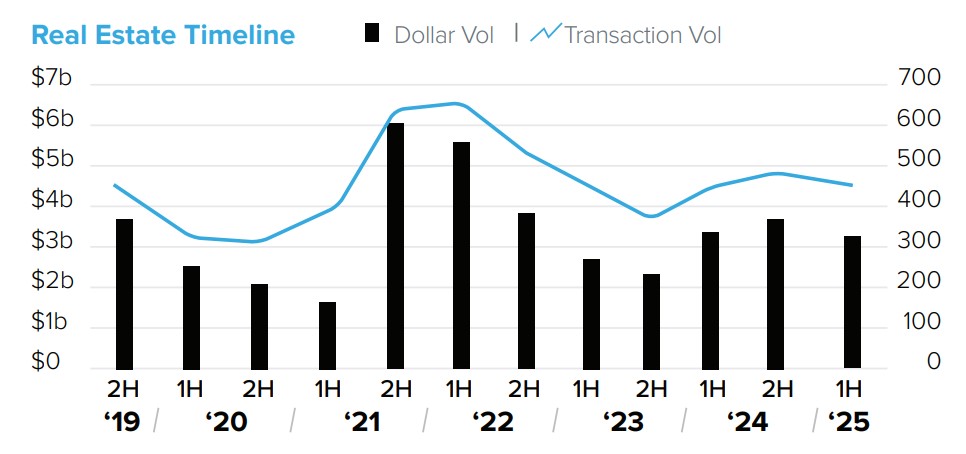

NEW YORK, NY – July 14, 2025 – Following a strong 2024, Brooklyn recorded 453 investment sales totaling $3.25 billion in 1H 2025, a modest 4% uptick in transaction volume and slight 2% decline in dollar volume compared to 1H 2024, according to Ariel Property Advisors’ Brooklyn 2025 Mid-Year Commercial Real Estate Trends report.

"Despite macroeconomic headwinds creating a sense of caution, the Brooklyn market demonstrated remarkable resilience in the first half of the year,” said Ariel Partner Sean R. Kelly, Esq. “Development land values hit an all-time high at $313/BSF, fueled by pro-housing initiatives like City of Yes, and signaling robust confidence in Brooklyn's long-term growth and development pipeline."

Ariel Director Steve Vorvolakos added, "Brooklyn's multifamily market was a clear bright spot in the first six months of the year, with transaction volume up 10% and dollar volume climbing 14% to over $2 billion. In this environment, we're seeing a strategic pivot from investors who are heavily targeting smaller, free-market buildings to sidestep rent regulations."

Associate Director Nicole Daniggelis continued, "The first half of 2025 revealed two very different stories in Brooklyn's commercial sector. While the industrial market tapped the brakes after a post-COVID boom, the retail sector hit its stride. A 16% surge in retail sales, driven by major institutional investments in prime locations like Williamsburg, proves that demand for high-quality, well-located retail space is stronger than ever."

Multifamily Highlights

Development

Industrial

Retail

Ariel Property Advisors’ Brooklyn 2025 Mid-Year Commercial Real Estate Trends report is available here.

Loading...![]()

Ariel Property Advisors is a New York City-based commercial real estate services and advisory company offering expertise in three core areas: Investment Sales, Capital Services and Research & Advisory. Our Investment Sales Group specializes in all major commercial asset types throughout the New York metropolitan area, the Capital Services Group provides clients nationwide with custom-tailored financing solutions and the Research & Advisory team delivers timely market reports, empowering both our professionals and clients. Additionally, our recent strategic partnership with GREA (Global Real Estate Advisors), a nationwide network of independent real estate investment services companies, further expands our reach and capabilities. To learn more, please visit us at arielpa.nyc.